Region:Asia

Author(s):Dev

Product Code:KRAC0560

Pages:86

Published On:August 2025

By Type:The contract logistics market can be segmented into various types, including Transportation Management, Warehousing & Fulfillment, Distribution & Last-Mile Services, Freight Forwarding & Brokerage, Value-Added Services, and Aftermarket/Reverse Logistics. Among these, Transportation Management is currently the leading segment due to the increasing need for efficient transportation solutions in the face of rising e-commerce demand. The focus on optimizing supply chains and reducing transportation costs has made this segment particularly attractive to businesses looking to enhance their logistics operations.

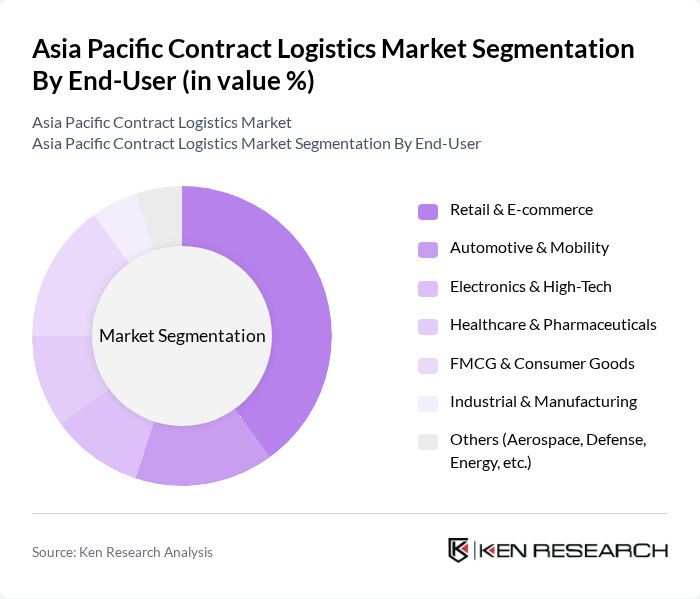

By End-User:The end-user segmentation includes Retail & E-commerce, Automotive & Mobility, Electronics & High-Tech, Healthcare & Pharmaceuticals, FMCG & Consumer Goods, Industrial & Manufacturing, and Others. The Retail & E-commerce segment is the most dominant, driven by the surge in online shopping and the need for efficient logistics solutions to meet consumer expectations for fast delivery. This segment's growth is further supported by technological advancements in inventory management and order fulfillment processes.

The Asia Pacific Contract Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain (Deutsche Post DHL Group), Kuehne+Nagel, DB Schenker, CEVA Logistics, Nippon Express Holdings (NIPPON EXPRESS/NEC Logistics), Yusen Logistics, DSV, GEODIS, Sinotrans Limited, Toll Group, SF Holding (SF Express), CJ Logistics, Kerry Logistics Network, Linfox, Gati (a Kintetsu World Express company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Asia Pacific contract logistics market appears promising, driven by ongoing digital transformation and the increasing importance of last-mile delivery solutions. As companies invest in technology to enhance supply chain visibility and efficiency, the demand for innovative logistics solutions will continue to rise. Additionally, sustainability initiatives are expected to gain traction, prompting logistics providers to adopt greener practices, which will further shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management (linehaul, drayage, domestic and cross-border) Warehousing & Fulfillment (ambient, cold chain, e-fulfillment) Distribution & Last-Mile Services Freight Forwarding & Brokerage Value-Added Services (kitting, postponement, packaging, returns) Aftermarket/Reverse Logistics |

| By End-User | Retail & E-commerce Automotive & Mobility Electronics & High-Tech Healthcare & Pharmaceuticals FMCG & Consumer Goods Industrial & Manufacturing Others (Aerospace, Defense, Energy, etc.) |

| By Region | East Asia (China, Japan, South Korea) Southeast Asia (Singapore, Indonesia, Thailand, Malaysia, Vietnam, Philippines, others) South Asia (India, Bangladesh, Sri Lanka, others) Oceania (Australia, New Zealand) Pacific Islands |

| By Service Model | Dedicated Contract Logistics (DCC) Shared/Multi-User Contract Logistics |

| By Industry Vertical | Food & Beverage (including cold chain) Pharmaceuticals & Life Sciences Electronics & Semiconductors Industrial & Engineering Goods Retail Fashion & Lifestyle |

| By Delivery Model | Standard Delivery Express & Same-Day Delivery Time-Definite/Deferred |

| By Pricing Model | Fixed/Fee-Per-Unit Pricing Variable/Consumption-Based Pricing Gainshare/Outcome-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Contract Logistics | 120 | Logistics Coordinators, Supply Chain Managers |

| Pharmaceutical Distribution | 90 | Operations Directors, Compliance Officers |

| Automotive Supply Chain Management | 70 | Procurement Managers, Logistics Analysts |

| Food and Beverage Logistics | 60 | Warehouse Supervisors, Quality Assurance Managers |

| E-commerce Fulfillment Services | 110 | eCommerce Operations Managers, Distribution Center Managers |

The Asia Pacific Contract Logistics Market is valued at approximately USD 110 billion, driven by the rapid growth of e-commerce, demand for efficient supply chain solutions, and globalization, which requires advanced logistics services for complex distribution networks.