APAC Fruit Vegetable Wash Market Overview

- The APAC Fruit Vegetable Wash Market is valued at USD 1.1 billion, based on a five?year historical analysis. This growth is primarily driven by increasing consumer awareness regarding food safety and hygiene, alongside a rising demand for organic produce. The market has seen a surge in the adoption of fruit and vegetable washes as consumers seek to eliminate pesticide residues and contaminants from their food, supported by heightened health consciousness and regulatory initiatives across the region .

- Countries such as China, India, and Japan dominate the APAC Fruit Vegetable Wash Market due to their large populations, rapid urbanization, and significant agricultural sectors. These nations experience a higher demand for effective cleaning solutions to ensure food safety, further amplified by the growing trend of health-conscious consumers who prioritize clean and safe produce .

- In 2023, the Indian government implemented the Food Safety and Standards (Food Products Standards and Food Additives) Amendment Regulations, 2023, mandating the use of food-grade sanitizers in food processing units. This regulation aims to enhance food safety standards and reduce the risk of foodborne illnesses, thereby boosting the demand for fruit and vegetable washes across the country .

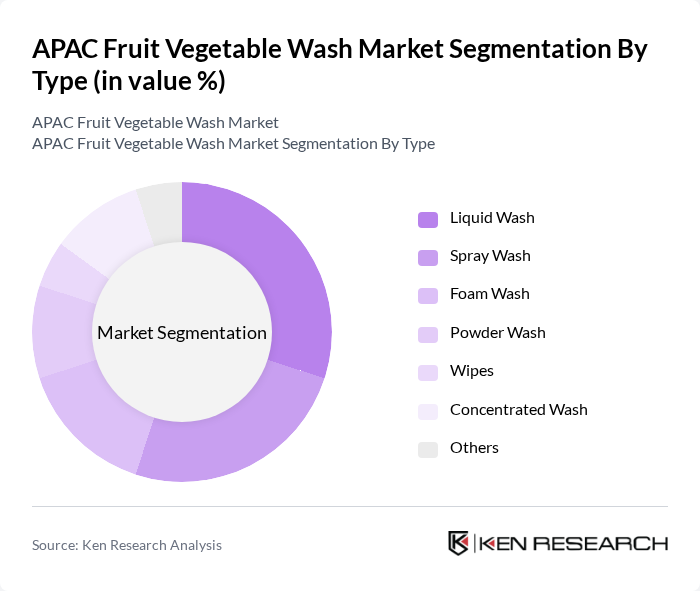

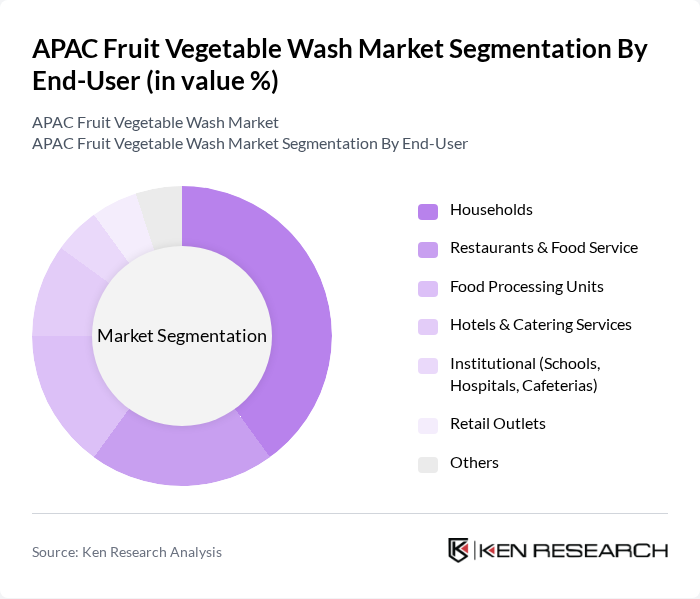

APAC Fruit Vegetable Wash Market Segmentation

By Type:The market is segmented into various types of fruit and vegetable washes, including Liquid Wash, Spray Wash, Foam Wash, Powder Wash, Wipes, Concentrated Wash, and Others. Each type caters to different consumer preferences and usage scenarios, influencing their market share and growth dynamics.

