Region:Asia

Author(s):Geetanshi

Product Code:KRAE0639

Pages:98

Published On:December 2025

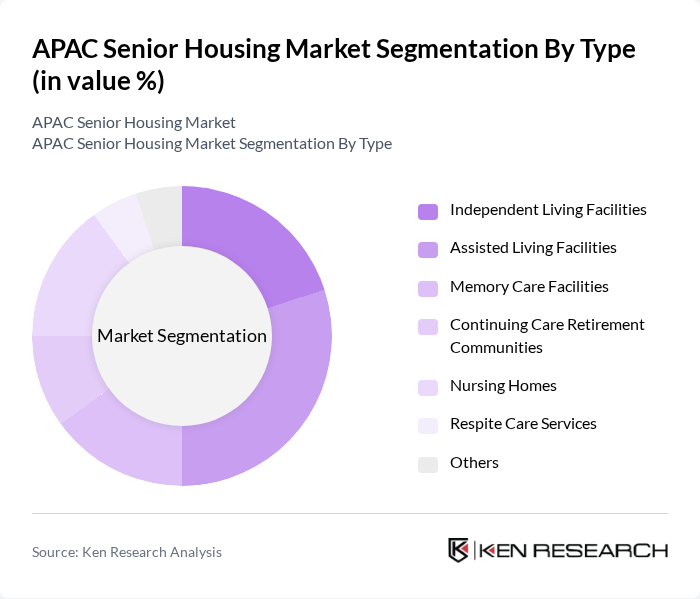

By Type:The senior housing market is segmented into various types, including Independent Living Facilities, Assisted Living Facilities, Memory Care Facilities, Continuing Care Retirement Communities, Nursing Homes, Respite Care Services, and Others. Among these, Assisted Living Facilities are gaining traction due to the increasing demand for personalized care and support services, catering to the needs of seniors who require assistance with daily activities while still maintaining a level of independence.

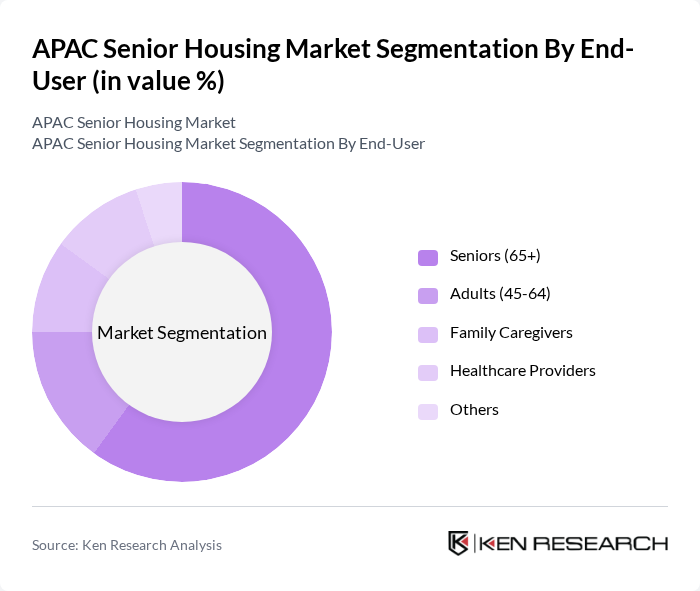

By End-User:The end-user segmentation includes Seniors (65+), Adults (45-64), Family Caregivers, Healthcare Providers, and Others. The segment of Seniors (65+) dominates the market as this demographic is the primary consumer of senior housing services, driven by the increasing life expectancy and the need for specialized care as they age.

The APAC Senior Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Brookdale Senior Living, Amedisys, Inc., Holiday Retirement, Five Star Senior Living, Sunrise Senior Living, Enlivant, LCS, and Capital Senior Living contribute to innovation, geographic expansion, and service delivery in this space.

The APAC senior housing market is poised for transformative growth, driven by demographic shifts and evolving consumer preferences. As the elderly population expands, there will be a greater emphasis on integrated care solutions that combine housing with health services. Additionally, the rise of technology in senior care, such as telehealth and smart home innovations, will enhance the living experience for seniors. These trends indicate a robust future for the sector, with opportunities for innovation and improved service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Independent Living Facilities Assisted Living Facilities Memory Care Facilities Continuing Care Retirement Communities Nursing Homes Respite Care Services Others |

| By End-User | Seniors (65+) Adults (45-64) Family Caregivers Healthcare Providers Others |

| By Region | East Asia Southeast Asia South Asia Oceania |

| By Service Type | Personal Care Services Health Care Services Social Activities Transportation Services Others |

| By Facility Size | Small Facilities (1-50 beds) Medium Facilities (51-150 beds) Large Facilities (151+ beds) Others |

| By Payment Model | Private Pay Long-term Care Insurance Government Programs Others |

| By Ownership Type | Private Ownership Non-Profit Organizations Government-Owned Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Independent Living Facilities | 150 | Facility Managers, Residents, Family Members |

| Assisted Living Services | 100 | Care Coordinators, Healthcare Providers, Residents |

| Nursing Homes | 80 | Administrators, Nursing Staff, Family Caregivers |

| Home Care Services | 120 | Home Care Managers, Clients, Family Members |

| Senior Housing Policy Makers | 60 | Government Officials, Policy Analysts, Industry Experts |

The APAC Senior Housing Market is valued at approximately USD 975 billion, driven by factors such as an aging population, increased life expectancy, and rising disposable incomes, which collectively enhance the demand for senior housing solutions across the region.