Region:Middle East

Author(s):Dev

Product Code:KRAB1945

Pages:90

Published On:January 2026

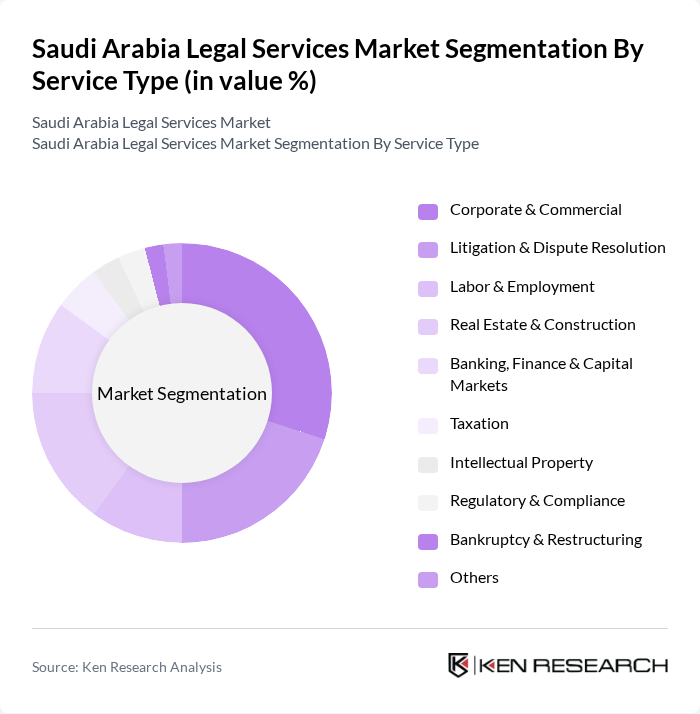

By Service Type:The service type segmentation includes various legal services that cater to different client needs. The subsegments are Corporate & Commercial, Litigation & Dispute Resolution, Labor & Employment, Real Estate & Construction, Banking, Finance & Capital Markets, Taxation, Intellectual Property, Regulatory & Compliance, Bankruptcy & Restructuring, and Others. Among these, Corporate & Commercial services dominate the market due to the increasing number of domestic and international businesses, M&A activity, and the need for legal compliance in commercial transactions, corporate restructuring, and foreign investment structures.

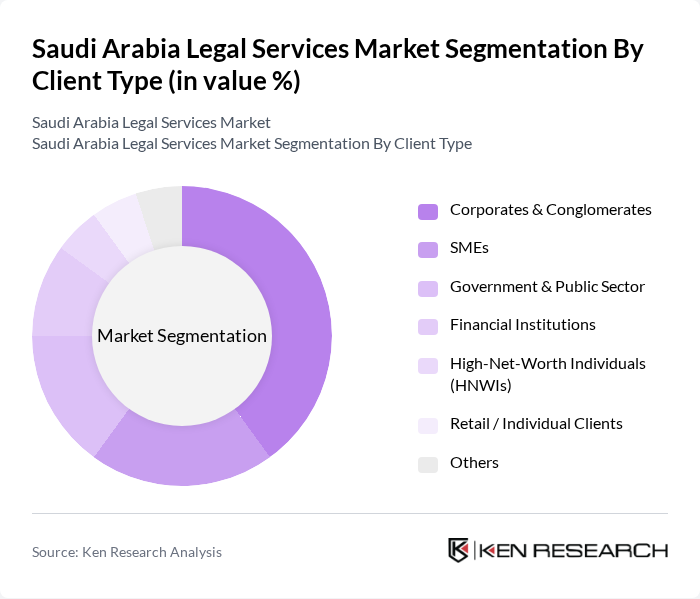

By Client Type:The client type segmentation encompasses various categories of clients seeking legal services. The subsegments include Corporates & Conglomerates, SMEs, Government & Public Sector, Financial Institutions, High-Net-Worth Individuals (HNWIs), Retail / Individual Clients, and Others. Corporates & Conglomerates are the leading client type, driven by the increasing number of large local and multinational businesses requiring comprehensive legal support for regulatory compliance, cross?border transactions, capital markets work, and complex dispute resolution.

The Saudi Arabia Legal Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Tamimi & Company, Abdulaziz AlGasim Law Firm, Hammad & Al-Mehdar Law Firm, Al-Jadaan & Partners Law Firm, Khoshaim & Associates, Law Office of Mohanned bin Saud Al-Rasheed, Al-Suwaiket & Al-Busaies Attorneys at Law, ZH Partners (Zaid Al-Hussein & Associates), The Law Firm of Wael A. Alissa, AlDhabaan & Partners, Dr. Qaisar Hamed Metawea Law Firm, Osool Law Firm, Khalid Al-Thebity Law Firm, International Firms Active in KSA (e.g., Clifford Chance, Latham & Watkins, Baker McKenzie), Emerging Saudi Legal Tech & ALSP Providers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia legal services market appears promising, driven by ongoing regulatory reforms and the increasing integration of technology in legal practices. As businesses continue to expand and adapt to new regulations, the demand for specialized legal services is expected to rise. Additionally, the growing emphasis on compliance and risk management will likely create new opportunities for legal professionals to offer tailored solutions, ensuring that businesses navigate the complexities of the evolving legal landscape effectively.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Corporate & Commercial Litigation & Dispute Resolution Labor & Employment Real Estate & Construction Banking, Finance & Capital Markets Taxation Intellectual Property Regulatory & Compliance Bankruptcy & Restructuring Others |

| By Client Type | Corporates & Conglomerates SMEs Government & Public Sector Financial Institutions High-Net-Worth Individuals (HNWIs) Retail / Individual Clients Others |

| By Industry Vertical | Energy & Utilities (Oil, Gas, Renewables) Infrastructure & Construction Financial Services (Banking, Insurance, Investment) Technology, Media & Telecommunications (TMT) Healthcare & Life Sciences Transport & Logistics Retail & Consumer Public Sector & Sovereign Entities Others |

| By Service Delivery Model | Traditional Law Firms Alternative Legal Service Providers (ALSPs) In-House Legal Departments Legal Process Outsourcing Online / Virtual Legal Platforms Others |

| By Geographic Presence | Riyadh Jeddah Dammam Khobar Makkah & Madinah Other Cities |

| By Client Size | Small Enterprises Medium Enterprises Large Enterprises Government Agencies Others |

| By Legal Work Type | Advisory & Transactional Litigation Mediation and Arbitration Compliance & Regulatory Support Documentation & Contract Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Legal Departments | 120 | General Counsels, Legal Advisors |

| Litigation Services | 90 | Litigation Partners, Case Managers |

| Real Estate Legal Services | 80 | Real Estate Lawyers, Property Managers |

| Intellectual Property Services | 70 | IP Attorneys, Patent Agents |

| Family Law Services | 60 | Family Law Practitioners, Mediators |

The Saudi Arabia Legal Services Market is valued at approximately USD 5.9 billion, driven by increasing legal complexities, foreign investments related to Vision 2030, and sector expansions in real estate, infrastructure, and financial services.