Region:Asia

Author(s):Geetanshi

Product Code:KRAA9193

Pages:99

Published On:November 2025

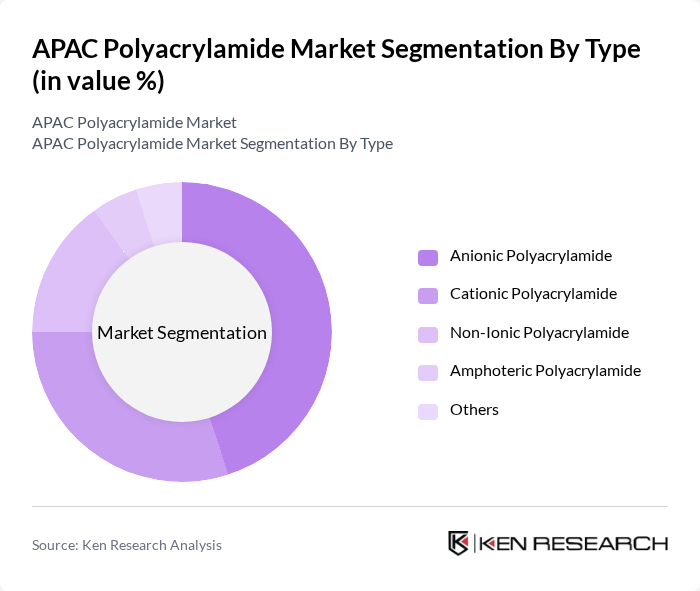

By Type:The market is segmented into various types of polyacrylamide, including Anionic Polyacrylamide, Cationic Polyacrylamide, Non-Ionic Polyacrylamide, Amphoteric Polyacrylamide, and Others. Anionic Polyacrylamide is the leading segment, accounting for the largest share due to its extensive use in water treatment, oil recovery, and mining applications. Cationic Polyacrylamide follows, primarily utilized in paper making, textile processing, and municipal wastewater treatment. Non-Ionic Polyacrylamide is favored for applications in mineral processing and sludge dewatering, while Amphoteric Polyacrylamide is used in specialized industrial processes requiring dual charge characteristics.

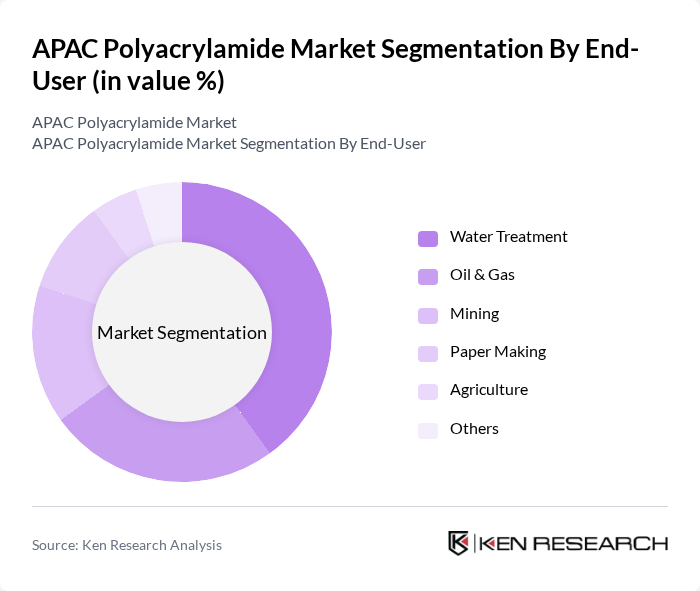

By End-User:The end-user segmentation includes Water Treatment, Oil & Gas, Mining, Paper Making, Agriculture, and Others. Water Treatment is the dominant segment, driven by the increasing need for clean water, regulatory mandates for effluent management, and the proliferation of municipal and industrial wastewater treatment projects. The Oil & Gas sector significantly contributes to the market, utilizing polyacrylamide for enhanced oil recovery and drilling fluid additives. Mining and Paper Making sectors also represent substantial demand, while Agriculture and other specialty industries use polyacrylamide for soil conditioning and erosion control.

The APAC Polyacrylamide Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, SNF Group, Kemira Oyj, Solvay S.A., Ashland Global Holdings Inc., Ecolab Inc., Mitsubishi Chemical Corporation, Dow Inc., Clariant AG, Anhui Jucheng Fine Chemicals Co., Ltd., Shandong Polymer Bio-chemicals Co., Ltd., Yixing Bluwat Chemicals Co., Ltd., Xitao Polymer Co., Ltd., SINOPEC (China Petroleum & Chemical Corporation), Black Rose Industries Ltd., Envitech Chemical Specialties Pvt. Ltd., Feralco Group, Shuiheng Chemicals contribute to innovation, geographic expansion, and service delivery in this space.

The APAC polyacrylamide market is poised for transformative growth, driven by increasing environmental awareness and technological advancements. As industries shift towards sustainable practices, the demand for eco-friendly polyacrylamide products is expected to rise. Additionally, investments in wastewater treatment infrastructure will likely enhance market dynamics, fostering innovation and collaboration across sectors. Companies that adapt to these trends will be better positioned to capitalize on emerging opportunities and navigate regulatory challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Anionic Polyacrylamide Cationic Polyacrylamide Non-Ionic Polyacrylamide Amphoteric Polyacrylamide Others |

| By End-User | Water Treatment Oil & Gas Mining Paper Making Agriculture Others |

| By Application | Flocculants Dispersants Thickening Agents Soil Stabilizers Viscosifiers Others |

| By Formulation | Powder Liquid Emulsion Gel Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | China India Japan South Korea Australia Malaysia Rest of Asia Pacific |

| By Industry Vertical | Water Treatment Oil & Gas Mining Paper Making Construction Agriculture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Applications of Polyacrylamide | 60 | Agronomists, Farm Managers |

| Water Treatment Facilities | 50 | Water Treatment Plant Operators, Environmental Engineers |

| Oil and Gas Industry Usage | 40 | Petroleum Engineers, Production Managers |

| Mining Sector Applications | 40 | Mining Engineers, Process Managers |

| Research and Development in Polymer Chemistry | 40 | Research Scientists, Product Development Managers |

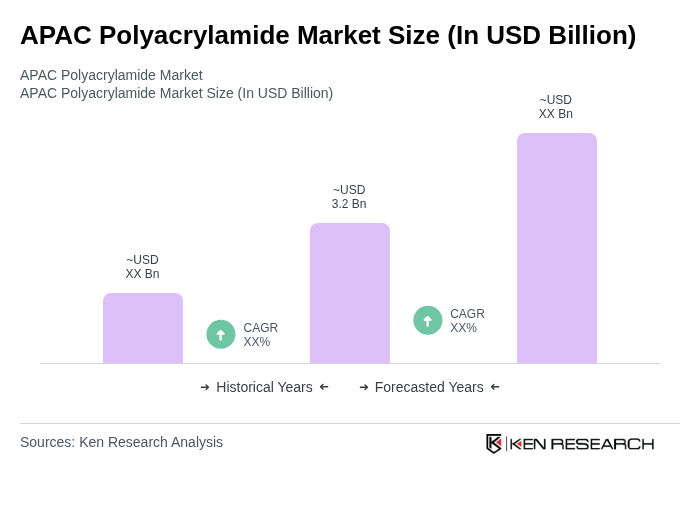

The APAC Polyacrylamide Market is currently valued at approximately USD 3.2 billion. This valuation is driven by increasing demand for water treatment solutions, oil recovery processes, and agricultural applications across the region.