Region:Central and South America

Author(s):Rebecca

Product Code:KRAA0326

Pages:88

Published On:August 2025

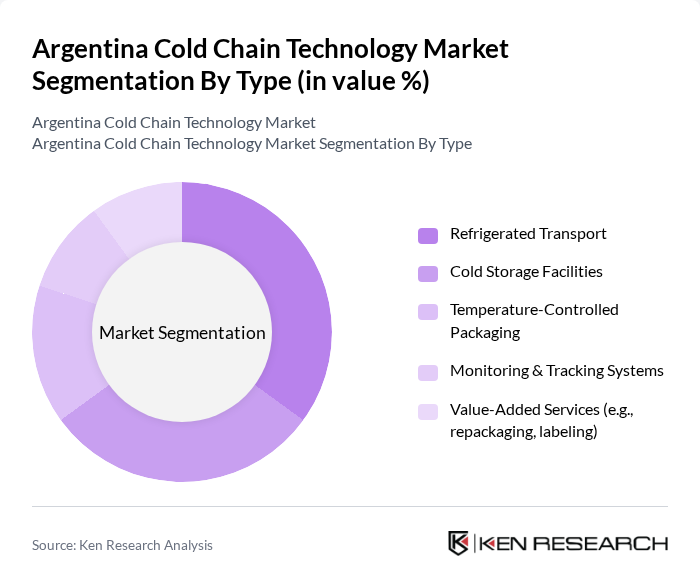

By Type:The market is segmented into Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring & Tracking Systems, and Value-Added Services. Refrigerated Transport includes road, rail, and air solutions for moving perishable goods under controlled temperatures. Cold Storage Facilities refer to warehouses and distribution centers equipped with refrigeration systems. Temperature-Controlled Packaging involves specialized containers and materials to maintain product integrity during transit. Monitoring & Tracking Systems utilize IoT and sensor technologies to ensure real-time temperature and location tracking. Value-Added Services include activities such as repackaging, labeling, and inventory management to support supply chain efficiency .

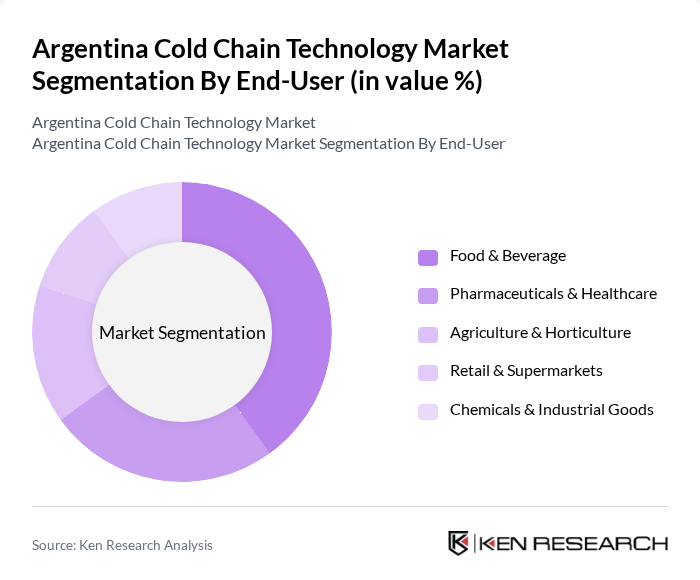

By End-User:The end-user segmentation includes Food & Beverage, Pharmaceuticals & Healthcare, Agriculture & Horticulture, Retail & Supermarkets, and Chemicals & Industrial Goods. The Food & Beverage sector requires cold chain solutions for dairy, meat, seafood, and processed foods to maintain freshness and safety. Pharmaceuticals & Healthcare depend on strict temperature control for vaccines, biologics, and medicines. Agriculture & Horticulture utilize cold chains for fruits, vegetables, and flowers to reduce spoilage. Retail & Supermarkets leverage cold logistics for inventory management and product quality, while Chemicals & Industrial Goods require specialized handling for temperature-sensitive materials .

The Argentina Cold Chain Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Frigotrans, Logística Fría, Grupo Logístico Andreani, TGL Cold Chain, Kuehne + Nagel, DHL Supply Chain, Cargill, Agrosuper, Grupo Sodecar, Transcold, Frío Express, Cold Logistics, Frigorífico Paladini, Celsur Logística, and Frigocenter contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain technology market in Argentina appears promising, driven by technological advancements and increasing consumer awareness regarding food safety. The integration of IoT and automation is expected to enhance operational efficiency, while the focus on sustainability will likely lead to the adoption of energy-efficient solutions. As the government continues to support infrastructure development, the market is poised for significant growth, addressing both domestic and export demands for perishable goods.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring & Tracking Systems Value-Added Services (e.g., repackaging, labeling) |

| By End-User | Food & Beverage Pharmaceuticals & Healthcare Agriculture & Horticulture Retail & Supermarkets Chemicals & Industrial Goods |

| By Temperature Range | Chilled (0°C to 8°C) Frozen (below -18°C) Ambient/Controlled Room Temperature |

| By Technology | Active Systems (mechanical refrigeration) Passive Systems (insulated containers, phase change materials) Hybrid Systems IoT & Automation Solutions |

| By Application | Food Distribution (meat, dairy, seafood, fruits & vegetables) Pharmaceutical Supply Chain (vaccines, biologics, medicines) Floral & Horticultural Distribution Chemicals & Specialty Products |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Region | Buenos Aires Córdoba Mendoza Santa Fe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Companies | 60 | Logistics Managers, Supply Chain Directors |

| Pharmaceutical Cold Chain Providers | 40 | Operations Managers, Quality Assurance Heads |

| Biotechnology Firms | 40 | Procurement Officers, R&D Managers |

| Retail Cold Storage Facilities | 40 | Facility Managers, Inventory Control Specialists |

| Logistics Technology Suppliers | 40 | Product Development Managers, Sales Directors |

The Argentina Cold Chain Technology Market is valued at approximately USD 1.1 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, along with the growth of e-commerce and organized retail.