Region:Asia

Author(s):Geetanshi

Product Code:KRAC3143

Pages:97

Published On:October 2025

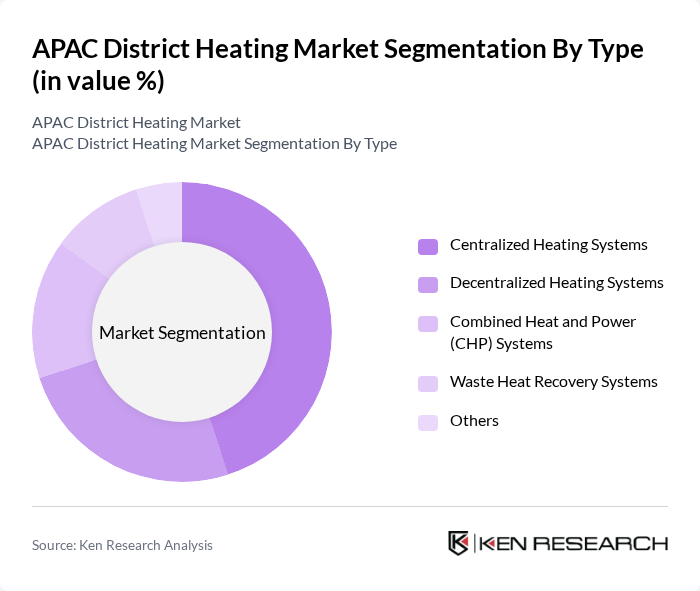

By Type:The market can be segmented into various types, including Centralized Heating Systems, Decentralized Heating Systems, Combined Heat and Power (CHP) Systems, Waste Heat Recovery Systems, and Others. Each of these subsegments plays a crucial role in meeting the diverse heating needs of urban and industrial areas. Centralized systems remain dominant due to their efficiency in serving dense urban populations, while CHP systems are increasingly favored for their ability to integrate renewable and waste heat sources, supporting both energy efficiency and emissions reduction goals.

The Centralized Heating Systems subsegment is currently dominating the market due to its efficiency in delivering heat to large urban areas. These systems are preferred for their ability to provide consistent heating and their integration with renewable energy sources, which aligns with sustainability goals. The trend towards urbanization and the need for efficient energy solutions further bolster the demand for centralized systems, making them the leading choice among consumers and municipalities. CHP systems are also gaining traction, especially in markets with strong policy support for renewables and waste heat utilization.

By End-User:The market is segmented based on end-users, including Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and contributes differently to the overall market dynamics. The residential sector is the largest, driven by urbanization and the need for efficient, sustainable heating in high-density housing. Commercial and industrial segments are also significant, supported by the expansion of office complexes, retail centers, hospitals, and large-scale manufacturing facilities that require stable thermal regulation year-round.

The Residential segment is the largest end-user category, driven by the increasing demand for efficient heating solutions in urban households. As more consumers seek sustainable and cost-effective heating options, the adoption of district heating systems in residential areas has surged. This trend is supported by government incentives and a growing awareness of energy efficiency, making the residential sector a key driver of market growth. The commercial sector is also expanding rapidly, with building owners and facility managers investing in district-based systems to reduce lifecycle operating costs and meet tightening environmental performance standards.

The APAC District Heating Market is characterized by a dynamic mix of regional and international players. Leading participants such as Korea District Heating Corporation (KDHC), Tokyo Gas Co., Ltd., China National Petroleum Corporation (CNPC), China Huadian Corporation, Tsinghua Tongfang Co., Ltd., Singapore District Cooling Pte Ltd (SDCPL), Fortum Corporation (Asia operations), ENGIE (Asia operations), Veolia Environnement S.A. (Asia operations), Dalkia (EDF Group, Asia operations), E.ON SE (Asia operations), Vattenfall AB (Asia operations), Statkraft AS (Asia operations), NRG Energy, Inc. (Asia operations), SUEZ S.A. (Asia operations) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC district heating market is poised for significant transformation, driven by increasing urbanization and a strong push for renewable energy adoption. As cities expand, the demand for efficient heating solutions will rise, prompting investments in advanced technologies. Furthermore, the integration of smart systems will enhance operational efficiency and sustainability. Stakeholders must navigate regulatory challenges while capitalizing on emerging opportunities to develop innovative, eco-friendly heating solutions that align with government initiatives and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Centralized Heating Systems Decentralized Heating Systems Combined Heat and Power (CHP) Systems Waste Heat Recovery Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | Japan South Korea China India Australia Singapore Taiwan Southeast Asia (ASEAN) Rest of APAC |

| By Technology | Biomass Heating Geothermal Heating Solar Thermal Heating Natural Gas Heating |

| By Application | District Heating Networks Industrial Heating Applications Residential Heating Solutions Commercial Heating Solutions |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential District Heating Users | 100 | Homeowners, Property Managers |

| Commercial District Heating Operators | 60 | Facility Managers, Energy Managers |

| Government Energy Policy Makers | 40 | Energy Regulators, Policy Analysts |

| Technology Providers for District Heating | 50 | Product Managers, Technical Sales Representatives |

| Consultants in Energy Efficiency | 40 | Energy Consultants, Sustainability Advisors |

The APAC District Heating Market is valued at approximately USD 25 billion, driven by urbanization, government initiatives for energy efficiency, and the demand for sustainable heating solutions. This market is expected to grow as investments in infrastructure increase across the region.