Region:Europe

Author(s):Shubham

Product Code:KRAC0835

Pages:87

Published On:August 2025

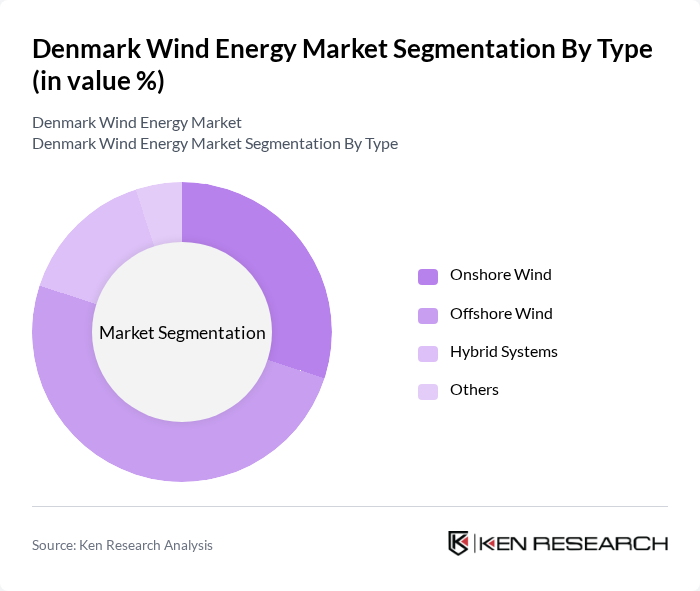

By Type:The market is segmented into Onshore Wind, Offshore Wind, Hybrid Systems, and Others. Offshore Wind is currently the leading segment, supported by Denmark's extensive coastline and favorable wind conditions, which enable the deployment of large-scale, high-efficiency wind farms. Onshore Wind remains significant, particularly in rural areas with available land and established grid connections. Hybrid Systems are gaining momentum as they integrate wind with other renewable sources and storage technologies to enhance grid stability and efficiency .

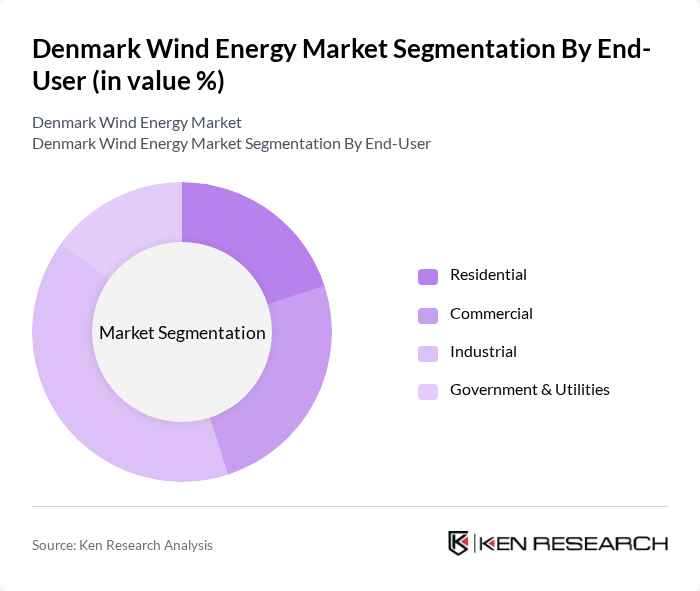

By End-User:The market is categorized into Residential, Commercial, Industrial, and Government & Utilities. The Industrial segment is the largest consumer of wind energy, driven by the need for reliable, sustainable power in manufacturing and heavy industry. Government & Utilities play a substantial role through investments in grid-scale projects and public procurement to meet national energy targets. The Residential and Commercial sectors are expanding as distributed generation and corporate sustainability commitments increase .

The Denmark Wind Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vestas Wind Systems A/S, Ørsted A/S, Siemens Gamesa Renewable Energy S.A., Vattenfall AB, MHI Vestas Offshore Wind A/S contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Denmark wind energy market appears promising, driven by increasing investments in green technologies and a strong governmental commitment to renewable energy. By in future, the integration of energy storage solutions is expected to enhance grid stability, while the expansion of offshore wind farms will significantly boost energy production. Additionally, the rise of digital solutions in wind energy management will optimize operations, leading to greater efficiency and sustainability in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore Wind Offshore Wind Hybrid Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Utility-Scale Projects Distributed Generation Off-Grid Solutions Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| By Technology | Turbine Technology Energy Management Systems Grid Integration Technologies Others |

| By Distribution Mode | Direct Sales Online Platforms Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Offshore Wind Farm Development | 60 | Project Managers, Environmental Consultants |

| Onshore Wind Energy Operations | 50 | Operations Managers, Maintenance Supervisors |

| Wind Turbine Manufacturing | 40 | Product Development Engineers, Supply Chain Managers |

| Regulatory Compliance in Wind Energy | 40 | Policy Advisors, Compliance Officers |

| Investment in Renewable Energy Projects | 50 | Investment Analysts, Financial Managers |

The Denmark Wind Energy Market is valued at approximately USD 18 billion, reflecting significant growth driven by renewable energy targets, technological advancements, and investments in both onshore and offshore wind farms.