Region:Asia

Author(s):Shubham

Product Code:KRAA8557

Pages:89

Published On:November 2025

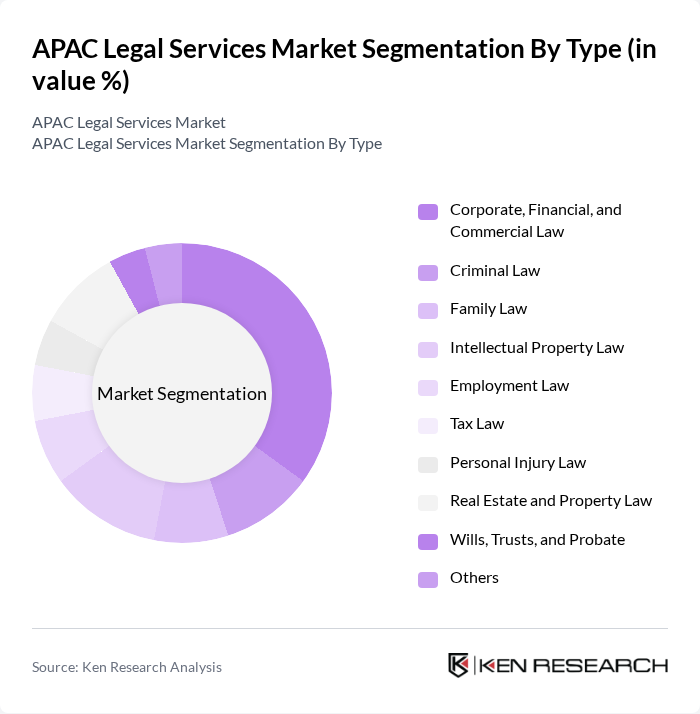

By Type:The legal services market is segmented into various types, including Corporate, Financial, and Commercial Law; Criminal Law; Family Law; Intellectual Property Law; Employment Law; Tax Law; Personal Injury Law; Real Estate and Property Law; Wills, Trusts, and Probate; and Others. Among these, Corporate, Financial, and Commercial Law is the leading segment, driven by the increasing complexity of business transactions, regulatory compliance requirements, and the expansion of multinational corporations and startups in the region. The adoption of digital solutions and legal technology is further accelerating growth in this segment .

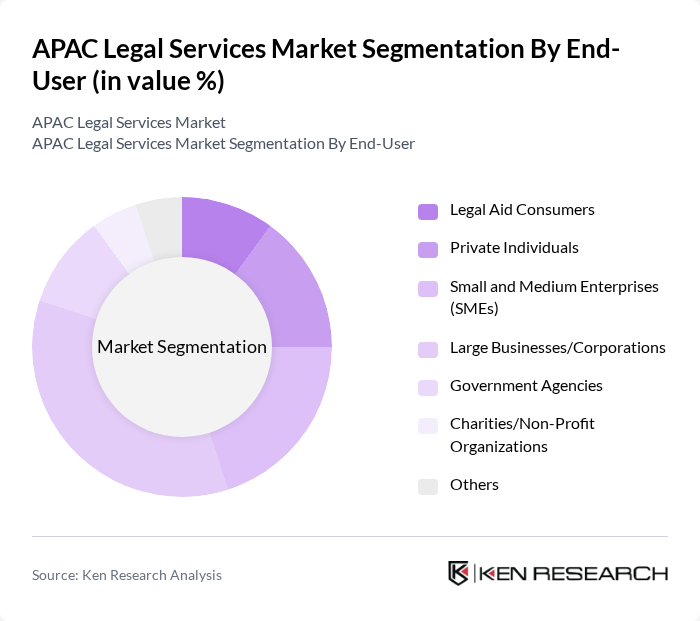

By End-User:The end-user segmentation includes Legal Aid Consumers, Private Individuals, Small and Medium Enterprises (SMEs), Large Businesses/Corporations, Government Agencies, Charities/Non-Profit Organizations, and Others. The segment of Large Businesses/Corporations is the most significant, as these entities require extensive legal support for compliance, mergers and acquisitions, and intellectual property protection. The increasing complexity of business operations and the rise of cross-border activities in the APAC region drive the demand for specialized legal services tailored to corporate needs .

The APAC Legal Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baker McKenzie, King & Wood Mallesons, Herbert Smith Freehills, Clifford Chance, Allen & Overy, DLA Piper, Nishimura & Asahi, Zhong Lun Law Firm, Rajah & Tann Asia, WongPartnership LLP, Ashurst, Linklaters, MinterEllison, Dentons, Kim & Chang contribute to innovation, geographic expansion, and service delivery in this space.

The APAC legal services market is poised for transformative growth, driven by technological advancements and evolving client expectations. As firms increasingly adopt AI and automation, operational efficiencies will improve, allowing for enhanced service delivery. Additionally, the focus on data privacy and cybersecurity will shape legal practices, ensuring compliance with stringent regulations. The rise of subscription-based models will also redefine client engagement, making legal services more accessible and tailored to individual needs, fostering a more dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Corporate, Financial, and Commercial Law Criminal Law Family Law Intellectual Property Law Employment Law Tax Law Personal Injury Law Real Estate and Property Law Wills, Trusts, and Probate Others |

| By End-User | Legal Aid Consumers Private Individuals Small and Medium Enterprises (SMEs) Large Businesses/Corporations Government Agencies Charities/Non-Profit Organizations Others |

| By Region | China India Japan Australia South Korea Southeast Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines) Rest of Asia-Pacific |

| By Service Delivery Model | Traditional Law Firms Virtual Law Firms Legal Process Outsourcing (LPO) In-house Legal Departments Freelance Legal Services Legal Tech Platforms Others |

| By Industry | Financial Services Healthcare Technology Real Estate Manufacturing Energy & Infrastructure Others |

| By Legal Specialization | Litigation & Dispute Resolution Advisory & Consultancy Services Mediation and Arbitration Compliance and Regulatory Services Bankruptcy & Restructuring Notarial and Certification Services Legal Research and Documentation Others |

| By Client Size | Individual Clients Small Businesses Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Legal Services | 120 | General Counsels, Legal Advisors |

| Litigation Services | 90 | Litigation Partners, Case Managers |

| Intellectual Property Services | 60 | IP Attorneys, Patent Agents |

| Legal Technology Solutions | 50 | Legal Tech Founders, Product Managers |

| Regulatory Compliance Services | 70 | Compliance Officers, Risk Management Executives |

The APAC Legal Services Market is valued at approximately USD 245 billion, reflecting significant growth driven by increasing demand for legal compliance, corporate governance, and dispute resolution services across various sectors in the region.