Region:Asia

Author(s):Geetanshi

Product Code:KRAD4142

Pages:83

Published On:December 2025

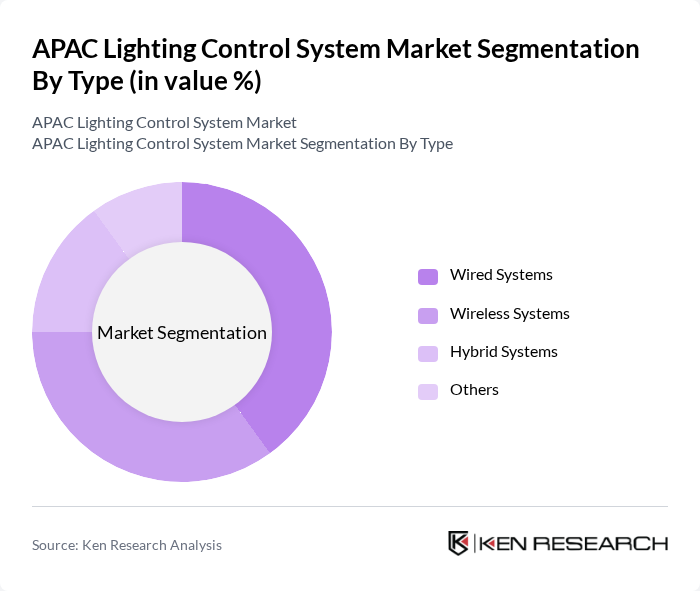

By Type:The market is segmented into various types, including Wired Systems, Wireless Systems, Hybrid Systems, and Others. Each of these segments caters to different consumer needs and preferences, with specific applications in residential, commercial, and industrial settings. Wired Systems remain widely used in large commercial, industrial, and infrastructure projects where robustness, low latency, and centralized control architectures are critical. At the same time, Wireless Systems are gaining strong traction across APAC due to their ease of installation in retrofits, scalability in smart homes and offices, and compatibility with IoT platforms, while Hybrid Systems combine wired backbones with wireless endpoints to balance reliability and flexibility in complex facilities.

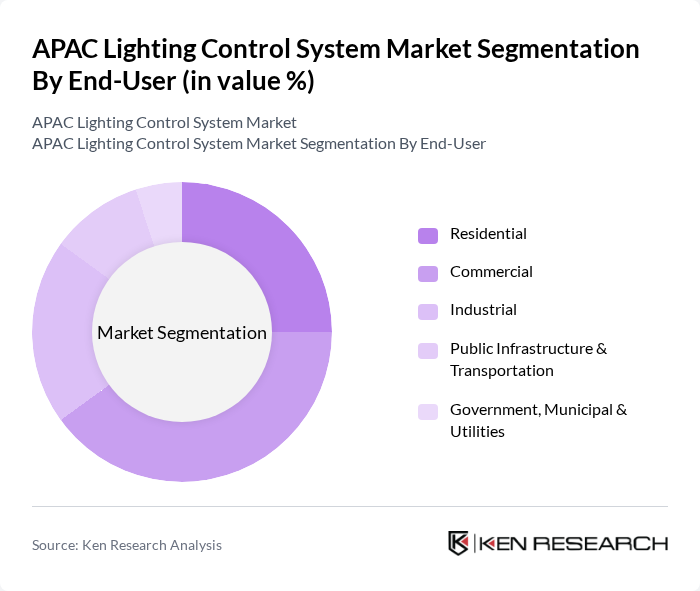

By End-User:The market is further segmented by end-user categories, including Residential, Commercial, Industrial, Public Infrastructure & Transportation, and Government, Municipal & Utilities. The Commercial segment is currently leading, supported by strong adoption of smart lighting and building automation in offices, retail, hospitality, healthcare, and data centers, driven by energy-cost reduction targets, green building certifications, and demand for better occupant experience and space utilization analytics. Residential adoption is expanding with the uptake of smart home platforms and connected luminaires, while Public Infrastructure & Transportation and Government, Municipal & Utilities segments benefit from road lighting modernization, metro and airport upgrades, and city-level smart streetlighting projects across APAC.

The APAC Lighting Control System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify N.V. (Philips Lighting), Schneider Electric SE, Siemens AG, Honeywell International Inc., Lutron Electronics Co., Inc., Legrand SA, Crestron Electronics, Inc., OSRAM Licht AG (ams OSRAM), Eaton Corporation plc (Cooper Lighting Solutions), Acuity Brands, Inc., Hubbell Lighting, Inc., Panasonic Holdings Corporation, Toshiba Corporation, Wipro Lighting (Wipro Enterprises Pvt. Ltd.), Opple Lighting Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC lighting control system market is poised for substantial growth, driven by technological advancements and increasing consumer demand for smart solutions. As urbanization accelerates, cities are expected to adopt more integrated lighting systems that enhance energy efficiency and sustainability. Furthermore, the rise of AI and machine learning in lighting control will enable more personalized user experiences, making systems more intuitive and responsive. This evolution will likely attract investments and foster innovation, positioning the market for a transformative future.

| Segment | Sub-Segments |

|---|---|

| By Type | Wired Systems Wireless Systems Hybrid Systems Others |

| By End-User | Residential Commercial Industrial Public Infrastructure & Transportation Government, Municipal & Utilities |

| By Region | China Japan India South Korea Australia & New Zealand Southeast Asia Rest of APAC |

| By Technology | DALI (Digital Addressable Lighting Interface) Zigbee Z-Wave Bluetooth & Bluetooth Mesh Wi?Fi & IP-Based Protocols Proprietary & Other Wireless Protocols |

| By Application | Indoor Commercial (Offices, Retail, Hospitality, Healthcare) Indoor Residential Industrial & Warehouse Lighting Outdoor & Street Lighting Architectural & Specialty Lighting |

| By Installation Type | New Installations Retrofit Installations |

| By Component | Hardware (Sensors, Controllers, Switches, Gateways) Software & Cloud Platforms Services (Design, Integration, Maintenance) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Lighting Control | 120 | Facility Managers, Building Owners |

| Residential Smart Lighting Solutions | 100 | Homeowners, Interior Designers |

| Industrial Automation in Lighting | 80 | Operations Managers, Plant Engineers |

| Government and Public Sector Initiatives | 70 | Policy Makers, Urban Planners |

| Retail Sector Lighting Control Systems | 90 | Retail Managers, Lighting Consultants |

The APAC Lighting Control System Market is valued at approximately USD 38.0 billion, driven by the increasing demand for energy-efficient LED lighting and smart lighting controls, along with government initiatives promoting sustainable energy practices across the region.