Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0320

Pages:83

Published On:August 2025

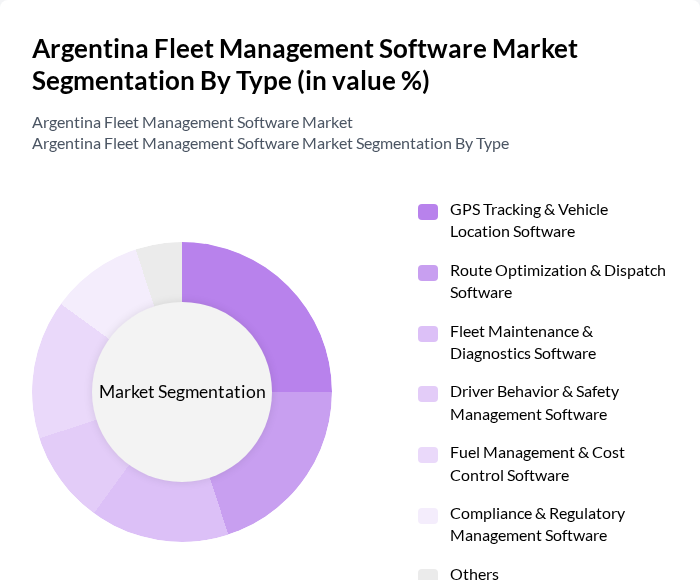

By Type:The market can be segmented into various types of fleet management software solutions, including GPS Tracking & Vehicle Location Software, Route Optimization & Dispatch Software, Fleet Maintenance & Diagnostics Software, Driver Behavior & Safety Management Software, Fuel Management & Cost Control Software, Compliance & Regulatory Management Software, and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency, reducing costs, and supporting regulatory compliance for fleet operators .

By End-User:The end-user segmentation includes Transportation & Logistics Providers, Construction & Infrastructure Companies, Public Sector & Municipal Fleets, Retail & Distribution, Utilities & Field Services, and Others. Each of these sectors has unique requirements for fleet management, driving the demand for tailored software solutions that address sector-specific challenges such as route optimization, asset tracking, compliance, and cost control .

The Argentina Fleet Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab, Verizon Connect, Fleet Complete, TomTom Telematics (Webfleet Solutions), Gurtam (Wialon), Pointer Argentina (Pointer Telocation), Omnicomm, FleetUp, Inseego, MiX Telematics, Ctrack, Samsara, Localiza Fleet Solutions, LoJack Argentina, and Tracktec contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fleet management software market in Argentina appears promising, driven by technological advancements and evolving consumer expectations. As companies increasingly prioritize efficiency and sustainability, the integration of AI and machine learning into fleet management solutions is expected to enhance decision-making processes. Additionally, the shift towards cloud-based platforms will facilitate real-time data access, enabling operators to respond swiftly to market changes and optimize their operations effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | GPS Tracking & Vehicle Location Software Route Optimization & Dispatch Software Fleet Maintenance & Diagnostics Software Driver Behavior & Safety Management Software Fuel Management & Cost Control Software Compliance & Regulatory Management Software Others |

| By End-User | Transportation & Logistics Providers Construction & Infrastructure Companies Public Sector & Municipal Fleets Retail & Distribution Utilities & Field Services Others |

| By Fleet Size | Small Fleets (1-20 vehicles) Medium Fleets (21-100 vehicles) Large Fleets (101+ vehicles) |

| By Deployment Type | On-Premise Cloud-Based Hybrid |

| By Region | Buenos Aires Córdoba Mendoza Rosario Others |

| By Technology | Telematics & IoT Integration Mobile Applications AI & Data Analytics Others |

| By Service Model | Subscription-Based (SaaS) Pay-Per-Use One-Time License Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 100 | Fleet Managers, Operations Directors |

| Public Transport Fleet Software | 70 | Transport Coordinators, City Planners |

| Private Sector Fleet Solutions | 60 | Business Owners, Fleet Supervisors |

| Telematics and Tracking Systems | 50 | IT Managers, Technology Officers |

| Fleet Maintenance Management | 40 | Maintenance Managers, Procurement Specialists |

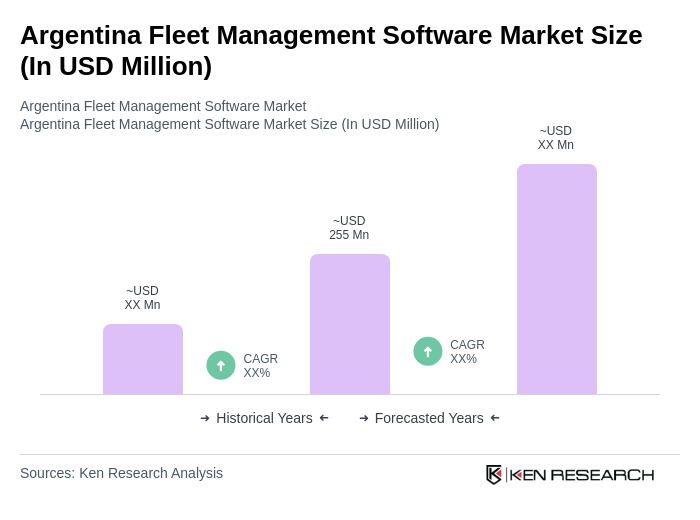

The Argentina Fleet Management Software Market is valued at approximately USD 255 million, reflecting a significant growth driven by the need for operational efficiency, cost reduction, and enhanced safety measures in fleet operations.