APAC Interactive Display Market Overview

- The APAC Interactive Display Market is valued at USD 4 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of interactive technologies in education, corporate, retail, and government sectors. Key drivers include large-scale classroom upgrades, government-led digitalization initiatives, and the expansion of domestic panel manufacturers, which have reduced hardware costs and increased product availability. The demand for enhanced user engagement, hybrid learning, and interactive customer experiences continues to accelerate market expansion .

- Key players in this market includeChina, Japan, and South Korea, which dominate due to advanced technological infrastructure and significant investment in research and development. These countries are home to leading manufacturers and a growing consumer base that values innovative display solutions, further solidifying their market leadership .

- In 2023, the Indian government implemented theNational Digital Education Architecture (NDEAR) Guidelines, 2023issued by the Ministry of Education. This policy includes a budget allocation of INR 200 billion to equip educational institutions with modern interactive technologies, aiming to enhance learning outcomes and digital literacy among students. The guidelines mandate the integration of digital infrastructure, including interactive displays, across public schools, with compliance requirements for procurement, teacher training, and reporting .

APAC Interactive Display Market Segmentation

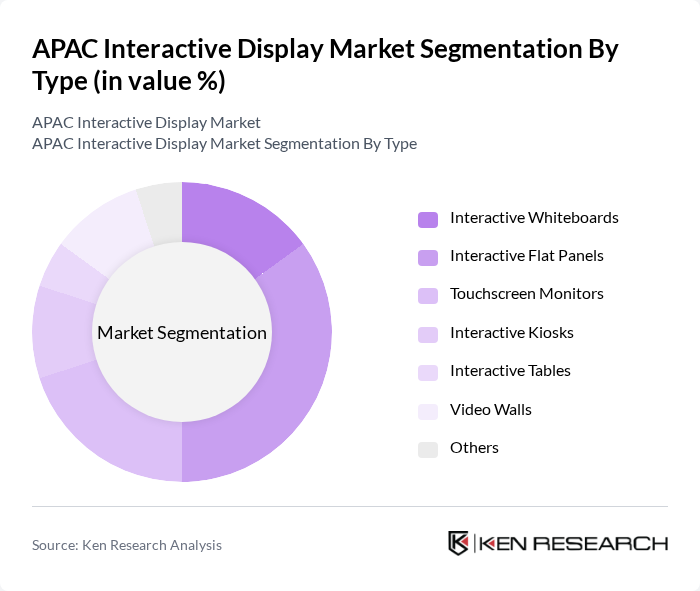

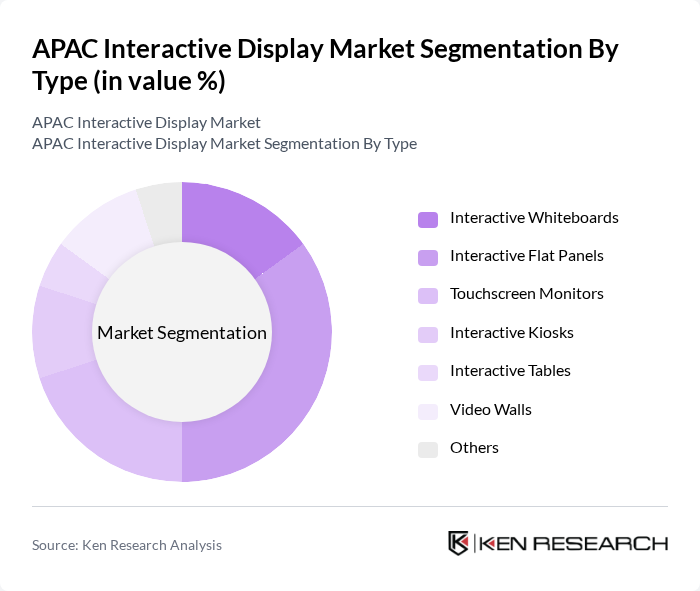

By Type:The market is segmented into Interactive Whiteboards, Interactive Flat Panels, Touchscreen Monitors, Interactive Kiosks, Interactive Tables, Video Walls, and Others. Among these,Interactive Flat Panelsare gaining significant traction due to their versatility, large format, and user-friendly interfaces, making them increasingly popular in both educational and corporate environments. The adoption of interactive kiosks and monitors is also rising in retail and hospitality, driven by the need for self-service and enhanced customer engagement .