By End-User:The end-user segmentation includes Households, Restaurants & Food Service, Food Processing Units, Hotels & Catering Services, Institutional (Schools, Hospitals, Cafeterias), Retail Outlets, and Others. Each segment reflects varying levels of demand based on consumer behavior and industry requirements.

APAC Fruit Vegetable Wash Market Competitive Landscape

The APAC Fruit Vegetable Wash Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ecolab Inc., Dabur India Ltd., Veggie Clean (Marico Ltd.), ITC Limited, Mapro Foods Pvt. Ltd., Fit Organic (HealthPro Brands Inc.), Pigeon Corporation, KiiltoClean Group, S. C. Johnson & Son, Inc., NatureClean (Planet Clean Inc.), Procter & Gamble (P&G), Unilever PLC, Lion Corporation, Reckitt Benckiser Group plc, Seventh Generation, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

APAC Fruit Vegetable Wash Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The APAC region has seen a significant rise in health consciousness, with 70% of consumers prioritizing food safety and hygiene. According to the World Health Organization, foodborne illnesses affect 600 million people annually, prompting consumers to seek effective washing solutions. This growing awareness is driving the demand for fruit and vegetable washes, as consumers aim to reduce pesticide residues and contaminants, leading to an estimated increase in market demand by 15 million liters in future.

- Rising Demand for Organic Produce:The organic food market in APAC is projected to reach $100 billion in future, with a 20% annual growth rate. As consumers increasingly opt for organic fruits and vegetables, the need for effective washing solutions to maintain their quality and safety becomes paramount. This trend is supported by the Organic Trade Association, which reported a 30% increase in organic produce sales in future, further fueling the demand for specialized washing products.

- Stringent Food Safety Regulations:Governments across APAC are implementing stricter food safety regulations, with the Food Safety and Standards Authority of India reporting a 25% increase in compliance checks in future. These regulations mandate the use of safe washing agents to ensure consumer safety. As a result, manufacturers are compelled to innovate and provide compliant products, leading to a projected increase in the fruit and vegetable wash market by 10 million liters in future, as businesses adapt to these regulations.

Market Challenges

- High Competition Among Brands:The APAC fruit and vegetable wash market is characterized by intense competition, with over 50 brands vying for market share. This saturation leads to price wars, reducing profit margins for manufacturers. According to industry reports, the average market share of leading brands has decreased by 5% in the last year, making it challenging for new entrants to establish themselves and for existing brands to maintain profitability amidst aggressive marketing strategies.

- Consumer Price Sensitivity:Economic fluctuations in the APAC region have heightened consumer price sensitivity, with 60% of shoppers indicating that price is a primary factor in their purchasing decisions. The IMF forecasts a 3% GDP growth in future, which may not significantly alleviate this sensitivity. As consumers prioritize affordability, premium-priced fruit and vegetable washes may struggle to gain traction, limiting market growth potential and forcing brands to reconsider their pricing strategies.

APAC Fruit Vegetable Wash Market Future Outlook

The APAC fruit and vegetable wash market is poised for significant evolution, driven by increasing health awareness and regulatory pressures. Innovations in eco-friendly formulations and packaging are expected to gain traction, aligning with consumer preferences for sustainability. Additionally, the rise of e-commerce platforms will facilitate broader market access, enabling brands to reach a wider audience. As the market adapts to these trends, companies that prioritize transparency and sustainability will likely capture a larger share of the growing consumer base in future and beyond.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets in Southeast Asia are witnessing a rapid increase in disposable income, projected to rise by 8% annually. This economic growth presents a lucrative opportunity for fruit and vegetable wash brands to penetrate these markets, catering to a growing middle class that prioritizes health and hygiene in food consumption.

- Development of Eco-friendly Products:With 65% of consumers expressing a preference for sustainable products, there is a significant opportunity for brands to develop eco-friendly fruit and vegetable washes. The global market for green cleaning products is expected to reach $20 billion in future, indicating a strong consumer shift towards environmentally responsible choices that can enhance brand loyalty and market share.