Region:Asia

Author(s):Rebecca

Product Code:KRAC8434

Pages:88

Published On:November 2025

By Technology:

The technology segment of the injection molding machine market includes hydraulic, electric, and hybrid machines. Hydraulic injection molding machines continue to dominate the market due to their high efficiency and ability to handle large-scale production, especially in automotive and packaging industries where high-speed production and precision are crucial. Electric injection molding machines are gaining traction owing to their energy efficiency, lower operational costs, and appeal to manufacturers focused on sustainability and precision applications. Hybrid machines, which combine the advantages of both hydraulic and electric technologies, are increasingly adopted for their versatility and ability to support a wide range of applications .

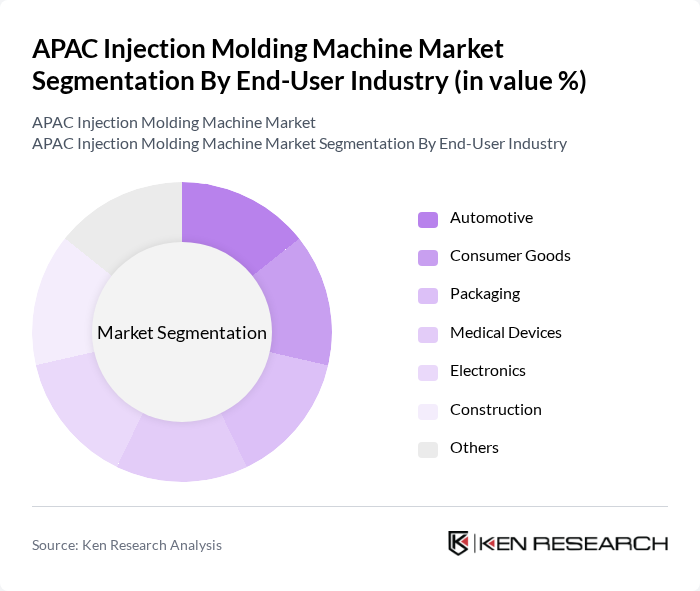

By End-User Industry:

The end-user industry segment encompasses automotive, consumer goods, packaging, medical devices, electronics, construction, and others. The automotive sector remains the largest consumer of injection molding machines, driven by the demand for lightweight, durable, and precision components. The packaging industry follows, as manufacturers seek efficient and cost-effective production methods for various plastic packaging solutions. The medical devices sector is expanding due to rising requirements for precision and compliance with stringent regulatory standards. Consumer goods and electronics are also significant contributors, reflecting the diverse and growing applications of injection molding technology across APAC .

The APAC Injection Molding Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arburg GmbH, Engel Austria GmbH, Husky Injection Molding Systems, Milacron Holdings Corp., Sumitomo (SHI) Demag Plastics Machinery GmbH, Nissei Plastic Industrial Co., Ltd., Toshiba Machine Co., Ltd., Fanuc Corporation, KraussMaffei Group, Wittmann Battenfeld, Haitian International Holdings Limited, Chen Hsong Holdings Limited, Yizumi Precision Machinery Co., Ltd., Ningbo Newpower Plastic Machinery Co., Ltd., Borche Machinery Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC injection molding machine market is poised for transformative growth driven by technological advancements and increasing demand for sustainable practices. As manufacturers adopt energy-efficient machines and integrate IoT technologies, operational efficiencies will improve. Additionally, the shift towards lightweight materials in automotive and consumer electronics will further stimulate demand. The focus on sustainability will likely lead to innovations in biodegradable plastics, creating new avenues for growth and positioning the market favorably for the future.

| Segment | Sub-Segments |

|---|---|

| By Technology | Hydraulic Injection Molding Machines Electric Injection Molding Machines Hybrid Injection Molding Machines |

| By End-User Industry | Automotive Consumer Goods Packaging Medical Devices Electronics Construction Others |

| By Material Type | Thermoplastics Thermosets Rubber |

| By Country/Region | China Japan India South Korea Southeast Asia (Thailand, Vietnam, Indonesia) Rest of APAC |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Injection Molding Applications | 45 | Manufacturing Engineers, Product Development Managers |

| Consumer Goods Production | 38 | Operations Managers, Supply Chain Coordinators |

| Medical Device Manufacturing | 42 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Packaging Industry Insights | 40 | Packaging Engineers, Production Managers |

| Electronics Component Production | 35 | Production Supervisors, R&D Engineers |

The APAC Injection Molding Machine Market is valued at approximately USD 8.3 billion, driven by increasing demand for plastic products across various industries, including automotive, consumer goods, packaging, and electronics.