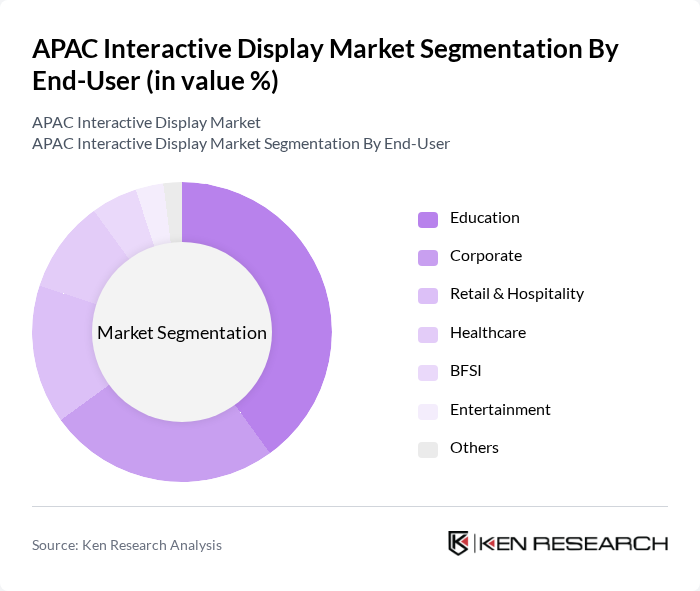

By End-User:The end-user segmentation includes Education, Corporate, Retail & Hospitality, Healthcare, BFSI, Entertainment, and Others. TheEducationsector is the leading segment, driven by the integration of technology in classrooms, government digitalization initiatives, and the demand for interactive learning tools that enhance student engagement and participation. The corporate segment is also expanding, supported by hybrid work models and the need for collaborative meeting solutions .

APAC Interactive Display Market Competitive Landscape

The APAC Interactive Display Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics, LG Electronics, Sharp Corporation, NEC Corporation, Epson, BenQ, ViewSonic, Panasonic Holdings Corporation, BOE Technology Group Co., Ltd., Hisense Group, Promethean Limited, SMART Technologies ULC, Microsoft Corporation, Google LLC, and Alibaba Group Holding Limited contribute to innovation, geographic expansion, and service delivery in this space.

APAC Interactive Display Market Industry Analysis

Growth Drivers

- Increasing Demand for Interactive Learning Solutions:The APAC region is witnessing a surge in demand for interactive learning solutions, driven by a growing emphasis on digital education. In future, the education technology market in APAC is projected to reach approximately $50 billion, with interactive displays playing a crucial role in enhancing student engagement. This shift is supported by government initiatives promoting digital literacy, with countries like India allocating $1.5 billion for educational technology enhancements, further fueling the adoption of interactive displays in classrooms.

- Rising Adoption of Digital Signage in Retail:The retail sector in APAC is increasingly adopting digital signage, with the market expected to grow to $10 billion in future. This growth is attributed to the need for enhanced customer engagement and personalized marketing strategies. For instance, Japan's retail industry is investing over $2 billion in digital signage solutions, recognizing the effectiveness of interactive displays in driving sales and improving customer experiences, thus significantly contributing to the interactive display market.

- Growth in Corporate Training and Collaboration Tools:The corporate sector in APAC is rapidly expanding its use of interactive displays for training and collaboration. In future, corporate training expenditures in the region are projected to exceed $30 billion, with interactive displays facilitating remote collaboration and training sessions. Companies are increasingly investing in these technologies to enhance employee engagement and productivity, with major firms like Samsung committing $500 million to develop advanced interactive training solutions, further driving market growth.

Market Challenges

- High Initial Investment Costs:One of the significant challenges facing the interactive display market in APAC is the high initial investment required for advanced display technologies. For instance, the average cost of a high-quality interactive display can range from $2,000 to $10,000, which poses a barrier for small and medium-sized enterprises. This financial hurdle is particularly pronounced in emerging markets, where budget constraints limit the adoption of such technologies, hindering overall market growth.

- Integration Issues with Existing Systems:Many organizations face challenges integrating interactive displays with their existing IT infrastructure. In future, approximately 40% of businesses in APAC report difficulties in achieving seamless integration, which can lead to increased operational costs and inefficiencies. This challenge is particularly evident in sectors like education and corporate training, where legacy systems may not support the latest interactive technologies, creating a significant barrier to widespread adoption.

APAC Interactive Display Market Future Outlook

The future of the APAC interactive display market appears promising, driven by technological advancements and increasing digitalization across various sectors. As organizations prioritize employee engagement and customer interaction, the demand for innovative display solutions is expected to rise. Furthermore, the integration of AI and machine learning into interactive displays will enhance user experiences, making them more intuitive and effective. This trend, coupled with a growing focus on sustainability, will likely shape the market landscape in the coming years, fostering further growth and innovation.

Market Opportunities

- Expansion in the Education Sector:The education sector presents a significant opportunity for interactive displays, with governments in APAC investing heavily in digital learning environments. For example, China's education budget for future is projected to exceed $100 billion, creating a fertile ground for interactive display adoption in classrooms and educational institutions, enhancing learning outcomes and engagement.

- Increasing Demand for Smart City Initiatives:The push for smart city initiatives across APAC is driving demand for interactive displays in public spaces. With cities like Singapore investing $1.5 billion in smart technology infrastructure, interactive displays are becoming essential for information dissemination and public engagement, presenting a lucrative opportunity for market players to innovate and expand their offerings.