Region:Asia

Author(s):Geetanshi

Product Code:KRAD3855

Pages:82

Published On:November 2025

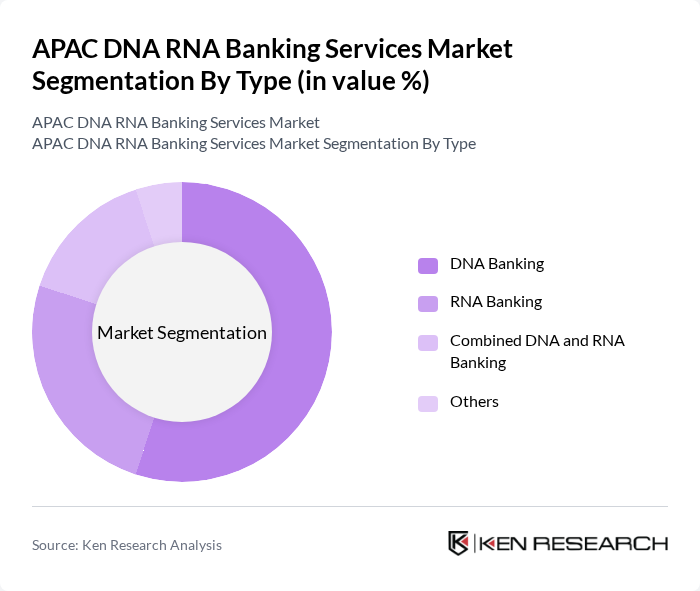

By Type:

The market is segmented into DNA Banking, RNA Banking, Combined DNA and RNA Banking, and Others. Among these, DNA Banking is the leading sub-segment, driven by the increasing demand for genetic testing, population genomics, and personalized medicine. The rise in chronic diseases and the need for targeted therapies have further propelled the growth of DNA banking services. RNA Banking is also gaining traction due to its applications in drug discovery, transcriptomics, and biomarker research, but DNA Banking remains the dominant force in the market .

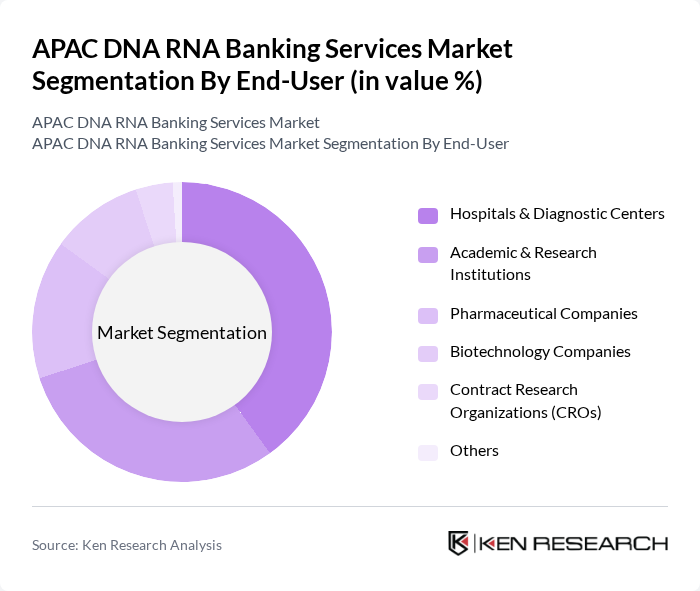

By End-User:

This segment includes Hospitals & Diagnostic Centers, Academic & Research Institutions, Pharmaceutical Companies, Biotechnology Companies, Contract Research Organizations (CROs), and Others. Hospitals & Diagnostic Centers are the leading end-users, as they require biobanked samples for clinical diagnostics, precision medicine, and treatment planning. Academic & Research Institutions follow closely, utilizing biobanked samples for genetic studies, translational research, and drug development .

The APAC DNA RNA Banking Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as BGI Group, MedGenome Labs, Macrogen Inc., Illumina, Inc., Thermo Fisher Scientific Inc., QIAGEN N.V., DNA Genotek Inc., EasyDNA, Gene Solutions, GenScript Biotech Corporation, Infinity Biologix (Sampled), ProteoGenex, Brooks Life Sciences, LGC Biosearch Technologies, and GoodCell contribute to innovation, geographic expansion, and service delivery in this space .

The future of the APAC DNA and RNA banking services market appears promising, driven by technological advancements and increasing healthcare investments. As personalized medicine gains traction, the integration of artificial intelligence in genetic data analysis is expected to enhance service offerings. Furthermore, collaborations between biobanks and healthcare providers will likely expand access to genetic testing, fostering innovation and improving patient outcomes. The focus on ethical practices will also play a crucial role in shaping consumer trust and participation in biobanking initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | DNA Banking RNA Banking Combined DNA and RNA Banking Others |

| By End-User | Hospitals & Diagnostic Centers Academic & Research Institutions Pharmaceutical Companies Biotechnology Companies Contract Research Organizations (CROs) Others |

| By Region | China Japan India South Korea Australia & New Zealand Southeast Asia Rest of APAC |

| By Application | Drug Discovery & Clinical Research Therapeutics Clinical Diagnostics Genetic Testing Others |

| By Storage Method | Cryopreservation Ambient Storage Automated Storage Systems Others |

| By Sample Type | Blood Samples Tissue Samples Saliva/Buccal Swab Samples Hair Follicles Others |

| By Service Type | Collection Services Processing Services Storage Services Quality Control Services Data Management Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biobanking Facilities | 100 | Laboratory Managers, Biobank Directors |

| Healthcare Providers | 80 | Genetic Counselors, Clinical Researchers |

| Pharmaceutical Companies | 60 | R&D Managers, Product Development Leads |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Academic Institutions | 50 | Research Scientists, Professors in Genetics |

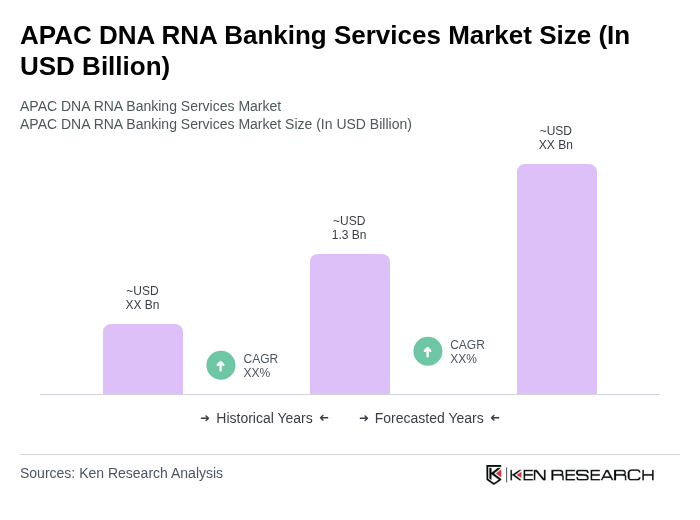

The APAC DNA RNA Banking Services Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by advancements in genomics, personalized medicine demand, and investments in biobanking infrastructure.