Region:Asia

Author(s):Dev

Product Code:KRAC3356

Pages:83

Published On:October 2025

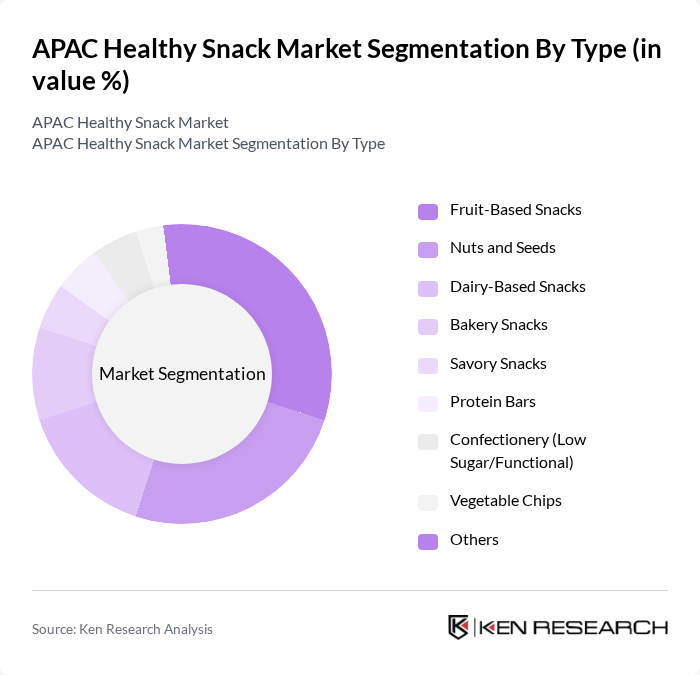

By Type:The healthy snack market is segmented into fruit-based snacks, nuts and seeds, dairy-based snacks, bakery snacks, savory snacks, protein bars, confectionery (low sugar/functional), vegetable chips, and others. Fruit-based snacks and nuts and seeds are the most popular segments, driven by their perceived health benefits, convenience, and strong consumer preference for natural ingredients. The increasing adoption of healthy snacking among urban and health-conscious consumers is fueling demand for these products, while dairy-based and bakery snacks continue to gain traction due to product innovation and expanded retail availability.

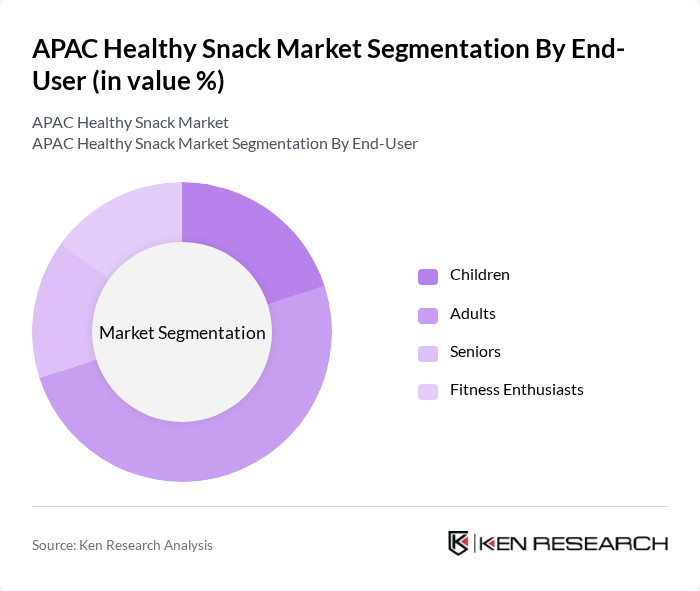

By End-User:The end-user segmentation includes children, adults, seniors, and fitness enthusiasts. Adults comprise the largest segment, reflecting increased focus on health and wellness, busy urban lifestyles, and a growing need for convenient snacking options. Rising awareness of nutrition and preventive health among adults is driving significant growth in healthy snack consumption, while fitness enthusiasts and seniors are increasingly seeking products tailored to their dietary needs.

The APAC Healthy Snack Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., PepsiCo, Inc., The Kellogg Company, Mondelez International, Inc., General Mills, Inc., Hain Celestial Group, Inc., Calbee, Inc., Want Want China Holdings Ltd., Orion Holdings Corp., Lotte Confectionery Co., Ltd., Universal Robina Corporation, Dali Foods Group Co., Ltd., Select Harvests Ltd., Monsoon Harvest, Fresh Del Monte Produce Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC healthy snack market is poised for continued growth, driven by evolving consumer preferences and technological advancements in food production. As health awareness increases, brands are likely to innovate with new flavors and ingredients, catering to diverse dietary needs. Additionally, the integration of technology in supply chains will enhance product availability and transparency, fostering consumer trust. The market is expected to adapt to sustainability trends, with a focus on eco-friendly packaging and sourcing, aligning with consumer values and regulatory demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Fruit-Based Snacks Nuts and Seeds Dairy-Based Snacks Bakery Snacks Savory Snacks Protein Bars Confectionery (Low Sugar/Functional) Vegetable Chips Others |

| By End-User | Children Adults Seniors Fitness Enthusiasts |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Health Food Stores Others |

| By Packaging Type | Resealable Bags Single-Serve Packs Bulk Packaging |

| By Flavor Profile | Sweet Savory Spicy |

| By Price Range | Premium Mid-Range Budget |

| By Region | North Asia (Japan, South Korea, China) Southeast Asia (Singapore, Indonesia, Thailand, Malaysia, Vietnam, Philippines) South Asia (India, Bangladesh, Sri Lanka, Pakistan) Oceania (Australia, New Zealand) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Healthy Snack Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences for Healthy Snacks | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Distribution Channels for Healthy Snacks | 80 | Logistics Managers, Supply Chain Coordinators |

| Market Trends in Healthy Snack Innovations | 60 | Product Development Specialists, R&D Managers |

| Regulatory Impact on Healthy Snack Products | 40 | Food Safety Officers, Regulatory Affairs Managers |

The APAC Healthy Snack Market is valued at approximately USD 24 billion, driven by increasing health consciousness, demand for natural ingredients, and lifestyle changes favoring convenient, nutritious options.