Region:Asia

Author(s):Rebecca

Product Code:KRAC2486

Pages:85

Published On:October 2025

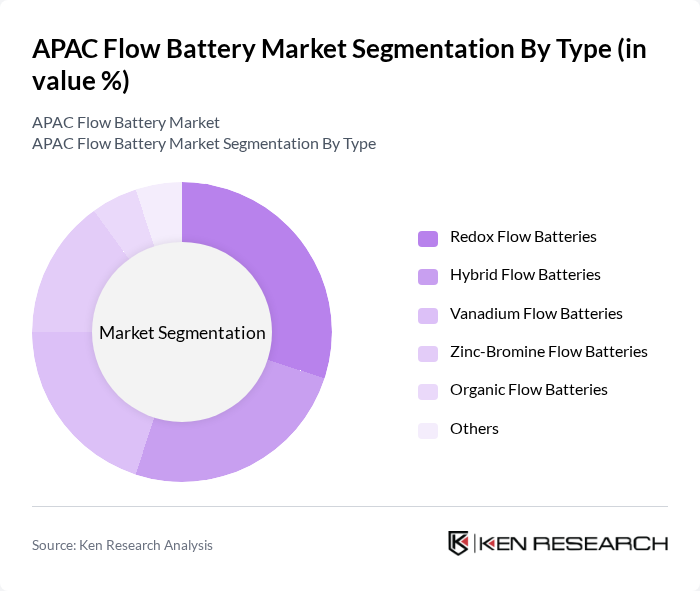

By Type:The flow battery market can be segmented into various types, including Redox Flow Batteries, Hybrid Flow Batteries, Vanadium Flow Batteries, Zinc-Bromine Flow Batteries, Organic Flow Batteries, and Others. Each type has unique characteristics and applications, catering to different energy storage needs. Redox flow batteries are preferred for large-scale grid and renewable integration due to their scalability and long cycle life. Vanadium flow batteries dominate utility-scale projects, while zinc-bromine and organic flow batteries are increasingly adopted for commercial and industrial applications.

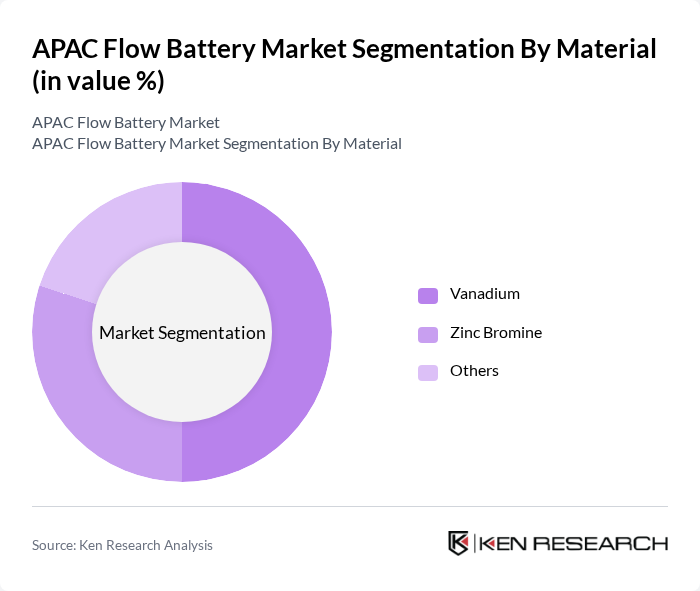

By Material:The materials used in flow batteries include Vanadium, Zinc Bromine, and Others. Each material has distinct advantages, influencing the choice of battery type based on application requirements and cost considerations. Vanadium is favored for its stability and long lifespan, making it ideal for grid-scale storage, while zinc-bromine offers cost benefits for commercial installations.

The APAC Flow Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sumitomo Electric Industries, Ltd., Rongke Power Co., Ltd., Invinity Energy Systems plc, Redflow Limited, VRB Energy, Inc., Dalian Bolong New Materials Co., Ltd., UniEnergy Technologies, Lockheed Martin Corporation, Stryten Energy LLC, Elestor BV, ViZn Energy Systems, SCHMID Group, H2, Inc., V-Flow Tech, Largo Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC flow battery market appears promising, driven by increasing investments in renewable energy and energy storage solutions. As countries strive to meet ambitious carbon neutrality goals, the demand for efficient energy storage systems will rise. Additionally, the integration of advanced technologies such as AI and IoT in energy management will enhance the operational efficiency of flow batteries, making them more attractive to energy providers and consumers alike. The market is poised for significant growth as these trends continue to evolve.

| Segment | Sub-Segments |

|---|---|

| By Type | Redox Flow Batteries Hybrid Flow Batteries Vanadium Flow Batteries Zinc-Bromine Flow Batteries Organic Flow Batteries Others |

| By Material | Vanadium Zinc Bromine Others |

| By Storage Scale | Large-Scale Small-Scale |

| By End-User | Utilities Commercial & Industrial Residential EV Charging Stations Government & Public Infrastructure Others |

| By Application | Grid-Connected Off-Grid Utility-Scale Projects Renewable Integration Backup Power Others |

| By Country | China Japan India South Korea Singapore Malaysia Rest of Asia Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility-Scale Flow Battery Projects | 100 | Project Managers, Energy Analysts |

| Commercial Applications of Flow Batteries | 70 | Facility Managers, Energy Procurement Officers |

| Research Institutions Focused on Energy Storage | 40 | Research Scientists, Policy Advisors |

| Manufacturers of Flow Battery Components | 50 | Product Development Engineers, Supply Chain Managers |

| End-Users in Renewable Energy Sector | 60 | Operations Managers, Sustainability Coordinators |

The APAC Flow Battery Market is valued at approximately USD 450 million, driven by the increasing demand for renewable energy storage solutions and significant investments in grid modernization and sustainability initiatives across the region.