Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7730

Pages:84

Published On:October 2025

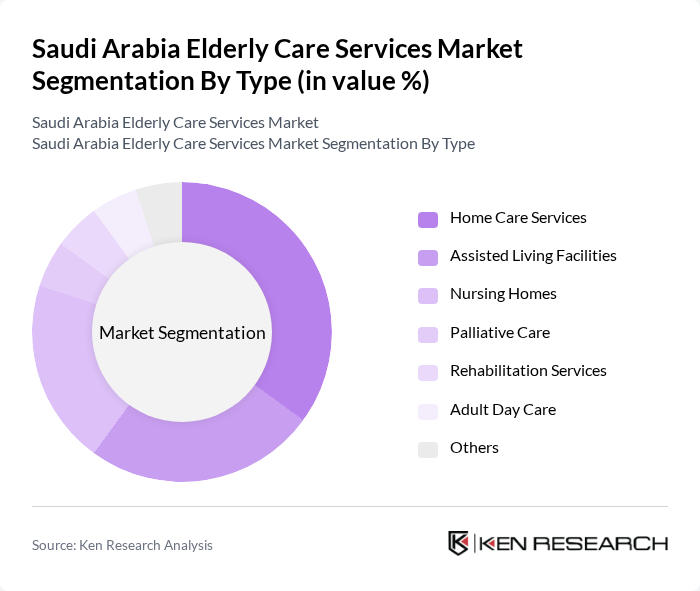

By Type:The market is segmented into various types of services catering to the elderly population. The subsegments include Home Care Services, Assisted Living Facilities, Nursing Homes, Palliative Care, Rehabilitation Services, Adult Day Care, and Others. Among these, Home Care Services are gaining significant traction due to the preference for personalized care in familiar environments. Assisted Living Facilities and Nursing Homes also play crucial roles, particularly for those requiring more intensive support.

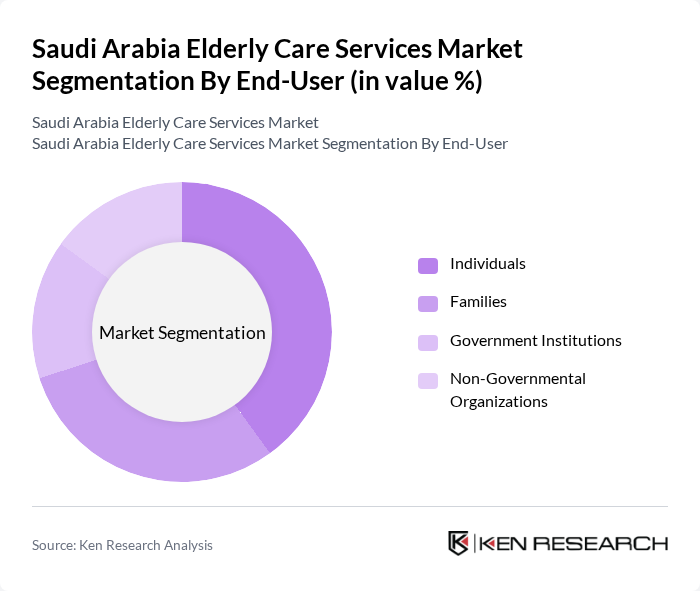

By End-User:The end-user segmentation includes Individuals, Families, Government Institutions, and Non-Governmental Organizations. Individuals and Families are the primary users of elderly care services, driven by the need for personalized care solutions. Government Institutions and NGOs also play a vital role in providing support and resources, particularly for low-income families and those in need of specialized care.

The Saudi Arabia Elderly Care Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Nahda Care, Home Instead Senior Care, Al-Muhaidib Group, Al-Faisaliah Group, Saudi German Hospital, Dallah Healthcare, Al-Hokair Group, Al-Mawaddah Group, Al-Salam Hospital, Al-Jazeera Healthcare, Al-Mansouria Care, Al-Muhaidib Healthcare, Al-Mahmal Care, Al-Muhaidib Home Care, Al-Mansour Care contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia elderly care services market is poised for significant transformation, driven by demographic changes and increasing awareness of care needs. As the elderly population continues to grow, the demand for personalized and technology-driven care solutions will rise. Additionally, government initiatives aimed at improving healthcare infrastructure will facilitate the development of specialized facilities and services. This evolving landscape presents opportunities for innovative service providers to enhance care delivery and address the unique needs of the elderly population effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Home Care Services Assisted Living Facilities Nursing Homes Palliative Care Rehabilitation Services Adult Day Care Others |

| By End-User | Individuals Families Government Institutions Non-Governmental Organizations |

| By Service Model | In-Home Care Facility-Based Care Community-Based Services |

| By Payment Model | Private Pay Insurance-Based Government Funded |

| By Age Group | 70 Years 80 Years Years and Above |

| By Geographic Distribution | Urban Areas Rural Areas |

| By Technology Adoption | Traditional Care Methods Digital Health Solutions Telehealth Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Care Services | 150 | Caregivers, Family Members of Elderly |

| Nursing Home Facilities | 100 | Facility Managers, Healthcare Administrators |

| Rehabilitation Services | 80 | Physical Therapists, Occupational Therapists |

| Community Support Programs | 70 | Social Workers, Program Coordinators |

| Health Insurance Providers | 90 | Insurance Agents, Policy Underwriters |

The Saudi Arabia Elderly Care Services Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by an increasing elderly population and rising awareness of elderly care needs.