Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA2049

Pages:100

Published On:August 2025

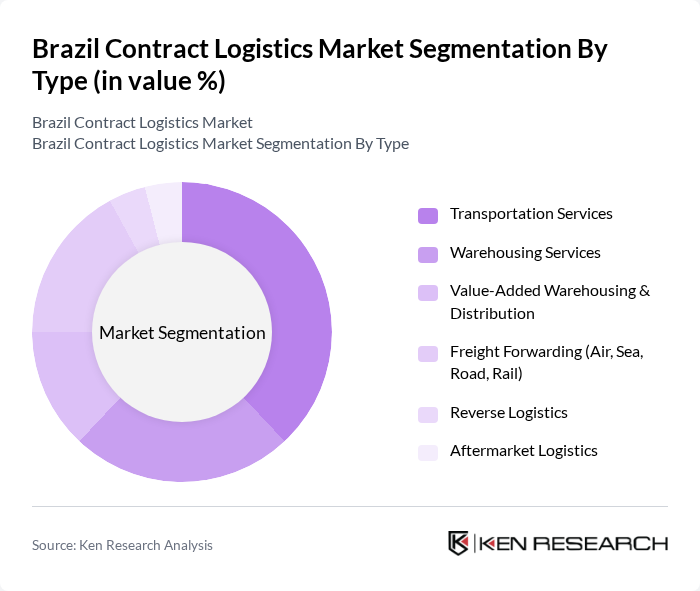

By Type:The market is segmented into various types, including Transportation Services, Warehousing Services, Value-Added Warehousing & Distribution, Freight Forwarding (Air, Sea, Road, Rail), Reverse Logistics, and Aftermarket Logistics. Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different customer needs and operational requirements .

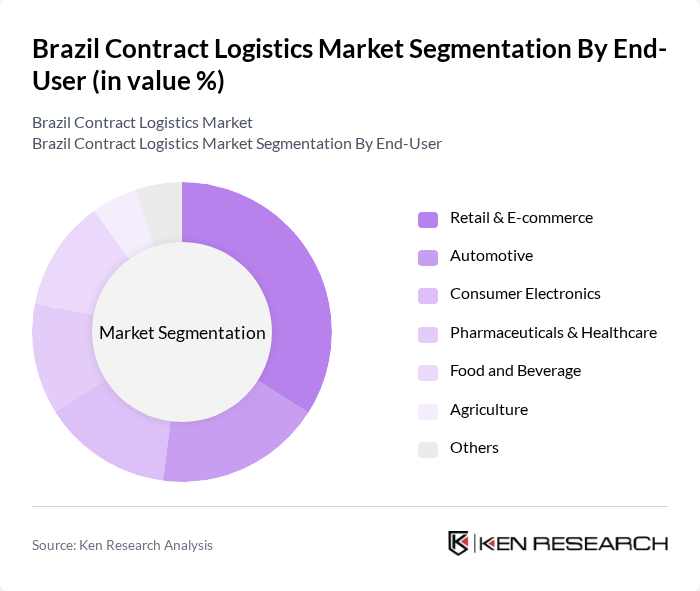

By End-User:The end-user segmentation includes Retail & E-commerce, Automotive, Consumer Electronics, Pharmaceuticals & Healthcare, Food and Beverage, Agriculture, and Others. Each sector has unique logistics requirements, influencing the demand for specific services and solutions .

The Brazil Contract Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Brasil, Kuehne + Nagel Brasil, DB Schenker Brasil, CEVA Logistics Brasil, JSL S.A., Tegma Gestão Logística S.A., Grupo BBM Logística, FedEx Brasil, Log-In Logística Intermodal S.A., TPC Logística Inteligente, RTE Rodonaves, Expresso Nepomuceno, Geodis Brasil, DSV Brasil, Yusen Logistics Brasil contribute to innovation, geographic expansion, and service delivery in this space .

The Brazil contract logistics market is poised for significant transformation as it adapts to evolving consumer demands and technological advancements. With the continued rise of e-commerce and infrastructure investments, logistics providers will increasingly focus on enhancing service efficiency and sustainability. The integration of automation and AI will streamline operations, while the emphasis on last-mile delivery solutions will cater to consumer expectations for speed. Overall, the market is expected to evolve rapidly, driven by innovation and strategic partnerships among key players.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing Services Value-Added Warehousing & Distribution Freight Forwarding (Air, Sea, Road, Rail) Reverse Logistics Aftermarket Logistics |

| By End-User | Retail & E-commerce Automotive Consumer Electronics Pharmaceuticals & Healthcare Food and Beverage Agriculture Others |

| By Service Model | Dedicated Contract Logistics Shared Contract Logistics Hybrid Logistics Solutions |

| By Industry Vertical | E-commerce Manufacturing Healthcare Construction Agribusiness Others |

| By Delivery Mode | Road Transport Rail Transport Air Transport Sea Transport |

| By Contract Duration | Short-term Contracts Long-term Contracts |

| By Pricing Model | Fixed Pricing Variable Pricing Performance-based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 100 | Logistics Coordinators, Supply Chain Managers |

| Automotive Supply Chain Management | 80 | Procurement Managers, Operations Directors |

| Pharmaceutical Distribution Networks | 60 | Warehouse Managers, Compliance Officers |

| E-commerce Fulfillment Strategies | 90 | eCommerce Operations Managers, Logistics Analysts |

| Food and Beverage Logistics | 50 | Supply Chain Directors, Quality Assurance Managers |

The Brazil Contract Logistics Market is valued at approximately USD 15 billion, reflecting significant growth driven by the demand for efficient supply chain solutions, e-commerce expansion, and investments in automation and infrastructure.