Region:Asia

Author(s):Shubham

Product Code:KRAC3523

Pages:82

Published On:October 2025

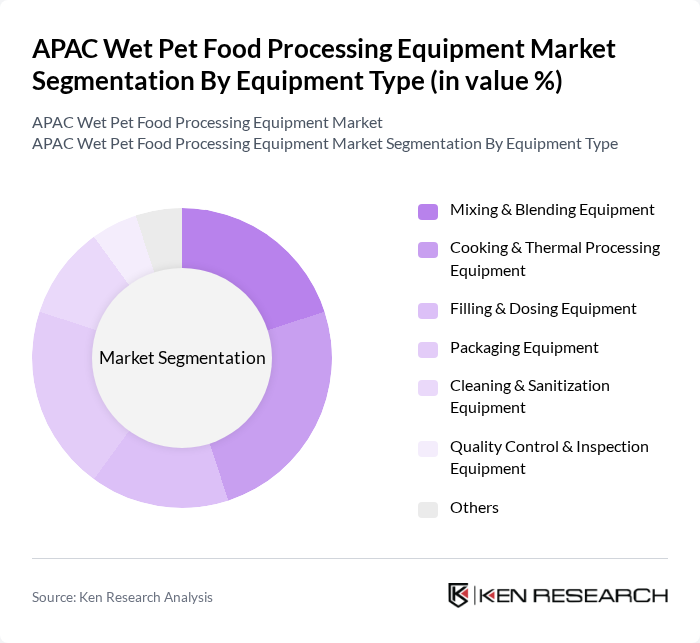

By Equipment Type:The equipment type segment includes Mixing & Blending Equipment, Cooking & Thermal Processing Equipment, Filling & Dosing Equipment, Packaging Equipment, Cleaning & Sanitization Equipment, Quality Control & Inspection Equipment, and Others. Each category is essential for ensuring efficient, safe, and high-quality wet pet food production. Cooking & Thermal Processing Equipment remains critical for pathogen elimination and product palatability, while automation in mixing, filling, and packaging is increasingly adopted to meet demand for variety and consistency.

The Cooking & Thermal Processing Equipment subsegment dominates due to its role in ensuring food safety and meeting consumer demand for nutritious, palatable pet food. Investment in advanced thermal technologies is rising as manufacturers respond to trends toward premiumization and health-focused formulations.

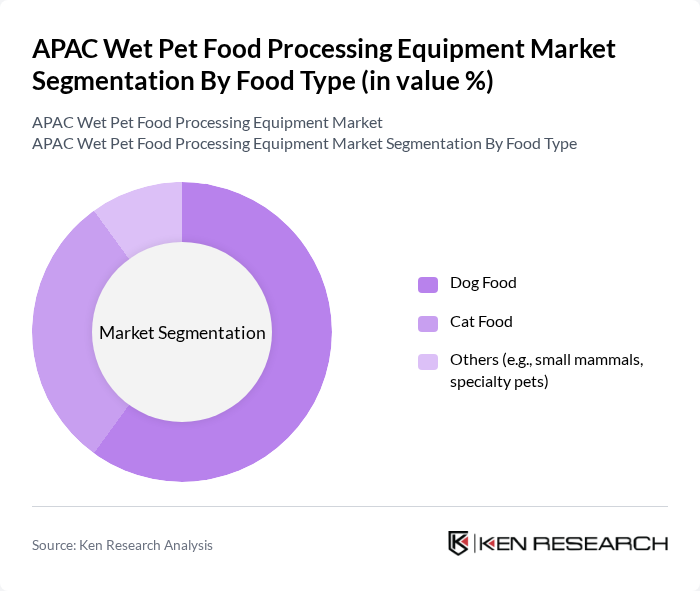

By Food Type:The food type segment includes Dog Food, Cat Food, and Others (e.g., small mammals, specialty pets). Cat food is the largest and fastest-growing segment, accounting for over 63% of the market by revenue, driven by rising cat ownership and demand for premium products. Dog food remains significant, but the cat food segment’s growth reflects shifting pet demographics and consumer preferences toward specialized nutrition.

While dog food has traditionally led due to higher ownership rates, the cat food segment is now the most lucrative, with the fastest growth, reflecting increased cat adoption and premiumization trends. The market is also seeing growth in specialty and organic pet food categories, catering to niche dietary needs.

The APAC Wet Pet Food Processing Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tetra Pak International S.A., Bühler AG, Marel hf., JBT Corporation, Multivac Sepp Haggenmüller SE & Co. KG, Clextral SAS, ANDRITZ AG, GEA Group AG, FENCO Food Machinery S.r.l., Shanghai Jimei Food Machinery Co., Ltd., Jiangsu Kuwai Machinery Co., Ltd., Krones AG, Buhler (China) Machinery Manufacturing Co., Ltd., Selo Food Processing and Packaging Systems, Pet Food Processing Solutions (PFPS) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC wet pet food processing equipment market is poised for significant growth, driven by evolving consumer preferences towards premium and nutritious pet food. As pet ownership continues to rise, manufacturers are expected to invest in innovative processing technologies to meet the demand for high-quality products. Additionally, sustainability will play a crucial role, with companies increasingly focusing on eco-friendly practices and ingredients, aligning with consumer trends towards health and environmental consciousness.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Mixing & Blending Equipment Cooking & Thermal Processing Equipment Filling & Dosing Equipment Packaging Equipment Cleaning & Sanitization Equipment Quality Control & Inspection Equipment Others |

| By Food Type | Dog Food Cat Food Others (e.g., small mammals, specialty pets) |

| By Form | Chunks in Gravy Loaf Minced Others |

| By Packaging Type | Cans Pouches Trays Others |

| By End-User | Pet Food Manufacturers Contract Manufacturers Others |

| By Country/Region | China Japan India South Korea Southeast Asia Australia & New Zealand Rest of APAC |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wet Pet Food Manufacturers | 60 | Production Managers, Quality Assurance Managers |

| Distributors and Wholesalers | 50 | Sales Directors, Supply Chain Managers |

| Retailers (Pet Stores and Supermarkets) | 40 | Category Managers, Purchasing Agents |

| Equipment Suppliers | 40 | Sales Engineers, Product Development Managers |

| Industry Experts and Consultants | 40 | Market Analysts, Industry Advisors |

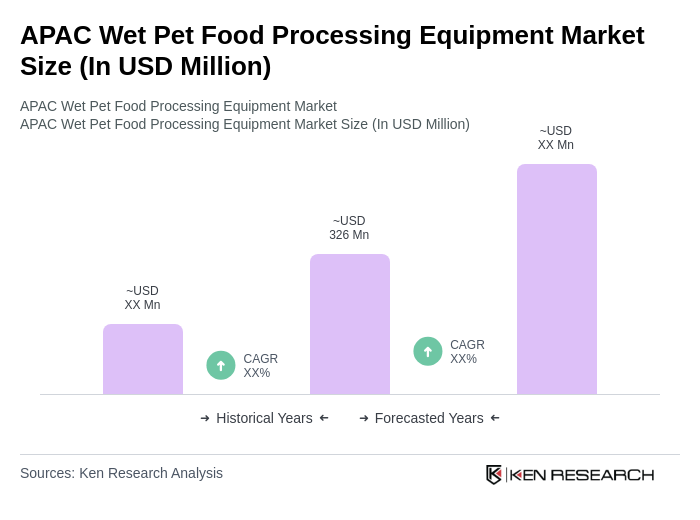

The APAC Wet Pet Food Processing Equipment Market is valued at approximately USD 326 million, reflecting a significant growth driven by increasing pet ownership and demand for high-quality pet food products.