Region:Europe

Author(s):Shubham

Product Code:KRAA1060

Pages:85

Published On:August 2025

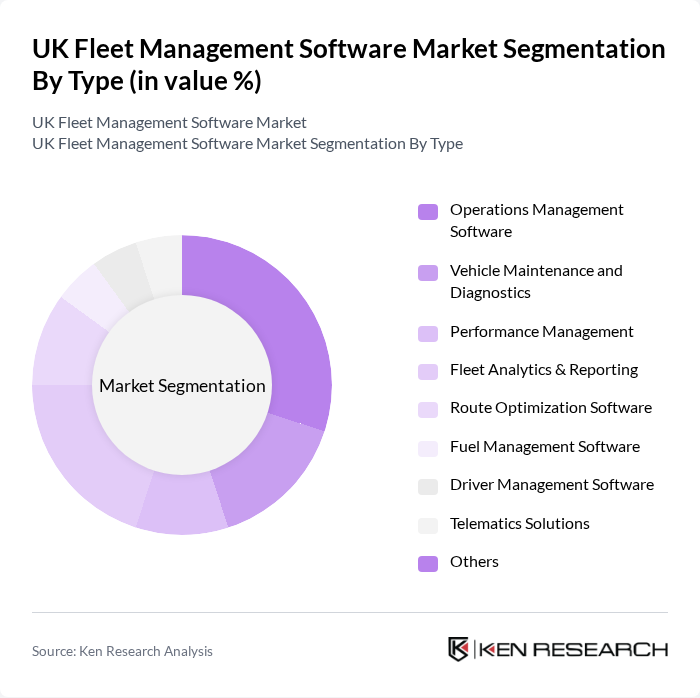

By Type:The market is segmented into various types of software solutions that cater to different operational needs. The subsegments include Operations Management Software, Vehicle Maintenance and Diagnostics, Performance Management, Fleet Analytics & Reporting, Route Optimization Software, Fuel Management Software, Driver Management Software, Telematics Solutions, and Others. Each of these subsegments plays a crucial role in enhancing fleet efficiency and reducing operational costs .

The Operations Management Software subsegment is currently dominating the market due to its ability to streamline various fleet operations, including scheduling, dispatching, and resource allocation. Companies are increasingly adopting these solutions to enhance productivity and reduce operational costs. Fleet Analytics & Reporting also holds a significant share, as businesses seek data-driven insights to improve decision-making and operational efficiency. The growing trend of digital transformation in the logistics sector further supports the demand for these software solutions .

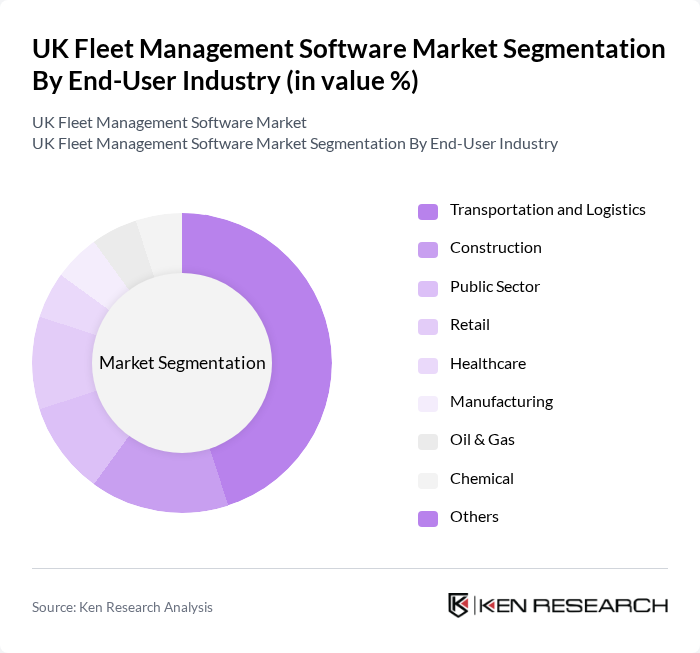

By End-User Industry:The market is segmented based on the industries that utilize fleet management software. The subsegments include Transportation and Logistics, Construction, Public Sector, Retail, Healthcare, Manufacturing, Oil & Gas, Chemical, and Others. Each industry has unique requirements and challenges that fleet management software addresses, leading to varied adoption rates across sectors .

The Transportation and Logistics sector is the largest end-user of fleet management software, driven by the need for efficient route planning, real-time tracking, and cost management. The Construction industry also shows significant adoption due to the necessity of managing heavy equipment and vehicles effectively. As businesses in these sectors increasingly recognize the benefits of fleet management solutions, the demand continues to grow .

The UK Fleet Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Verizon Connect, Teletrac Navman, TomTom Telematics (Webfleet Solutions), Geotab, Quartix, Chevin Fleet Solutions, Microlise, Fleet Complete, Fleetio, Ctrack (Inseego), GpsGate, Zubie, Omnicomm contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK fleet management software market appears promising, driven by technological innovations and increasing regulatory pressures. As businesses prioritize efficiency and compliance, the adoption of cloud-based solutions and IoT integration is expected to rise significantly. In future, the market will likely see enhanced functionalities in software offerings, including advanced analytics and real-time data insights, which will empower fleet operators to make informed decisions and improve overall operational performance.

| Segment | Sub-Segments |

|---|---|

| By Type | Operations Management Software Vehicle Maintenance and Diagnostics Performance Management Fleet Analytics & Reporting Route Optimization Software Fuel Management Software Driver Management Software Telematics Solutions Others |

| By End-User Industry | Transportation and Logistics Construction Public Sector Retail Healthcare Manufacturing Oil & Gas Chemical Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Fleet Size | Small Fleet (1-5 Vehicles) Medium Fleet (6-20 Vehicles) Large Fleet (21-50 Vehicles) Enterprise Fleet (51+ Vehicles) |

| By Region | England Scotland Wales Northern Ireland |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Integration Capability | API Integration Third-Party Software Integration Custom Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 100 | Fleet Managers, Operations Directors |

| Public Transport Fleet Software | 60 | Transport Planners, IT Managers |

| Construction Vehicle Management | 50 | Site Managers, Procurement Officers |

| Utility Fleet Optimization | 40 | Fleet Supervisors, Compliance Officers |

| Telematics and Tracking Solutions | 50 | IT Specialists, Data Analysts |

The UK Fleet Management Software Market is valued at approximately USD 3.2 billion, reflecting a significant growth driven by the need for operational efficiency, cost reduction, and enhanced vehicle tracking capabilities among businesses.