Region:Middle East

Author(s):Dev

Product Code:KRAD5279

Pages:93

Published On:December 2025

By Raw Material:The market is segmented into various raw materials used in the production of rainscreen cladding. The primary subsegments include Fiber Cement, Composite Materials (including Aluminum Composite Panels), Metal (Aluminum, Steel and Others), High-Pressure Laminates (HPL), Terracotta, Ceramic & Porcelain, Natural Stone, and Other Raw Materials. Among these, Terracotta leads in revenue share due to its durability and aesthetic qualities, while Composite Materials and Metal are gaining traction due to their lightweight properties and aesthetic appeal, making them a preferred choice for modern architectural designs.

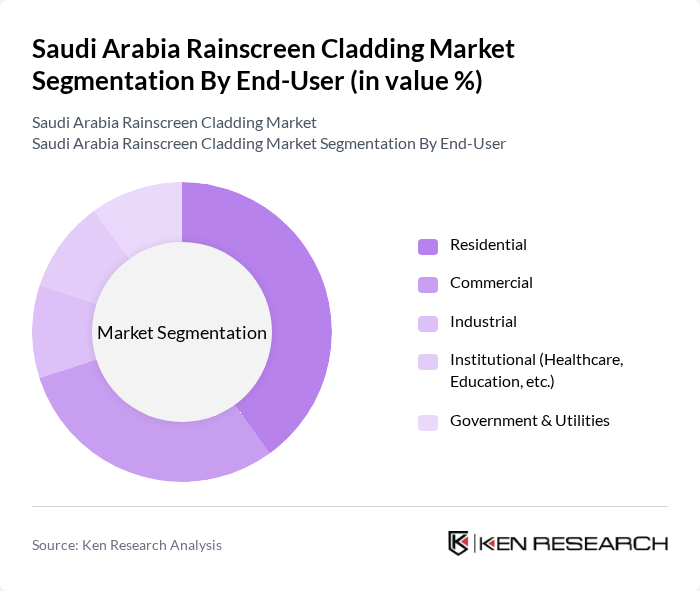

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Institutional (Healthcare, Education, etc.), and Government & Utilities. The Residential segment is currently leading the market due to the increasing demand for modern housing solutions and the growing trend of sustainable living. The Commercial sector is also significant, driven by the rise in office buildings and retail spaces that require aesthetic and functional cladding solutions.

The Saudi Arabia Rainscreen Cladding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kingspan Group plc, Compagnie de Saint-Gobain SA, Rockwool A/S, FunderMax GmbH, CAREA SA, Alucobond (3A Composites GmbH), Alucoil SAU, Alubond U.S.A (Mulk Holdings International), Nucor Corporation, OmniMax International LLC (including Alcoa Architectural Products), Middle East Insulation LLC, Saudi American Glass Company Ltd., Zamil Industrial Investment Company, Technical Glass & Aluminum Company LLC, Al Mufaddal Aluminum & Glass Factory contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia rainscreen cladding market appears promising, driven by increasing urbanization and a strong governmental push towards sustainable construction. As the nation invests heavily in infrastructure, the demand for innovative building materials is expected to rise. Additionally, the integration of smart technologies and eco-friendly materials will likely shape the market landscape, fostering a shift towards more efficient and aesthetically pleasing building designs that meet modern consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Raw Material | Fiber Cement Composite Materials (including Aluminum Composite Panels) Metal (Aluminum, Steel and Others) High-Pressure Laminates (HPL) Terracotta Ceramic & Porcelain Natural Stone Other Raw Materials |

| By End-User | Residential Commercial Industrial Institutional (Healthcare, Education, etc.) Government & Utilities |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Khobar, Jubail) Western Region (including Jeddah, Makkah, Madinah, NEOM & Red Sea projects) Southern Region |

| By Application | New Construction Renovation & Refurbishment Façade Retrofitting for Energy Efficiency Other Applications |

| By Material Source | Domestic Production Imported Materials Recycled & Sustainable Materials Other Sources |

| By Installation System | Pressure-Equalized Rainscreen Systems Drained and Back-Ventilated Systems Ventilated Cavity Systems Other Installation Types |

| By Design & Performance | Standard Designs High-Performance Thermal & Acoustic Systems Custom & Architect-Specified Designs Other Design Categories |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Projects | 100 | Project Managers, Architects |

| Residential Cladding Installations | 80 | Home Builders, Contractors |

| Industrial Facility Cladding | 60 | Facility Managers, Procurement Officers |

| Public Infrastructure Developments | 70 | Urban Planners, Government Officials |

| Sustainable Building Practices | 90 | Sustainability Consultants, Material Suppliers |

The Saudi Arabia Rainscreen Cladding Market is valued at approximately USD 2.5 billion, driven by rapid urbanization, increasing construction activities, and a focus on energy-efficient building solutions.