Region:Middle East

Author(s):Dev

Product Code:KRAC8717

Pages:85

Published On:November 2025

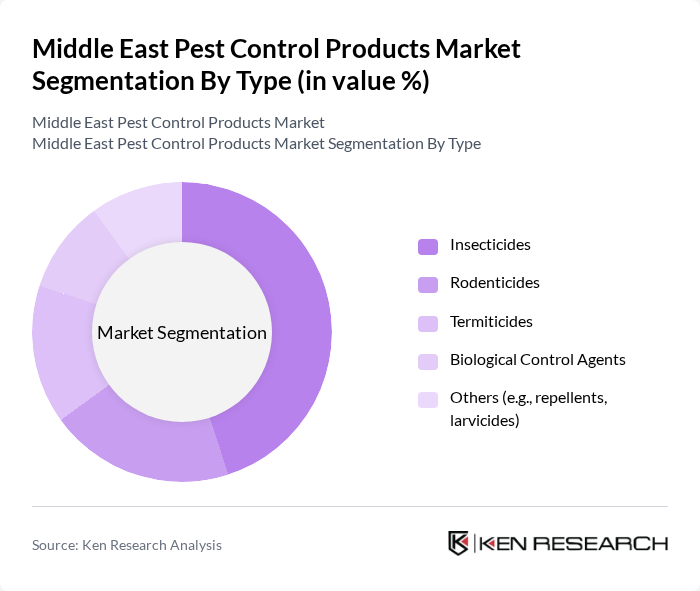

By Type:

The pest control products market can be segmented into various types, including insecticides, rodenticides, termiticides, biological control agents, and others such as repellents and larvicides. Among these, insecticides dominate the market due to their widespread use in both residential and agricultural applications. The increasing prevalence of pests and the need for effective pest management solutions have led to a higher demand for insecticides. Additionally, the adoption of integrated pest management (IPM) practices is rising, with insecticides often serving as a core component alongside biological and mechanical controls to achieve sustainable results .

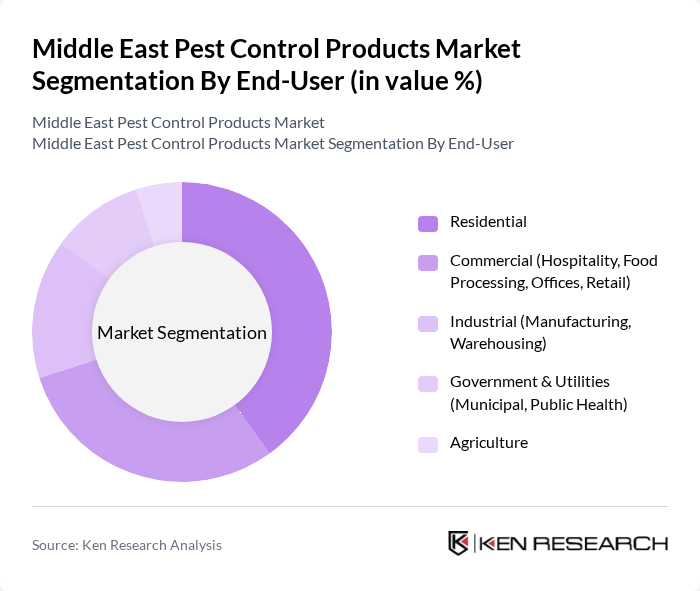

By End-User:

The end-user segmentation of the pest control products market includes residential, commercial, industrial, government & utilities, and agriculture. The residential segment is the largest end-user, driven by increasing consumer awareness regarding pest-related health risks and the growing trend of home gardening. The commercial sector, particularly in hospitality and food processing, also shows significant demand due to stringent hygiene standards. The agricultural sector is increasingly adopting pest control products to enhance crop yield and protect against pest infestations, further contributing to market growth. Additionally, the adoption of pest control solutions in government and utilities is rising, especially for public health and vector control initiatives .

The Middle East Pest Control Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rentokil Initial plc, Rollins Inc. (Orkin), Ecolab Inc., Bayer CropScience AG, Syngenta AG, FMC Corporation, BASF SE, Anticimex AB, ServiceMaster Global Holdings (Terminix), National Pest Control (UAE), Masa Establishment for Pest Extermination (Saudi Arabia), Al Mobidoon Pest Control (UAE), Boecker Public Health (Lebanon/Regional), Al Madina Pest Control (UAE), Pest Control Dubai (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East pest control products market appears promising, driven by technological advancements and a growing emphasis on sustainability. As urbanization continues, the demand for innovative pest control solutions will likely increase, particularly those that integrate smart technologies. Additionally, the shift towards eco-friendly products will shape market dynamics, as consumers and businesses alike prioritize health and environmental safety. Companies that adapt to these trends will be well-positioned for success in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Insecticides Rodenticides Termiticides Biological Control Agents Others (e.g., repellents, larvicides) |

| By End-User | Residential Commercial (Hospitality, Food Processing, Offices, Retail) Industrial (Manufacturing, Warehousing) Government & Utilities (Municipal, Public Health) Agriculture |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Palestine, Iraq) North Africa (Egypt, Libya, Algeria, Morocco, Tunisia) |

| By Application | Agriculture Residential Pest Control Commercial Pest Control Public Health (Vector Control, Disease Prevention) Others |

| By Distribution Channel | Online Retail Offline Retail (Supermarkets, Specialty Stores) Direct Sales Distributors/Dealers Others |

| By Product Formulation | Liquid Granular Aerosol Bait Others |

| By Packaging Type | Bottles Cans Pouches Bulk Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Pest Control Services | 100 | Pest Control Technicians, Homeowners |

| Agricultural Pest Management | 60 | Agronomists, Farm Managers |

| Commercial Pest Control Solutions | 50 | Facility Managers, Business Owners |

| Public Health Pest Control Initiatives | 40 | Public Health Officials, Environmental Health Specialists |

| Industrial Pest Control Applications | 40 | Operations Managers, Safety Officers |

The Middle East Pest Control Products Market is valued at approximately USD 1.3 billion, driven by urbanization, health awareness, and agricultural expansion. This market reflects a growing demand for both chemical and biological pest control solutions.