Region:Middle East

Author(s):Rebecca Mary Reji

Product Code:KRAA1164

Pages:87

Published On:August 2025

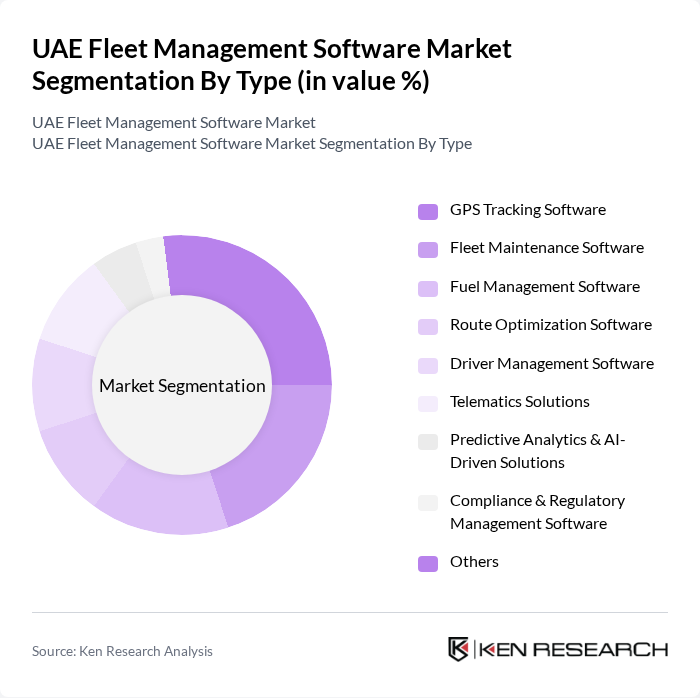

By Type:The market is segmented into various types of software solutions that address different operational needs. The subsegments include GPS Tracking Software, Fleet Maintenance Software, Fuel Management Software, Route Optimization Software, Driver Management Software, Telematics Solutions, Predictive Analytics & AI-Driven Solutions, Compliance & Regulatory Management Software, and Others. These solutions are increasingly integrated, enabling fleet operators to enhance operational efficiency, reduce costs, and ensure regulatory compliance through centralized platforms and real-time data analytics .

The GPS Tracking Software subsegment is currently dominating the market due to its critical role in real-time vehicle tracking and monitoring. Fleet operators increasingly rely on GPS technology to enhance route efficiency, reduce fuel consumption, and improve overall fleet visibility. The growing emphasis on safety, regulatory compliance, and the integration of telematics with other digital platforms further drives the adoption of GPS tracking solutions, making it a preferred choice among fleet managers .

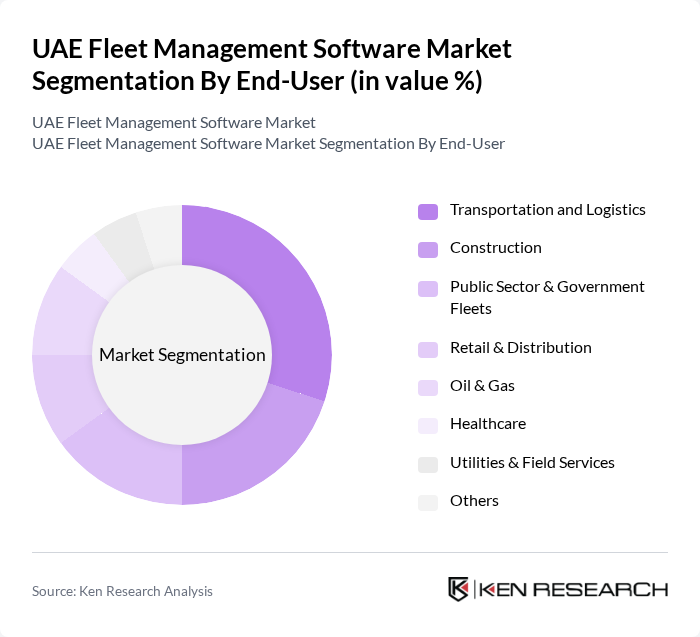

By End-User:The market is segmented based on the end-users of fleet management software, which includes Transportation and Logistics, Construction, Public Sector & Government Fleets, Retail & Distribution, Oil & Gas, Healthcare, Utilities & Field Services, and Others. Each end-user segment has unique requirements and operational challenges, with fleet management software tailored to address industry-specific needs such as compliance, asset utilization, and service reliability .

The Transportation and Logistics segment is the leading end-user of fleet management software, driven by the need for efficient supply chain management, timely deliveries, and real-time visibility of assets. Companies in this sector are increasingly adopting advanced fleet management solutions to optimize routes, reduce operational costs, and enhance customer satisfaction. The rapid growth of e-commerce and last-mile delivery services further fuels the demand for robust fleet management systems in this segment .

The UAE Fleet Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab, Fleet Complete, MiX Telematics, Verizon Connect, Gurtam (Wialon), TomTom Telematics, Teletrac Navman, Omnicomm, Fleetio, Ctrack (Inseego), Chevin Fleet Solutions, Microlise, Traklink, Location Solutions, FMS Tech contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE fleet management software market appears promising, driven by technological advancements and increasing regulatory pressures. As businesses prioritize operational efficiency and sustainability, the demand for integrated solutions that offer real-time data analytics and compliance features is expected to rise. Furthermore, the growing trend towards electric vehicles will likely necessitate specialized fleet management tools, creating new avenues for innovation and investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | GPS Tracking Software Fleet Maintenance Software Fuel Management Software Route Optimization Software Driver Management Software Telematics Solutions Predictive Analytics & AI-Driven Solutions Compliance & Regulatory Management Software Others |

| By End-User | Transportation and Logistics Construction Public Sector & Government Fleets Retail & Distribution Oil & Gas Healthcare Utilities & Field Services Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Vehicle Type | Light Commercial Vehicles Heavy Commercial Vehicles Passenger Vehicles Electric Vehicles Specialized Vehicles (e.g., Construction, Mining) |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Transportation Companies | 60 | Fleet Managers, Operations Directors |

| Public Sector Fleet Management | 40 | Government Fleet Coordinators, Procurement Officers |

| Small and Medium Enterprises (SMEs) | 50 | Business Owners, Logistics Managers |

| Technology Providers in Fleet Management | 40 | Product Managers, Software Developers |

| End-Users of Fleet Management Software | 50 | Logistics Coordinators, IT Support Staff |

The UAE Fleet Management Software Market is valued at approximately USD 245 million, reflecting significant growth driven by the demand for operational efficiency, cost reduction, and enhanced safety measures in fleet operations.