Region:Asia

Author(s):Dev

Product Code:KRAC8640

Pages:80

Published On:November 2025

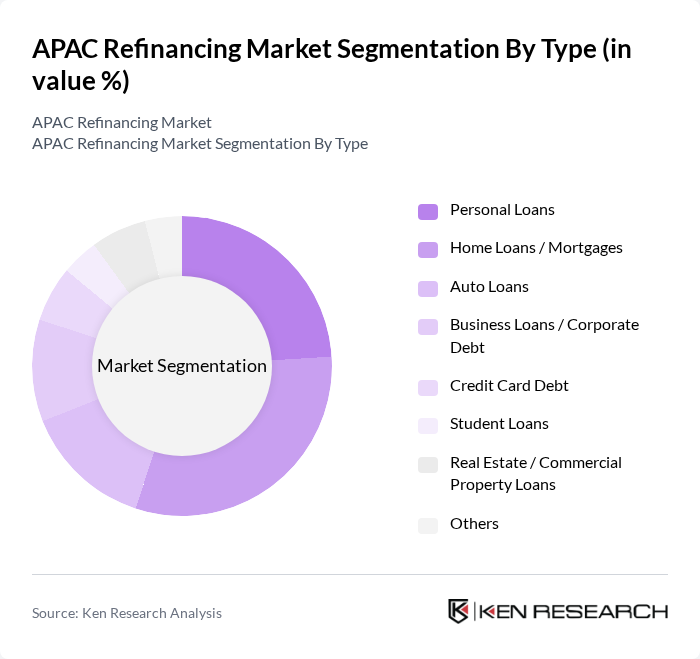

By Type:The refinancing market is segmented into personal loans, home loans/mortgages, auto loans, business loans/corporate debt, credit card debt, student loans, real estate/commercial property loans, and others. Each subsegment addresses distinct borrower needs, reflecting the region’s diverse financial landscape and the rising importance of both traditional and alternative financing channels.

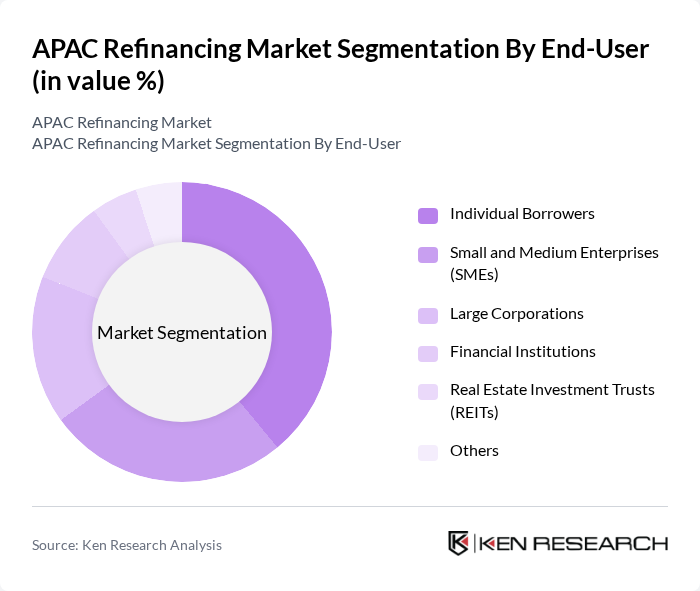

By End-User:The end-user segmentation includes individual borrowers, small and medium enterprises (SMEs), large corporations, financial institutions, real estate investment trusts (REITs), and others. These categories represent a wide spectrum of refinancing demand, with SMEs and corporates increasingly utilizing both bank and private credit channels to address evolving capital needs.

The APAC Refinancing Market is characterized by a dynamic mix of regional and international players. Leading participants such as HSBC Holdings plc, Standard Chartered Bank, Australia and New Zealand Banking Group (ANZ), DBS Bank Ltd., Bank of China Limited, Citibank N.A., ICICI Bank Limited, Commonwealth Bank of Australia, Westpac Banking Corporation, Malayan Banking Berhad (Maybank), CIMB Group Holdings Berhad, Sumitomo Mitsui Banking Corporation (SMBC), United Overseas Bank Limited (UOB), Mitsubishi UFJ Financial Group (MUFG), Oversea-Chinese Banking Corporation (OCBC Bank) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC refinancing market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As digital lending platforms gain traction, the ease of accessing refinancing options will likely increase, attracting a broader customer base. Additionally, the integration of artificial intelligence in credit assessments will enhance risk evaluation, enabling lenders to offer more personalized refinancing solutions. These trends suggest a dynamic market landscape where innovation and consumer-centric approaches will play pivotal roles in shaping future growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Home Loans / Mortgages Auto Loans Business Loans / Corporate Debt Credit Card Debt Student Loans Real Estate / Commercial Property Loans Others |

| By End-User | Individual Borrowers Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions Real Estate Investment Trusts (REITs) Others |

| By Region | North Asia (China, Japan, Korea, Hong Kong, Taiwan) Southeast Asia (Singapore, Malaysia, Indonesia, Thailand, Philippines, Vietnam) South Asia (India, Pakistan, Bangladesh, Sri Lanka) Oceania (Australia, New Zealand) |

| By Loan Purpose | Debt Consolidation Home Renovation Education Financing Business Expansion / Working Capital Asset Acquisition Others |

| By Loan Size | Small Loans (up to $10,000) Medium Loans ($10,001 - $50,000) Large Loans (over $50,000) Institutional / Syndicated Loans Others |

| By Interest Rate Type | Fixed Rate Variable Rate Hybrid Rate Others |

| By Repayment Term | Short Term (up to 3 years) Medium Term (3-7 years) Long Term (over 7 years) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Refinancing in Real Estate | 100 | Chief Financial Officers, Real Estate Managers |

| Manufacturing Sector Debt Restructuring | 80 | Financial Controllers, Operations Directors |

| Technology Sector Equity Financing | 60 | Investment Analysts, Corporate Development Executives |

| SME Refinancing Strategies | 70 | Small Business Owners, Financial Advisors |

| Cross-border Refinancing Trends | 50 | International Finance Managers, Legal Advisors |

The APAC Refinancing Market is valued at approximately USD 1.1 trillion, driven by increasing demand for refinancing options, the growth of private credit, and significant activity in commercial real estate refinancing across the region.