Region:Asia

Author(s):Dev

Product Code:KRAA3923

Pages:100

Published On:January 2026

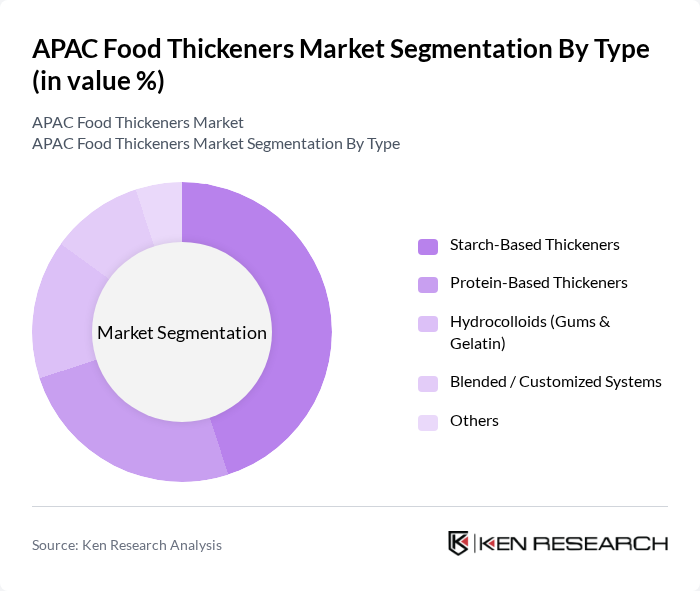

By Type:The market is segmented into various types of thickeners, including starch-based thickeners, protein-based thickeners, hydrocolloids (gums & gelatin), blended/customized systems, and others. This structure aligns with global classifications where starches, hydrocolloids, and proteins are the primary thickener classes. Among these, starch-based thickeners hold a significant share in APAC because of their widespread use in sauces, soups, noodles, bakery, confectionery, and dairy applications, and their cost?effectiveness and local agricultural availability (corn, tapioca, wheat, and rice). Hydrocolloids such as guar gum, xanthan gum, carrageenan, pectin, and gelatin have a strong presence in high?value applications like dairy, beverages, desserts, and meat products, reflecting the global leadership of hydrocolloids in value share. Protein-based thickeners are gaining traction, particularly in dairy, clinical nutrition, and dairy alternative products, driven by increasing demand for plant?based and high?protein offerings, where texturizing proteins contribute both functionality and nutritional value. Blended and customized systems are increasingly adopted by large food processors and foodservice operators seeking consistent texture, shelf life, and processing performance tailored to specific formulations.

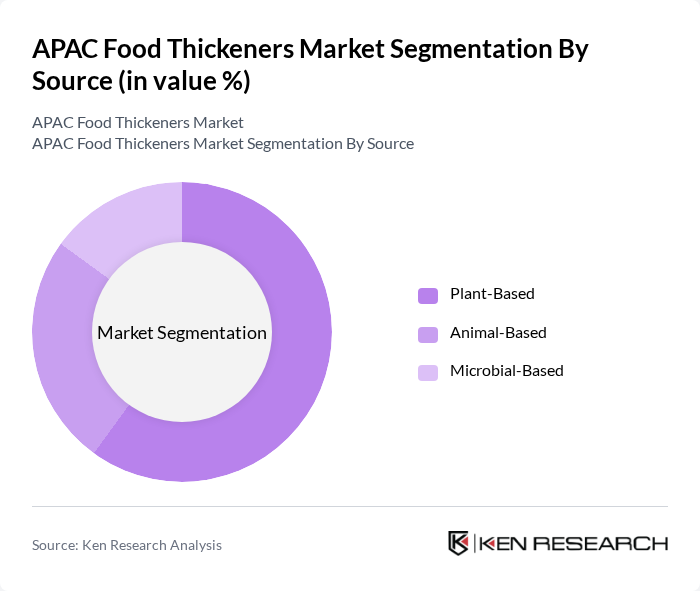

By Source:The food thickeners market is categorized based on the source of thickeners, including plant-based, animal-based, and microbial-based sources, consistent with global market segmentation. Plant-based thickeners are the most widely used and account for a dominant share, supported by rising demand for clean?label, natural, vegetarian, and vegan products, and the broad availability of starches, pectin, cellulose derivatives, and plant gums sourced from corn, tapioca, potato, citrus, and guar. Animal-based thickeners, including gelatin and certain dairy?derived ingredients, remain important in confectionery, desserts, meat products, and specialty nutrition, but face growing competition from plant?based and microbial alternatives due to lifestyle and religious dietary preferences. Microbial-based thickeners, such as xanthan gum, gellan gum, and other fermentation?derived polysaccharides, are emerging as a dynamic segment in APAC, driven by advancements in biotechnology, precision fermentation, and the need for highly functional, stable, and label?friendly solutions for beverages, sauces, and ready meals.

The APAC Food Thickeners Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company (ADM), Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC, International Flavors & Fragrances Inc. (IFF, including former DuPont Nutrition & Biosciences), Kerry Group plc, Ashland Inc., Roquette Frères, Emsland Group, Nexira, Beneo GmbH, GELITA AG, Univar Solutions Inc., Sensient Technologies Corporation, Naturex S.A. (a Givaudan company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC food thickeners market appears promising, driven by ongoing trends towards natural and organic ingredients. As consumers increasingly demand transparency in food production, the shift towards clean label products is expected to accelerate. Additionally, technological advancements in food processing are likely to enhance the efficiency and effectiveness of thickeners, further solidifying their role in the food industry. Companies that adapt to these trends will likely gain a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Starch-Based Thickeners Protein-Based Thickeners Hydrocolloids (Gums & Gelatin) Blended / Customized Systems Others |

| By Source | Plant-Based Animal-Based Microbial-Based |

| By Application | Bakery & Confectionery Dairy & Dairy Alternatives Beverages Soups, Sauces & Dressings Convenience & Processed Foods Others (Infant Nutrition, Clinical & Specialized Foods) |

| By Function | Thickening & Viscosity Control Stabilization & Suspension Gelling & Texturizing Mouthfeel & Sensory Enhancement Others |

| By End-Use Sector | Industrial / Food Processing Foodservice / HoReCa Retail & Consumer |

| By Country | China Japan India South Korea Australia & New Zealand Southeast Asia Rest of APAC |

| By Product Form | Powder Liquid Gel / Paste Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Companies | 120 | Product Development Managers, Quality Assurance Specialists |

| Food Ingredient Suppliers | 90 | Sales Managers, Technical Support Staff |

| Food Retailers | 80 | Category Managers, Procurement Officers |

| Food Service Providers | 70 | Operations Managers, Menu Development Chefs |

| Regulatory Bodies | 40 | Food Safety Inspectors, Policy Makers |

The APAC Food Thickeners Market is valued at approximately USD 4.0 billion, reflecting significant growth driven by increasing demand for processed foods, convenience meals, and innovations in food technology across the region.