Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA2039

Pages:99

Published On:August 2025

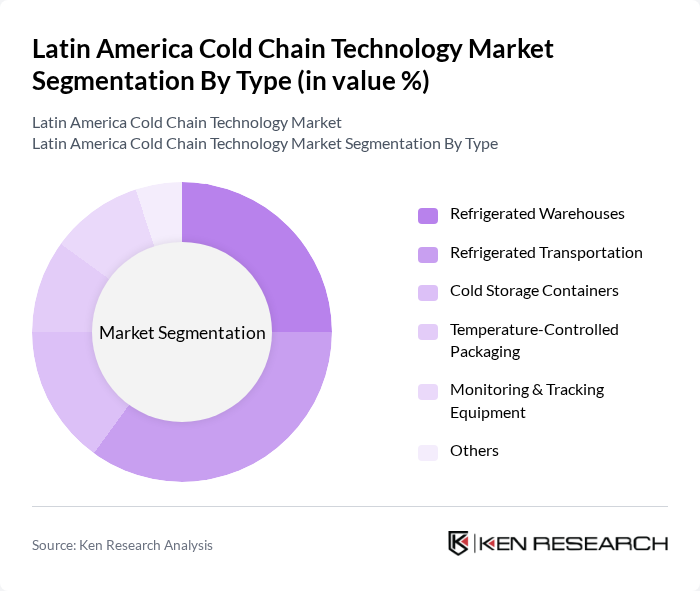

By Type:

The cold chain technology market is segmented into Refrigerated Warehouses, Refrigerated Transportation, Cold Storage Containers, Temperature-Controlled Packaging, Monitoring & Tracking Equipment, and Others.Refrigerated Transportationremains the largest sub-segment, driven by the increasing need for efficient logistics of fresh produce, pharmaceuticals, and temperature-sensitive goods. The surge in e-commerce and the expansion of food retail chains have further intensified demand for reliable refrigerated transport, making it a cornerstone of the cold chain ecosystem .

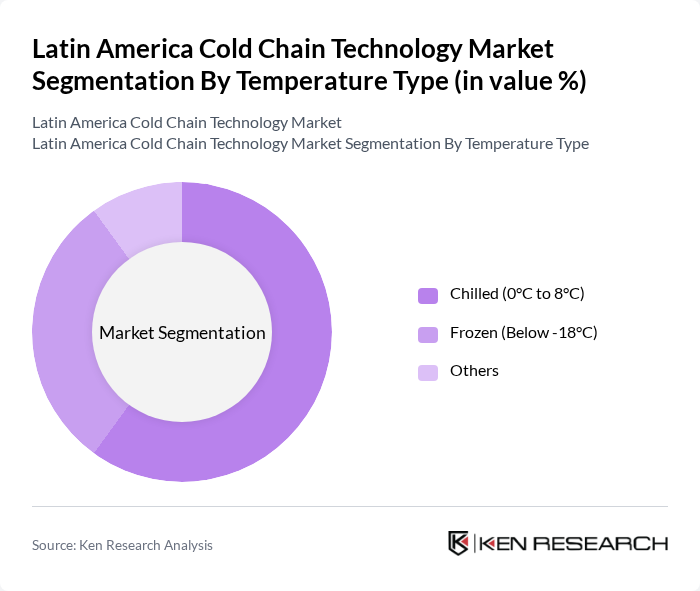

By Temperature Type:

The market is also segmented by temperature type: Chilled (0°C to 8°C), Frozen (Below -18°C), and Others. TheChilledsegment holds the largest share, reflecting the high demand for fresh produce, dairy, and ready-to-eat foods among increasingly health-conscious consumers. Maintaining strict temperature control during storage and transportation is essential for preserving product integrity and meeting regulatory requirements .

The Latin America Cold Chain Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emergent Cold Latin America, Friozem Armazéns Frigoríficos Ltda., SuperFrio Logística Frigorificada, Solistica, DHL Supply Chain, Lineage Logistics Holdings LLC, Kuehne + Nagel International AG, Maersk Line, AGRO Merchants Group (now part of Americold), Arfrio, Transportes Cavalinho, Grupo Qualita, Brasfrigo, Columbia Logística, and TPC Logística Inteligente contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain technology market in Latin America appears promising, driven by technological advancements and increasing consumer awareness of food safety. The integration of IoT and AI technologies is expected to enhance operational efficiency, enabling real-time monitoring of temperature-sensitive products. Additionally, as sustainability becomes a priority, companies are likely to invest in eco-friendly refrigeration solutions, aligning with global environmental standards and consumer preferences for sustainable practices in food logistics.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Warehouses Refrigerated Transportation Cold Storage Containers Temperature-Controlled Packaging Monitoring & Tracking Equipment Others |

| By Temperature Type | Chilled (0°C to 8°C) Frozen (Below -18°C) Others |

| By End-User | Food and Beverages Pharmaceuticals and Chemicals Floral and Agricultural Products Retail Others |

| By Application | Fruits & Vegetables Dairy & Frozen Desserts Meat, Fish & Seafood Bakery & Confectionery Vaccines & Biopharmaceuticals Others |

| By Country | Brazil Mexico Argentina Chile Colombia Rest of Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Networks | 100 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Chain Operations | 80 | Quality Assurance Managers, Operations Directors |

| Retail Cold Storage Facilities | 60 | Warehouse Managers, Inventory Control Specialists |

| Technology Providers for Cold Chain Solutions | 50 | Product Development Managers, Sales Executives |

| Logistics Regulatory Compliance | 40 | Compliance Officers, Regulatory Affairs Managers |

The Latin America Cold Chain Technology Market is valued at approximately USD 18.5 billion, driven by increasing demand for perishable foods, advancements in refrigerated transport, and the growth of e-commerce platforms requiring effective cold storage solutions.