Region:Global

Author(s):Shubham

Product Code:KRAA2477

Pages:86

Published On:August 2025

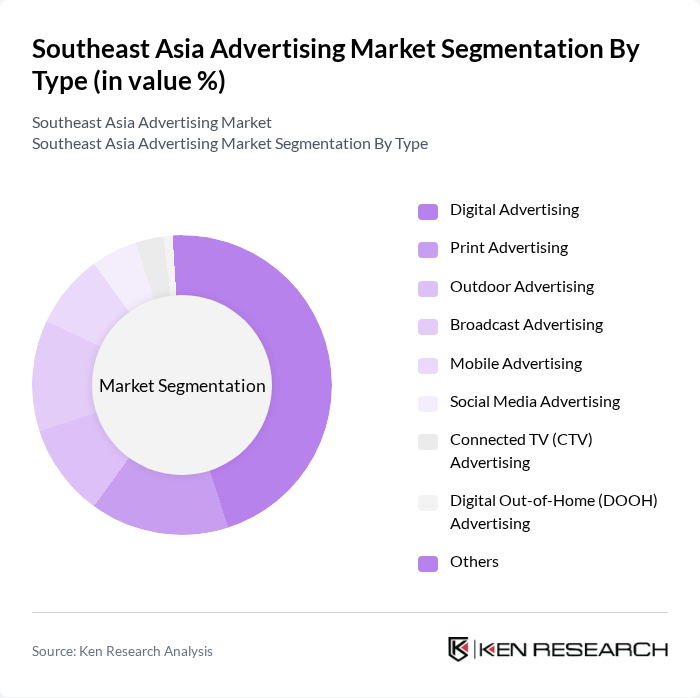

By Type:The advertising market is segmented into Digital Advertising, Print Advertising, Outdoor Advertising, Broadcast Advertising, Mobile Advertising, Social Media Advertising, Connected TV (CTV) Advertising, Digital Out-of-Home (DOOH) Advertising, and Others. Digital Advertising leads the market, driven by mobile and social media engagement, while Connected TV and DOOH are emerging as high-growth categories due to superior conversion rates and increased adoption by brands seeking innovative outreach strategies.

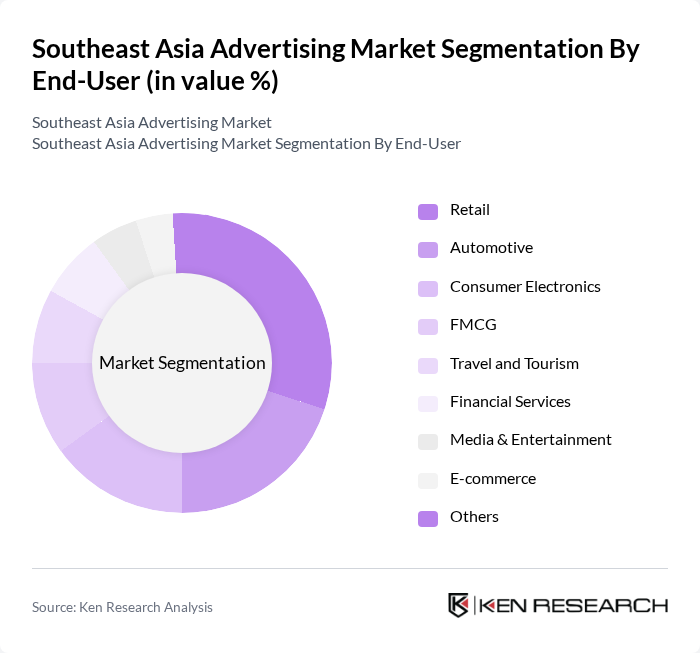

By End-User:The advertising market is also segmented by end-user industries, including Retail, Automotive, Consumer Electronics, FMCG, Travel and Tourism, Financial Services, Media & Entertainment, E-commerce, and Others. Retail and Media & Entertainment sectors are leading growth, with retail media networks and e-commerce platforms driving targeted advertising investments. The rise of digital payment systems and data-driven marketing is further boosting advertising spend across these industries.

The Southeast Asia Advertising Market is characterized by a dynamic mix of regional and international players. Leading participants such as WPP plc, Omnicom Group Inc., Publicis Groupe, Dentsu International, Havas Group, IPG Mediabrands, GroupM, Zenith Media, Starcom, Carat, Mediavest, Initiative, PHD Media, VMLY&R, DDB Worldwide, JCDecaux Singapore Pte Ltd, Clear Channel Singapore Pte Ltd, OOH Media (Mediacorp Pte Ltd), XCO Media (SMRT Experience Pte Ltd), Moove Media Pte Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The Southeast Asia advertising market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As brands increasingly leverage artificial intelligence and machine learning, personalized advertising will become more prevalent, enhancing customer engagement. Additionally, the integration of sustainability into marketing strategies will resonate with environmentally conscious consumers, prompting brands to adopt greener practices. This shift will likely create new avenues for growth, positioning the region as a dynamic hub for innovative advertising solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Advertising Print Advertising Outdoor Advertising Broadcast Advertising Mobile Advertising Social Media Advertising Connected TV (CTV) Advertising Digital Out-of-Home (DOOH) Advertising Others |

| By End-User | Retail Automotive Consumer Electronics FMCG Travel and Tourism Financial Services Media & Entertainment E-commerce Others |

| By Region | Indonesia Malaysia Thailand Philippines Vietnam Singapore Others |

| By Channel | Online Platforms Television Radio Print Media Outdoor Billboards Direct Mail OTT/Streaming Platforms Others |

| By Advertising Format | Display Ads Video Ads Sponsored Content Native Advertising Search Ads Audio Ads Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Geographic Targeting Interest-Based Targeting Others |

| By Budget Size | Small Budget Campaigns Medium Budget Campaigns Large Budget Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Strategies | 100 | Digital Marketing Managers, Social Media Strategists |

| Television Advertising Effectiveness | 80 | Media Buyers, Brand Managers |

| Print Media Trends | 60 | Advertising Executives, Creative Directors |

| Influencer Marketing Insights | 50 | Influencer Managers, PR Specialists |

| Consumer Perception Studies | 90 | General Consumers, Target Demographic Groups |

The Southeast Asia Advertising Market is valued at approximately USD 28 billion, driven by digital transformation, increased internet penetration, and the growing influence of social media platforms. This market is expected to continue evolving as consumer behaviors shift towards digital channels.