Region:Asia

Author(s):Dev

Product Code:KRAB5483

Pages:93

Published On:October 2025

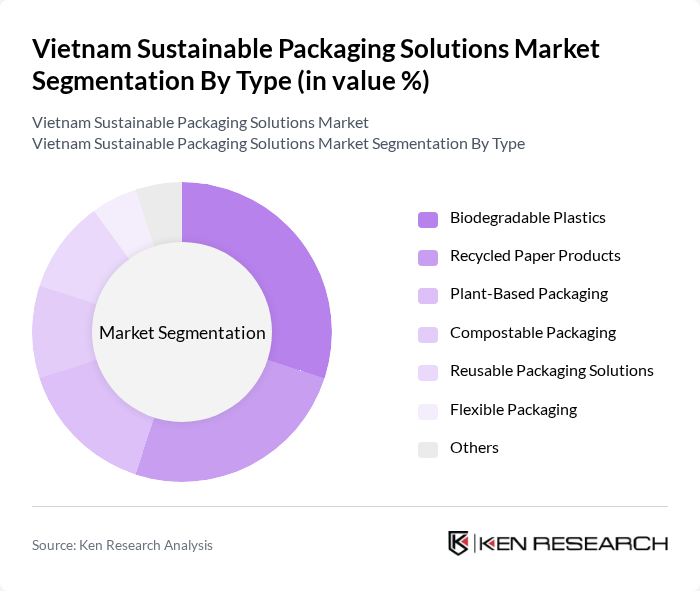

By Type:The sustainable packaging solutions market can be segmented into various types, including biodegradable plastics, recycled paper products, plant-based packaging, compostable packaging, reusable packaging solutions, flexible packaging, and others. Among these, biodegradable plastics and recycled paper products are gaining significant traction due to their eco-friendly attributes and increasing consumer preference for sustainable options.

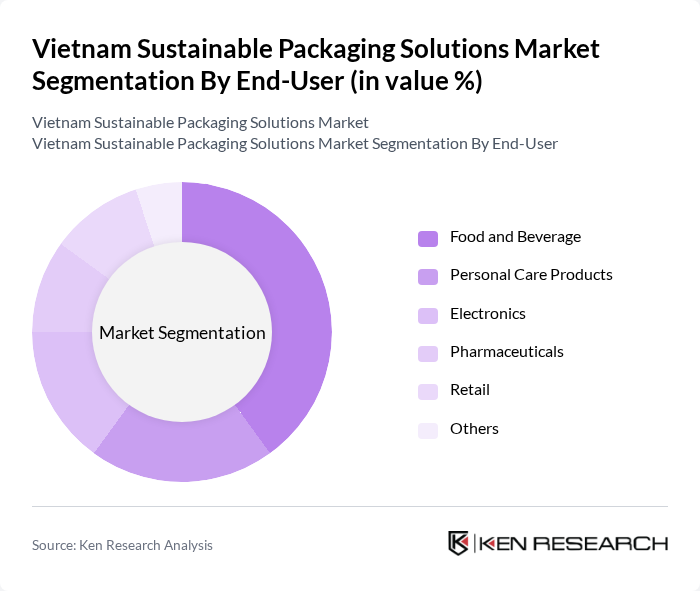

By End-User:The end-user segmentation of the sustainable packaging solutions market includes food and beverage, personal care products, electronics, pharmaceuticals, retail, and others. The food and beverage sector is the largest end-user, driven by the increasing demand for sustainable packaging solutions that align with consumer preferences for eco-friendly products.

The Vietnam Sustainable Packaging Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever Vietnam, Nestlé Vietnam, Coca-Cola Vietnam, Tetra Pak Vietnam, SCG Packaging, Amcor Vietnam, Biopak Vietnam, Ecolean Vietnam, Packtech Vietnam, Vina Kraft Paper, Tan Phat Packaging, Huu Nghi Packaging, Green Pack Vietnam, An Phat Holdings, Binh Minh Plastic contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sustainable packaging market in Vietnam appears promising, driven by increasing consumer awareness and government support. As the economy continues to grow, the demand for eco-friendly packaging solutions is expected to rise significantly. Innovations in biodegradable materials and smart packaging technologies will likely enhance product offerings. Additionally, collaborations between businesses and educational institutions can further promote sustainable practices, ensuring that Vietnam remains competitive in the global market for sustainable products.

| Segment | Sub-Segments |

|---|---|

| By Type | Biodegradable Plastics Recycled Paper Products Plant-Based Packaging Compostable Packaging Reusable Packaging Solutions Flexible Packaging Others |

| By End-User | Food and Beverage Personal Care Products Electronics Pharmaceuticals Retail Others |

| By Application | Packaging for Food Products Packaging for Non-Food Products Industrial Packaging E-commerce Packaging Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores Direct Sales Others |

| By Material Type | Paper and Cardboard Bioplastics Glass Metal Others |

| By Price Range | Low Price Mid Price High Price |

| By Brand Positioning | Premium Brands Mid-Range Brands Budget Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 150 | Packaging Managers, Sustainability Officers |

| Consumer Goods Packaging | 100 | Product Development Managers, Brand Managers |

| Retail Sector Insights | 80 | Store Managers, Supply Chain Coordinators |

| Logistics & Distribution | 70 | Logistics Managers, Operations Directors |

| Government & Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

The Vietnam Sustainable Packaging Solutions Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer awareness of environmental sustainability and government initiatives promoting eco-friendly practices.