Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8250

Pages:83

Published On:November 2025

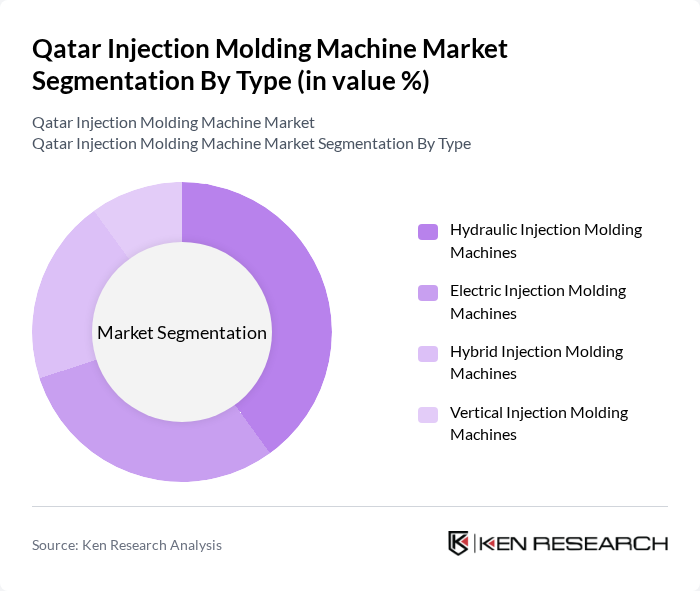

By Type:The injection molding machine market can be segmented into four main types: Hydraulic Injection Molding Machines, Electric Injection Molding Machines, Hybrid Injection Molding Machines, and Vertical Injection Molding Machines. Each type serves different manufacturing needs and preferences, with hydraulic machines being favored for their robustness, while electric machines are gaining traction due to their energy efficiency and precision.

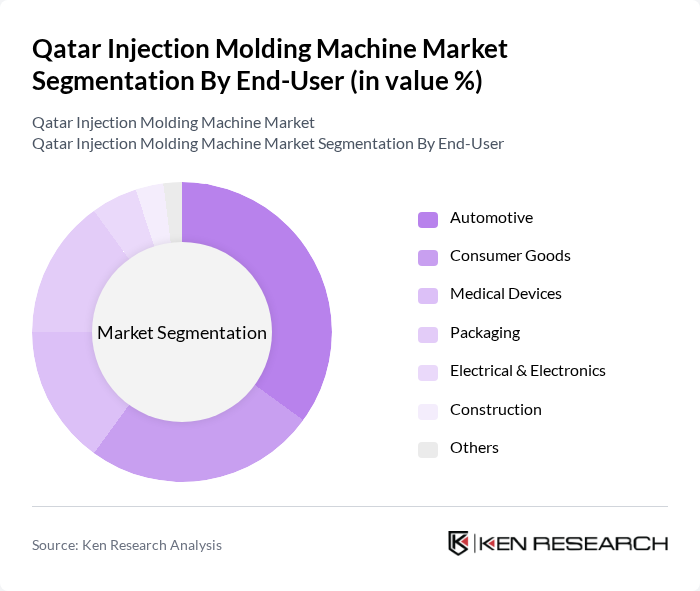

By End-User:The end-user segmentation includes Automotive, Consumer Goods, Medical Devices, Packaging, Electrical & Electronics, Construction, and Others. The automotive sector is a significant contributor to the demand for injection molding machines, driven by the need for high-quality plastic components in vehicle manufacturing.

The Qatar Injection Molding Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Plastic Products Company, Gulf Plastic Industries, Qatar National Plastic Company, Doha Plastic Factory, Al Jazeera Plastic Products Company, Qatar Petrochemical Company (QAPCO), Qatar Industrial Manufacturing Company (QIMC), Qatar Chemical Company (Q-Chem), Qatar Polymer Industrial Company, Aalmir Plastic Industries, ENGEL Austria GmbH, Haitian International Holdings Limited, Yizumi Holdings Co., Ltd., Sumitomo (SHI) Demag Plastics Machinery GmbH, Arburg GmbH + Co KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar injection molding machine market appears promising, driven by increasing demand for sustainable and innovative plastic solutions. As manufacturers embrace automation and smart technologies, operational efficiencies are expected to improve, leading to enhanced production capabilities. Additionally, the government's commitment to supporting local manufacturing through financial incentives and infrastructure development will likely foster a conducive environment for growth, positioning Qatar as a regional hub for injection molding technology.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydraulic Injection Molding Machines Electric Injection Molding Machines Hybrid Injection Molding Machines Vertical Injection Molding Machines |

| By End-User | Automotive Consumer Goods Medical Devices Packaging Electrical & Electronics Construction Others |

| By Industry Application | Electronics & Electrical Components Construction Materials Automotive Parts Medical & Healthcare Products Packaging Solutions Others |

| By Machine Size (Clamping Force) | Up to 200 Tons (Small) –500 Tons (Medium) Above 500 Tons (Large) |

| By Production Capacity (Units per Hour) | Low Capacity (<100 units/hour) Medium Capacity (100–500 units/hour) High Capacity (>500 units/hour) |

| By Material Type | Thermoplastics Thermosetting Plastics Elastomers Bioplastics Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Injection Molding | 60 | Production Managers, Quality Control Engineers |

| Consumer Goods Manufacturing | 50 | Product Development Managers, Supply Chain Analysts |

| Packaging Industry Insights | 40 | Operations Directors, Packaging Engineers |

| Medical Device Manufacturing | 40 | Regulatory Affairs Specialists, Manufacturing Engineers |

| Construction Materials Sector | 40 | Procurement Managers, Project Engineers |

The Qatar Injection Molding Machine Market is valued at approximately USD 465 thousand, reflecting a five-year historical analysis. This valuation is influenced by the growing demand for plastic products across various sectors, including automotive and packaging.