Region:Global

Author(s):Dev

Product Code:KRAA5202

Pages:82

Published On:January 2026

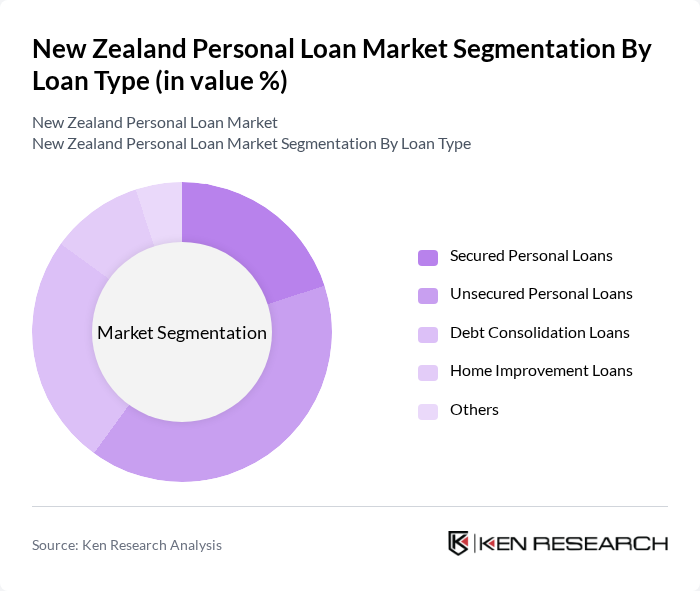

By Loan Type:The personal loan market is segmented into various types, including secured personal loans, unsecured personal loans, debt consolidation loans, home improvement loans, and others. Among these, unsecured personal loans are currently dominating the market due to their accessibility and the growing trend of consumers seeking quick and hassle-free financing options without collateral. The convenience of online applications and the increasing acceptance of digital lending platforms have further fueled the demand for unsecured loans.

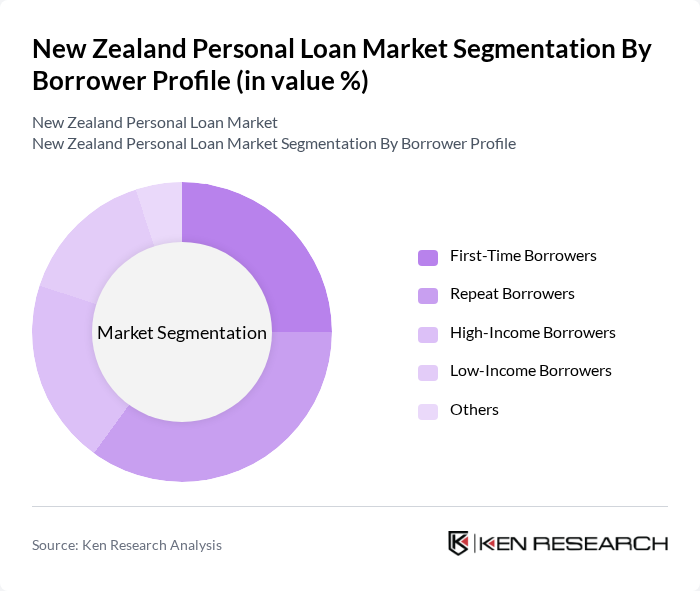

By Borrower Profile:This segmentation includes first-time borrowers, repeat borrowers, high-income borrowers, low-income borrowers, and others. The segment of repeat borrowers is currently leading the market, as these individuals often seek additional financing for various needs, including home renovations and personal expenses. Their established credit history and familiarity with the lending process make them attractive to lenders, resulting in a higher approval rate for repeat loans.

The New Zealand Personal Loan Market is characterized by a dynamic mix of regional and international players. Leading participants such as ANZ Bank, Westpac New Zealand, ASB Bank, BNZ (Bank of New Zealand), Kiwibank, Harmoney, Latitude Financial Services, Certegy, Q Mastercard, Resimac, Freedom Financial, Cash Converters, LendMe, MyLoan, Pocket Money contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand personal loan market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As digital lending platforms gain traction, the market is likely to see increased competition and innovation in loan products. Additionally, a focus on financial literacy initiatives will empower consumers to make informed borrowing decisions. These trends, combined with a stable economic environment, suggest a resilient market that can adapt to challenges while capitalizing on emerging opportunities in the lending landscape.

| Segment | Sub-Segments |

|---|---|

| By Loan Type | Secured Personal Loans Unsecured Personal Loans Debt Consolidation Loans Home Improvement Loans Others |

| By Borrower Profile | First-Time Borrowers Repeat Borrowers High-Income Borrowers Low-Income Borrowers Others |

| By Loan Purpose | Education Expenses Medical Expenses Travel Expenses Emergency Expenses Others |

| By Loan Tenure | Short-Term Loans Medium-Term Loans Long-Term Loans Others |

| By Interest Rate Type | Fixed Interest Rate Loans Variable Interest Rate Loans Others |

| By Distribution Channel | Online Platforms Banks Credit Unions Financial Brokers Others |

| By Customer Segment | Individual Customers Small Businesses Corporates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Personal Loan Borrowers | 120 | Individuals aged 25-45 with recent loan experience |

| First-time Borrowers | 80 | Young professionals seeking their first personal loan |

| High-value Loan Customers | 60 | Individuals with loans exceeding NZD 50,000 |

| Debt Consolidation Seekers | 50 | Borrowers looking to consolidate existing debts into a single loan |

| Financial Advisors | 40 | Professionals providing financial advice on personal loans |

The New Zealand personal loan market is valued at approximately USD 3.2 billion, reflecting a significant increase driven by consumer demand for personal financing options such as debt consolidation and home improvements.