Region:Asia

Author(s):Shubham

Product Code:KRAC4904

Pages:81

Published On:October 2025

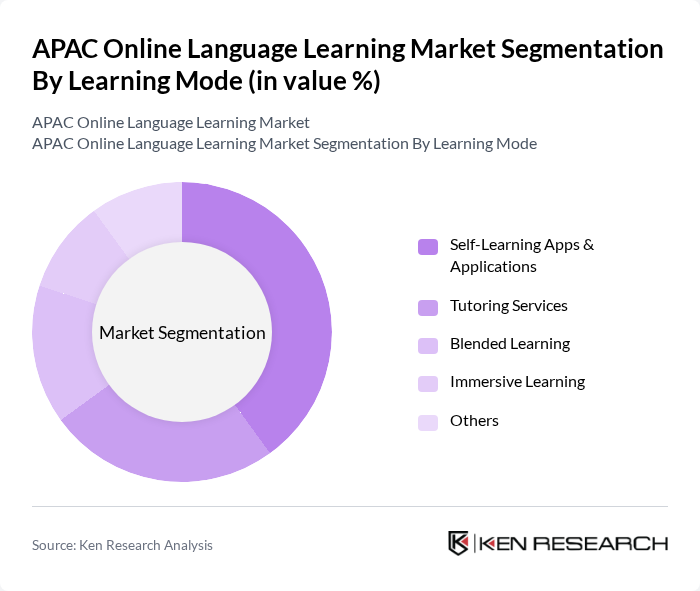

By Learning Mode:The learning mode segmentation includes various methods through which language learning is facilitated. The subsegments are Self-Learning Apps & Applications, Tutoring Services, Blended Learning, Immersive Learning, and Others. Each of these modes caters to different learning preferences and needs, with self-learning apps gaining popularity due to their convenience and accessibility.

The Self-Learning Apps & Applications segment is currently leading the market due to the increasing adoption of mobile technology and the demand for flexible learning solutions. Users appreciate the ability to learn at their own pace and access a wide range of resources anytime, anywhere. This trend is further supported by the proliferation of smartphones and the internet, making language learning more accessible to a broader audience.

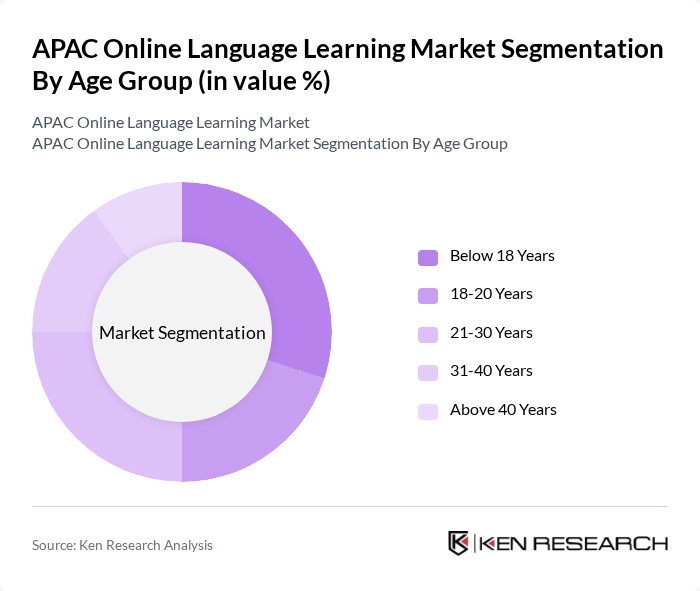

By Age Group:The age group segmentation includes Below 18 Years, 18-20 Years, 21-30 Years, 31-40 Years, and Above 40 Years. Each age group has distinct learning preferences and motivations, with younger learners often gravitating towards interactive and gamified learning experiences.

The 21-30 Years age group is the most significant segment in the market, driven by young professionals seeking to enhance their language skills for career advancement. This demographic is tech-savvy and prefers online learning platforms that offer flexibility and a variety of resources. Additionally, the increasing globalization of the job market has heightened the demand for language proficiency among this age group.

The APAC Online Language Learning Market is characterized by a dynamic mix of regional and international players. Leading participants such as Duolingo Inc., Rosetta Stone, Inc., Babbel GmbH, Busuu Limited, Berlitz Corporation, Memrise Inc., FluentU (Enux Education Limited), Mondly, New Oriental Education & Technology Group Inc., Mango Languages, Transparent Language, Inc., ELSA Corp., Sanako Corporation, Inlingua International Ltd., Cambridge University Press contribute to innovation, geographic expansion, and service delivery in this space.

The APAC online language learning market is poised for significant evolution, driven by technological advancements and changing learner preferences. As mobile learning continues to gain traction, platforms that offer flexible, on-the-go solutions will likely thrive. Additionally, the integration of AI and machine learning will enhance personalized learning experiences, catering to individual learner needs. With increasing government support for digital education, the market is expected to witness robust growth, fostering innovation and accessibility in language learning solutions.

| Segment | Sub-Segments |

|---|---|

| By Learning Mode | Self-Learning Apps & Applications Tutoring Services Blended Learning Immersive Learning Others |

| By Age Group | Below 18 Years 20 Years 30 Years 40 Years Above 40 Years |

| By Language Offered | English Mandarin Spanish French German Italian Arabic Japanese Korean Others |

| By End-User | Individual Learners Educational Institutions Corporate Organizations Government Agencies NGOs Others |

| By Region | China Japan South Korea India Indonesia Australia & New Zealand Taiwan Hong Kong Singapore Malaysia Vietnam Rest of Asia-Pacific |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium One-Time Payment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Language Learning Platforms | 150 | Product Managers, Marketing Directors |

| Language Instructors and Tutors | 100 | Freelance Tutors, Language School Teachers |

| Students Engaged in Online Language Learning | 150 | High School Students, University Learners |

| Corporate Language Training Programs | 80 | HR Managers, Training Coordinators |

| Government Education Officials | 50 | Policy Makers, Educational Program Directors |

The APAC Online Language Learning Market is valued at approximately USD 4,830 million. This valuation reflects the growing demand for language proficiency, the rise of digital learning platforms, and increased mobile user engagement in flexible learning solutions across the region.