Region:Asia

Author(s):Dev

Product Code:KRAA9710

Pages:83

Published On:November 2025

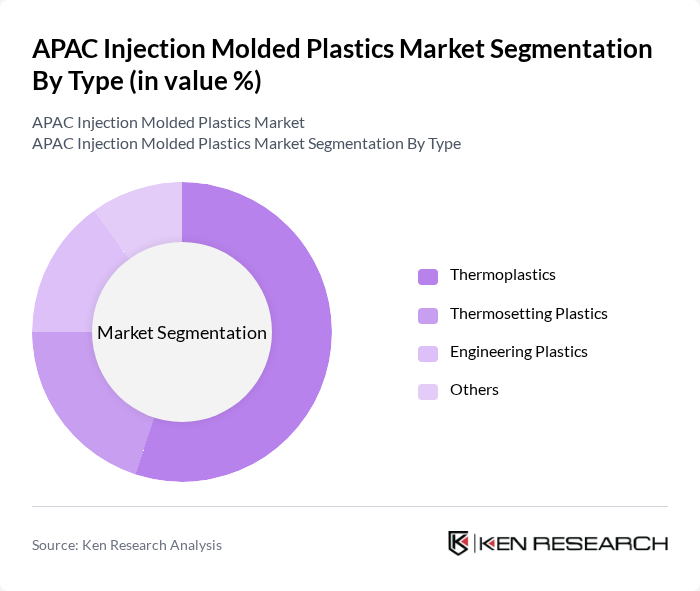

By Type:The market is segmented into Thermoplastics, Thermosetting Plastics, Engineering Plastics, and Others. Thermoplastics dominate the market due to their versatility, ease of processing, and recyclability, making them suitable for a wide range of applications including automotive, packaging, and consumer goods. Thermosetting Plastics are significant in industries requiring high thermal stability and chemical resistance, such as electrical and electronics. Engineering Plastics are gaining traction due to their superior mechanical properties and use in high-performance applications, while the 'Others' category includes specialty polymers for niche uses.

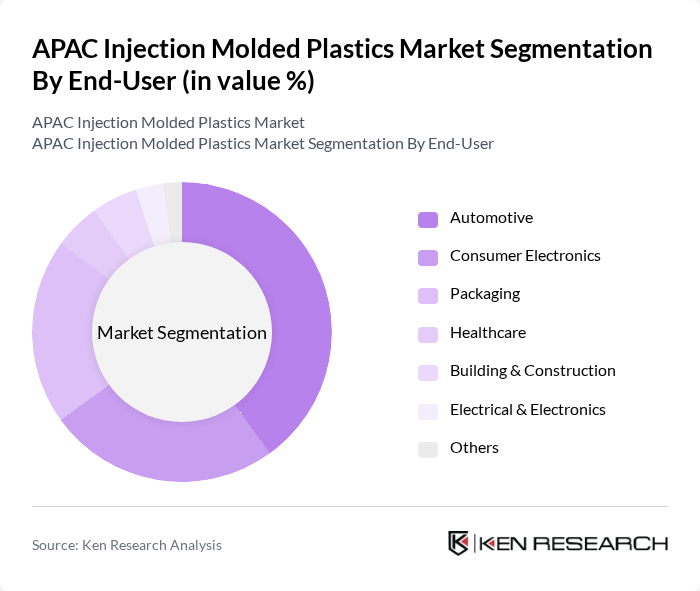

By End-User:The end-user segments include Automotive, Consumer Electronics, Packaging, Healthcare, Building & Construction, Electrical & Electronics, and Others. The Automotive sector is the largest consumer of injection molded plastics, driven by the demand for lightweight components that enhance fuel efficiency and meet regulatory standards. Consumer Electronics significantly contributes to the market, with the need for durable, high-precision, and aesthetically pleasing products. Packaging is rapidly growing due to the increasing demand for sustainable and protective packaging solutions, especially in e-commerce and FMCG sectors. Healthcare, Building & Construction, and Electrical & Electronics are also important segments, utilizing injection molded plastics for specialized applications.

The APAC Injection Molded Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., SABIC, LyondellBasell Industries, INEOS Group, Mitsubishi Chemical Corporation, Covestro AG, LG Chem Ltd., Huntsman Corporation, Eastman Chemical Company, Solvay S.A., DuPont de Nemours, Inc., Formosa Plastics Corporation, Toray Industries, Inc., Teijin Limited, Sumitomo Chemical Co., Ltd., China National Petroleum Corporation (CNPC), Reliance Industries Limited, PetroChina Company Limited, Mitsui Chemicals, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC injection molded plastics market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The shift towards sustainable materials is expected to gain momentum, with an increasing number of manufacturers adopting biodegradable plastics. Additionally, the integration of automation and digital technologies in production processes will enhance efficiency and reduce costs. As companies navigate regulatory challenges, innovation in recycling technologies will also play a crucial role in shaping the future landscape of the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermoplastics Thermosetting Plastics Engineering Plastics Others |

| By End-User | Automotive Consumer Electronics Packaging Healthcare Building & Construction Electrical & Electronics Others |

| By Region | China India Japan South Korea Southeast Asia Australia Others |

| By Application | Automotive Components Household Goods Industrial Equipment Medical Devices Packaging Products Electrical Housings Others |

| By Material | Polypropylene (PP) Polyethylene (PE) Polyvinyl Chloride (PVC) Polystyrene (PS) Polyethylene Terephthalate (PET) Polyurethane (PU) Others |

| By Production Process | Injection Molding Blow Molding Rotational Molding Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Injection Molding | 100 | Production Managers, Quality Assurance Leads |

| Consumer Goods Manufacturing | 80 | Product Development Managers, Supply Chain Analysts |

| Electronics Components Production | 60 | Operations Managers, Engineering Managers |

| Medical Device Manufacturing | 50 | Regulatory Affairs Specialists, Manufacturing Engineers |

| Packaging Solutions | 70 | Marketing Managers, Production Supervisors |

The APAC Injection Molded Plastics Market is valued at approximately USD 190 billion, driven by the demand for lightweight and durable materials across various industries, including automotive, consumer electronics, and packaging.