Region:Asia

Author(s):Dev

Product Code:KRAC4144

Pages:100

Published On:October 2025

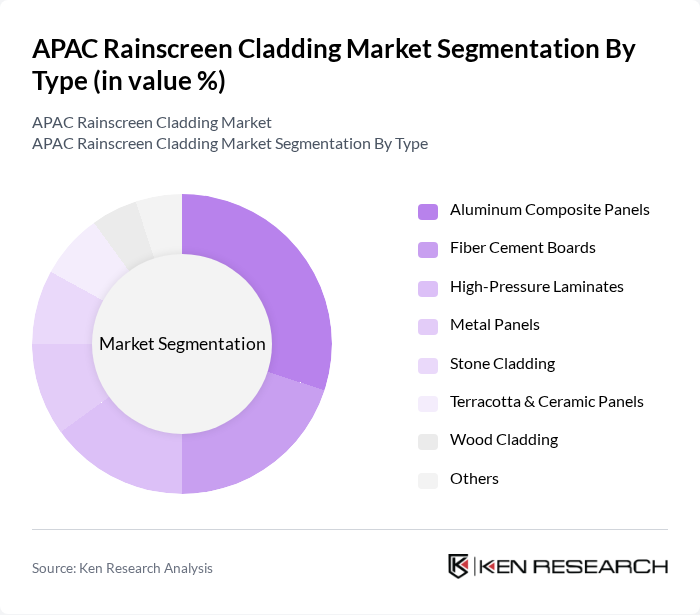

By Type:The market is segmented into various types of rainscreen cladding materials, including Aluminum Composite Panels, Fiber Cement Boards, High-Pressure Laminates, Metal Panels, Stone Cladding, Terracotta & Ceramic Panels, Wood Cladding, and Others. Each type offers unique benefits, catering to different aesthetic and functional requirements in construction.

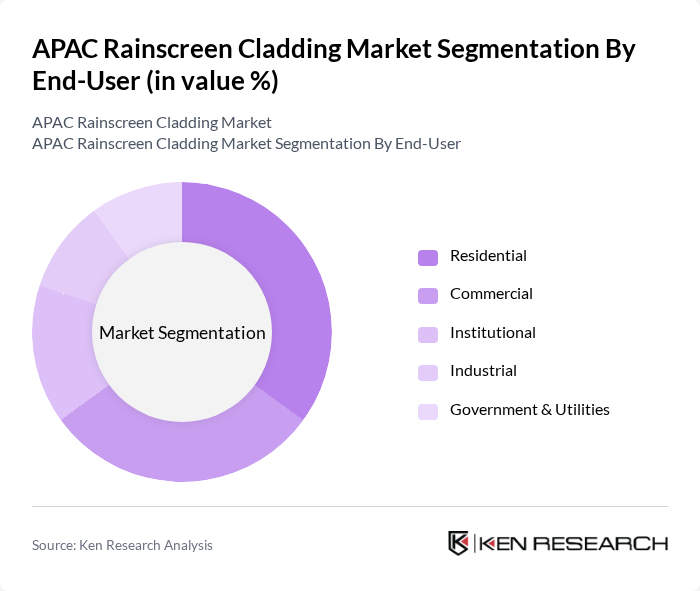

By End-User:The market is segmented based on end-users, including Residential, Commercial, Institutional, Industrial, and Government & Utilities. Each segment has distinct requirements and preferences, influencing the choice of cladding materials used in various construction projects.

The APAC Rainscreen Cladding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kingspan Group plc, Trespa International B.V., Rockwool International A/S, Alucobond (3A Composites), CAREA Group, Sika AG, Saint-Gobain S.A., Nichiha Corporation, James Hardie Industries plc, Boral Limited, Cembrit Holding A/S, Metecno Group, A. Proctor Group Ltd., Etex Group, Tata Steel Limited, Danpal, FunderMax GmbH, Hunter Douglas N.V., Proteus Facades Ltd., Sotech Optima contribute to innovation, geographic expansion, and service delivery in this space.

The APAC rainscreen cladding market is poised for significant growth, driven by urbanization and a shift towards sustainable construction practices. As governments implement stricter building codes and promote green initiatives, the demand for innovative cladding solutions will rise. Additionally, advancements in material technology will enhance product offerings, making them more appealing to builders. The integration of smart technologies into building designs will further influence market dynamics, creating opportunities for manufacturers to innovate and expand their product lines.

| Segment | Sub-Segments |

|---|---|

| By Type | Aluminum Composite Panels Fiber Cement Boards High-Pressure Laminates Metal Panels Stone Cladding Terracotta & Ceramic Panels Wood Cladding Others |

| By End-User | Residential Commercial Institutional Industrial Government & Utilities |

| By Region | China India Japan South Korea Australia Southeast Asia Rest of APAC |

| By Application | New Construction Renovation Facade Retrofitting Others |

| By Investment Source | Domestic FDI PPP Government Schemes |

| By Policy Support | Subsidies Tax Exemptions RECs |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Projects | 120 | Architects, Project Managers |

| Residential Cladding Installations | 100 | Contractors, Home Builders |

| Industrial Facility Upgrades | 80 | Facility Managers, Engineers |

| Public Infrastructure Developments | 65 | City Planners, Government Officials |

| Sustainable Building Initiatives | 85 | Sustainability Consultants, Environmental Engineers |

The APAC Rainscreen Cladding Market is valued at approximately USD 39.7 billion, driven by rapid urbanization, increased construction activities, and a focus on energy-efficient building materials. This growth reflects the rising demand for modern and aesthetically pleasing facades in both commercial and residential buildings.