Region:Middle East

Author(s):Shubham

Product Code:KRAA0767

Pages:83

Published On:August 2025

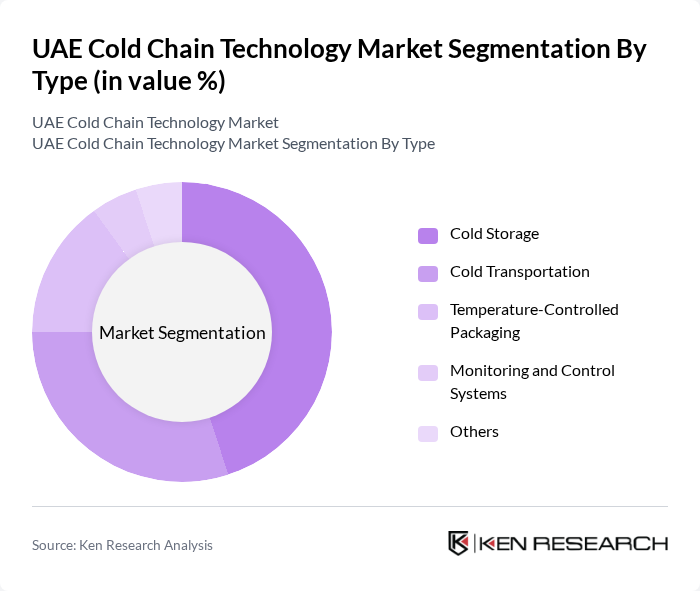

By Type:The market is segmented into Cold Storage, Cold Transportation, Temperature-Controlled Packaging, Monitoring and Control Systems, and Others. Cold Storage remains the leading segment, driven by the increasing need for preserving perishable goods such as fresh produce, dairy, and pharmaceuticals. Cold Transportation is also significant as it ensures the safe delivery of temperature-sensitive products across the supply chain. Monitoring and Control Systems are gaining traction as businesses seek to enhance efficiency, real-time visibility, and compliance with increasingly stringent safety regulations through IoT, automation, and digital tracking solutions .

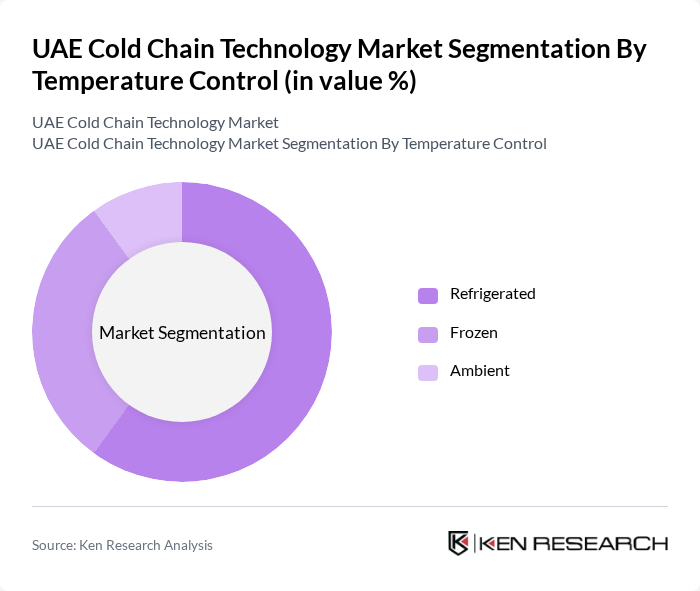

By Temperature Control:The market is categorized into Refrigerated, Frozen, and Ambient. The Refrigerated segment dominates the market due to the high demand for fresh produce, dairy, and pharmaceuticals requiring controlled environments. The Frozen segment is also significant, driven by the need for long-term storage and distribution of perishable goods such as meat, seafood, and frozen foods. Ambient storage is less prevalent, used for products that do not require strict temperature control but still benefit from managed logistics .

The UAE Cold Chain Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Logistics, Al-Futtaim Logistics, Agility Logistics, GWC (Gulf Warehousing Company), RSA Cold Chain, Al-Watania Logistics, Gulf Cold Storage, Al Jazeera Cold Storage, Al Mufeed Cold Storage, Al Maktoum Cold Storage, National Food Products Company, Al Ain Farms, Al Marai, Al Ghurair Foods, and Al Safi Danone contribute to innovation, geographic expansion, and service delivery in this space .

The UAE cold chain technology market is poised for significant advancements driven by technological innovations and increasing consumer demand for quality perishable goods. As the e-commerce sector continues to expand, businesses will increasingly adopt automated solutions and IoT technologies for real-time monitoring. Furthermore, the government's commitment to enhancing food safety standards will likely lead to further investments in cold chain infrastructure, ensuring compliance and efficiency in logistics operations across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Cold Storage Cold Transportation Temperature-Controlled Packaging Monitoring and Control Systems Others |

| By Temperature Control | Refrigerated Frozen Ambient |

| By End-User Sector | Food and Beverage Pharmaceuticals Healthcare Chemicals Agriculture |

| By Ownership | Integrated Contract |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Application | Food Storage Medical Supply Chain Retail Distribution Others |

| By Sales Channel | Online Sales Offline Sales B2B Sales Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment Others |

| By Policy Support | Subsidies for Cold Chain Infrastructure Tax Incentives for Cold Storage Facilities Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Management | 100 | Supply Chain Managers, Quality Assurance Officers |

| Food & Beverage Cold Storage Solutions | 80 | Operations Managers, Logistics Coordinators |

| Technology Providers in Cold Chain | 50 | Product Development Managers, Sales Directors |

| Retail Cold Chain Logistics | 60 | Warehouse Managers, Inventory Control Specialists |

| Government Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The UAE Cold Chain Technology Market is valued at approximately USD 1.4 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as the growth of e-commerce and logistics services in the region.