Global Legal Services Market Overview

- The Global Legal Services Market is valued at USD 1,100 billion, based on a five-year historical analysis. This growth is primarily driven by increasing demand for legal compliance, the rise of corporate governance, and the expansion of international trade, which necessitates legal expertise across various jurisdictions. The market has seen a significant uptick in the need for specialized legal services, particularly in areas such as intellectual property and corporate law. Recent trends also highlight the adoption of digital technologies, the integration of artificial intelligence in legal processes, and the emergence of alternative legal service providers, which are enhancing efficiency and broadening service offerings .

- Key players in this market are concentrated in major financial hubs such as New York, London, and Hong Kong. These cities dominate due to their established legal frameworks, access to a diverse client base, and the presence of multinational corporations. The concentration of legal talent and resources in these regions further enhances their competitive advantage, making them attractive locations for legal service providers. North America holds the largest market share, driven by advanced legal infrastructure and technology adoption, while Asia-Pacific is experiencing rapid growth due to economic development and increasing cross-border transactions .

- In 2023, the European Union implemented the Digital Services Act (Regulation (EU) 2022/2065, issued by the European Parliament and the Council), which mandates stricter regulations for online platforms regarding user data protection and content moderation. This regulation has significant implications for legal service providers, as businesses must now navigate complex compliance requirements, leading to increased demand for legal expertise in digital law and data privacy. The Act requires platforms to implement robust mechanisms for risk management, transparency, and user rights protection, thereby intensifying the need for specialized legal counsel in the digital domain .

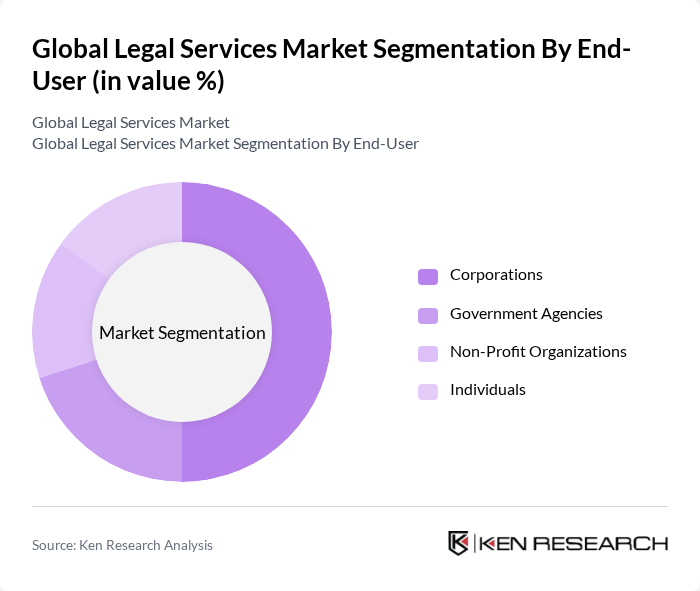

Global Legal Services Market Segmentation

By Type:The legal services market can be segmented into various types, including Corporate Law, Criminal Law, Family Law, Intellectual Property Law, Tax Law, Employment/Labor Law, Real Estate Law, Litigation & Dispute Resolution, Bankruptcy & Restructuring, Alternative Dispute Resolution (ADR), and Others (Regulatory, Antitrust, Environmental, Contract Law, Personal Injury, Consumer Protection). Each of these segments caters to specific legal needs and client requirements.

By End-User:The end-users of legal services include Corporations, Government Agencies, Non-Profit Organizations, and Individuals. Each of these segments has distinct legal needs, with corporations typically requiring extensive legal support for compliance and transactions, while individuals may seek legal assistance for personal matters.

Global Legal Services Market Competitive Landscape

The Global Legal Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baker McKenzie, DLA Piper, Clifford Chance, Allen & Overy, Skadden, Arps, Slate, Meagher & Flom LLP, Latham & Watkins LLP, Hogan Lovells, Norton Rose Fulbright, Sidley Austin LLP, White & Case LLP, Freshfields Bruckhaus Deringer, Linklaters, King & Spalding, Paul Hastings LLP, Cleary Gottlieb Steen & Hamilton LLP, Morgan, Lewis & Bockius LLP, Jones Day, Kirkland & Ellis LLP, CMS Legal Services EEIG, Eversheds Sutherland LLP contribute to innovation, geographic expansion, and service delivery in this space.

Global Legal Services Market Industry Analysis

Growth Drivers

- Increasing Demand for Compliance Services:The global compliance services market is projected to reach $50 billion by 2025, driven by heightened regulatory scrutiny across industries. In the future, 75% of companies reported increased spending on compliance, reflecting a shift towards proactive risk management. This trend is particularly evident in sectors like finance and healthcare, where regulatory frameworks are evolving rapidly, necessitating legal expertise to navigate complex compliance landscapes effectively.

- Rise in Corporate Legal Expenditures:Corporate legal spending is expected to exceed $350 billion in 2025, as businesses increasingly recognize the value of legal services in mitigating risks. A survey by the Association of Corporate Counsel indicated that 65% of companies plan to increase their legal budgets, particularly in areas such as contract management and intellectual property. This growth is fueled by the need for legal support in mergers, acquisitions, and international operations, driving demand for specialized legal services.

- Expansion of Legal Technology Solutions:The legal technology market is anticipated to grow to $25 billion by 2025, with innovations such as AI-driven document review and e-discovery tools gaining traction. In the future, 55% of law firms reported investing in technology to enhance efficiency and reduce costs. This shift towards technology adoption is transforming traditional legal practices, enabling firms to offer more streamlined and cost-effective services, thus attracting a broader client base.

Market Challenges

- High Competition Among Law Firms:The legal services sector is characterized by intense competition, with over 1.4 million lawyers practicing in the U.S. alone. In the future, 45% of law firms reported challenges in maintaining profitability due to competitive pressures, necessitating innovative strategies to attract and retain clients.

- Regulatory Changes and Compliance Issues:Frequent changes in regulations pose significant challenges for legal firms, particularly in sectors like finance and healthcare. In the future, 70% of legal professionals cited regulatory compliance as a top concern, with the introduction of new laws requiring constant adaptation. This dynamic environment increases operational costs and necessitates ongoing training for legal staff, impacting overall firm efficiency and client service delivery.

Global Legal Services Market Future Outlook

The future of the legal services market is poised for transformation, driven by technological advancements and evolving client expectations. As firms increasingly adopt AI and automation, operational efficiencies will improve, allowing for more competitive pricing. Additionally, the demand for remote legal services is expected to rise, reflecting changing work patterns post-pandemic. Firms that embrace these trends will likely enhance their service offerings and expand their market reach, positioning themselves favorably in a competitive landscape.

Market Opportunities

- Growth in Alternative Legal Service Providers:The alternative legal service provider (ALSP) market is projected to reach $25 billion by 2025, driven by demand for cost-effective legal solutions. ALSPs are increasingly utilized for tasks such as document review and legal research, allowing traditional firms to focus on higher-value services. This trend presents significant opportunities for collaboration and innovation within the legal sector.

- Increased Focus on Cybersecurity and Data Privacy:With data breaches affecting 65% of businesses in the future, the demand for legal expertise in cybersecurity and data privacy is surging. Legal firms that specialize in these areas can capitalize on the growing need for compliance with regulations like GDPR and CCPA. This focus not only enhances client trust but also positions firms as leaders in a critical and expanding field.