Region:Africa

Author(s):Rebecca

Product Code:KRAB0850

Pages:92

Published On:December 2025

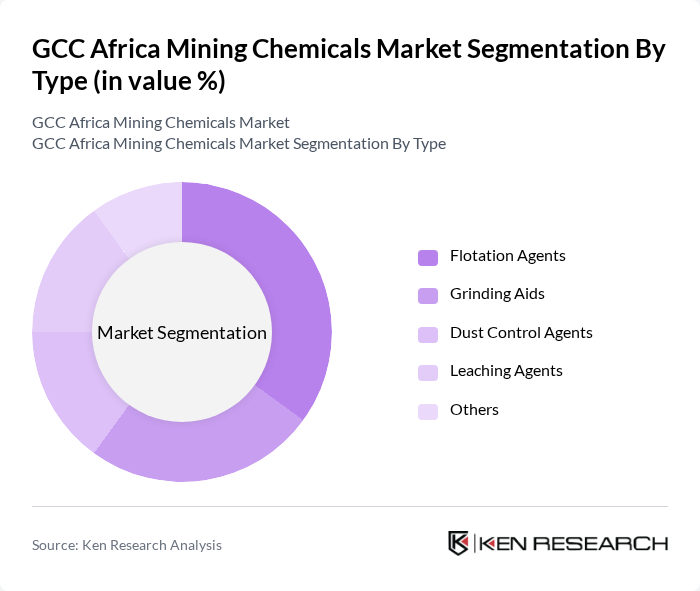

By Type:The market is segmented into various types of mining chemicals, including flotation agents, grinding aids, dust control agents, leaching agents, and others, which aligns with typical mining chemicals classifications in mineral processing, explosives and drilling, and water and wastewater treatment. Among these, flotation agents are currently the leading sub-segment due to their critical role in the extraction of valuable minerals from ores and their central role in collectors and frothers used for selective mineral recovery. The increasing focus on efficient mineral recovery processes, particularly for low-grade and polymetallic ores, has led to a heightened demand for these agents, especially in gold, copper, and emerging battery-metal mining operations.

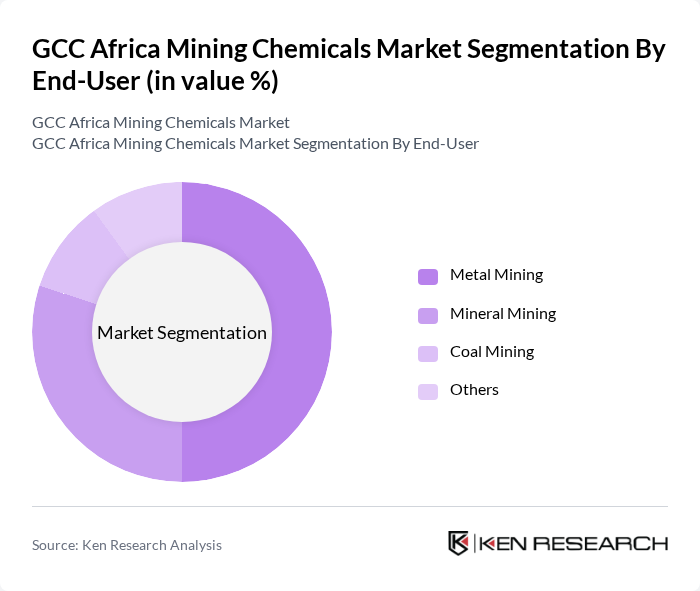

By End-User:The end-user segmentation includes metal mining, mineral mining, coal mining, and others, which is consistent with the wider Middle East and Africa mining chemicals market structure. Metal mining is the dominant segment, driven by the high demand for metals such as gold, copper, and platinum, as well as iron ore and base metals that underpin steelmaking and infrastructure. The growth in this sector is fueled by the increasing industrial applications of these metals in construction, automotive, electronics, and renewable energy systems, alongside rising investment in exploration of untapped reserves across GCC and African economies.

The GCC Africa Mining Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, Huntsman Corporation, Solvay S.A., AkzoNobel N.V., Dow Chemical Company, Orica Limited, SNF Group, Kemira Oyj, Ecolab Inc., FLSmidth & Co. A/S, Imerys S.A., Sika AG, Albemarle Corporation, and Chemtura Corporation contribute to innovation, geographic expansion, and service delivery in this space, with many of these companies explicitly active in African and Middle East mining chemical supply.

The future of the GCC Africa mining chemicals market appears promising, driven by the increasing demand for critical minerals essential for energy transition technologies. The African Continental Free Trade Area (AfCFTA) is expected to facilitate regional value chains, enhancing local processing capabilities. As countries focus on domestic refining and manufacturing, the mining chemicals sector is likely to experience significant growth. Additionally, strategic investments in infrastructure and technology will be crucial for overcoming existing challenges and maximizing market potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Flotation Agents Grinding Aids Dust Control Agents Leaching Agents Others |

| By End-User | Metal Mining Mineral Mining Coal Mining Others |

| By Application | Surface Mining Underground Mining Others |

| By Chemical Composition | Organic Chemicals Inorganic Chemicals Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | North Africa West Africa East Africa Southern Africa Others |

| By Regulatory Compliance | ISO Standards Local Regulations International Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mining Chemical Suppliers | 100 | Sales Managers, Product Development Leads |

| Mining Operations Managers | 80 | Site Managers, Chemical Engineers |

| Regulatory Bodies | 50 | Policy Makers, Environmental Compliance Officers |

| Mining Equipment Manufacturers | 70 | Product Managers, Technical Sales Representatives |

| Industry Consultants | 60 | Market Analysts, Strategic Advisors |

The GCC Africa Mining Chemicals Market is valued at approximately USD 1.4 billion, driven by increasing mining activities, demand for metals like gold and copper, and the need for specialized reagents in water and wastewater treatment operations.