Region:Asia

Author(s):Geetanshi

Product Code:KRAC2368

Pages:98

Published On:October 2025

By Animal Type:The livestock identification market is segmented by animal type, which includes various categories such as cattle, swine, ovine/caprine (sheep/goats), poultry, and others. Among these, cattle identification is the most significant segment due to the high economic value of cattle in the region. Swine and poultry also represent substantial segments, driven by their importance in food production and consumption .

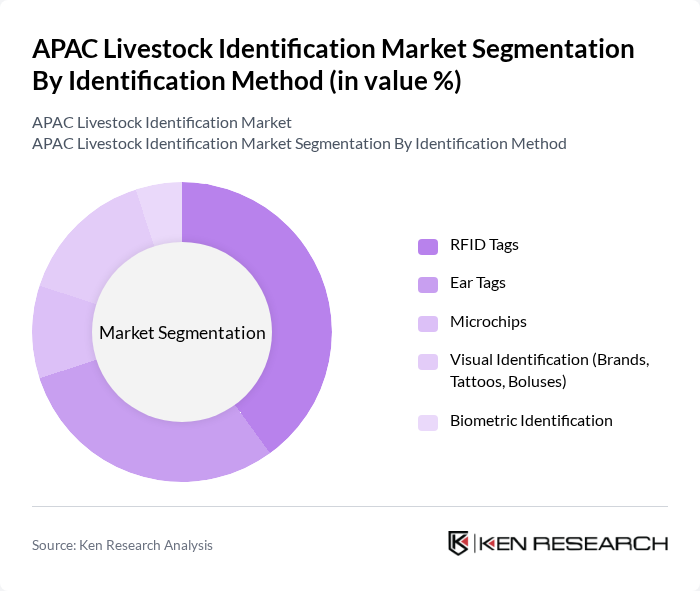

By Identification Method:The identification method segment includes various technologies such as RFID tags, ear tags, microchips, visual identification (brands, tattoos, boluses), and biometric identification. RFID tags are leading this segment due to their efficiency and accuracy in tracking livestock, while ear tags remain popular for their simplicity and cost-effectiveness. The adoption of digital and automated identification solutions is accelerating, with RFID and smart sensors increasingly integrated into livestock management systems .

The APAC Livestock Identification Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allflex Livestock Intelligence (MSD Animal Health), Datamars SA, Leader Products, IDEXX Animana, Ever.Ag, Connectra, CowManager BV, HerdInsights, Moocall Ltd., BouMatic, CSIRO (Commonwealth Scientific and Industrial Research Organisation), Ardes, LAIPSON, Stockbrands Co Pty Ltd, Caisley International GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The APAC livestock identification market is poised for significant transformation, driven by technological innovations and increasing regulatory pressures. As digital identification solutions gain traction, the integration of IoT and blockchain technologies will enhance traceability and data management. Furthermore, the rising consumer demand for sustainable practices will push farmers to adopt more efficient identification methods. In future, the market is expected to see a substantial shift towards these advanced technologies, fostering a more transparent and efficient livestock supply chain.

| Segment | Sub-Segments |

|---|---|

| By Animal Type | Cattle Swine Ovine/Caprine (Sheep/Goats) Poultry Others |

| By Identification Method | RFID Tags Ear Tags Microchips Visual Identification (Brands, Tattoos, Boluses) Biometric Identification |

| By End-User | Farmers Livestock Traders Government Agencies Veterinary Services |

| By Region | China India Japan South Korea ASEAN Oceania |

| By Technology | Passive RFID Active RFID GPS Tracking Biometric Identification |

| By Application | Disease Management Breeding Management Supply Chain Management Animal Welfare & Traceability Others |

| By Investment Source | Private Investments Government Grants International Aid Others |

| By Policy Support | Subsidies Tax Exemptions Training Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cattle Identification Practices | 100 | Cattle Farmers, Livestock Managers |

| Sheep and Goat Tracking Technologies | 60 | Sheep Farmers, Agricultural Technologists |

| Poultry Identification Systems | 50 | Poultry Producers, Farm Operations Managers |

| Regulatory Compliance in Livestock | 40 | Regulatory Officials, Compliance Officers |

| Technology Adoption in Livestock Management | 45 | Agri-tech Innovators, Veterinary Technicians |

The APAC Livestock Identification Market is valued at approximately USD 575 million, driven by increasing demand for traceability, enhanced biosecurity measures, and the adoption of advanced identification technologies across the region.