Region:Europe

Author(s):Geetanshi

Product Code:KRAA1940

Pages:92

Published On:August 2025

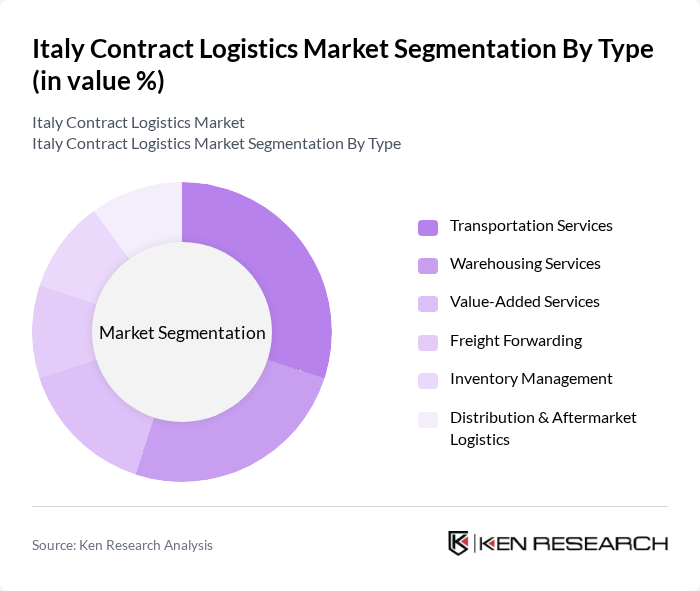

By Type:The contract logistics market can be segmented into various types, includingTransportation Services, Warehousing Services, Value-Added Services, Freight Forwarding, Inventory Management, and Distribution & Aftermarket Logistics. Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different customer needs and operational requirements.

TheTransportation Servicessegment is currently dominating the market due to the increasing demand for efficient and timely delivery of goods. This segment encompasses various modes of transport, including road, rail, air, and sea, catering to diverse customer needs. The rise of e-commerce and omnichannel retailing has significantly boosted the demand for transportation services, as businesses seek to enhance their delivery capabilities. Additionally, advancements in technology, such as route optimization, real-time tracking, and fleet electrification, have further improved service efficiency, making this segment a key player in the logistics landscape.

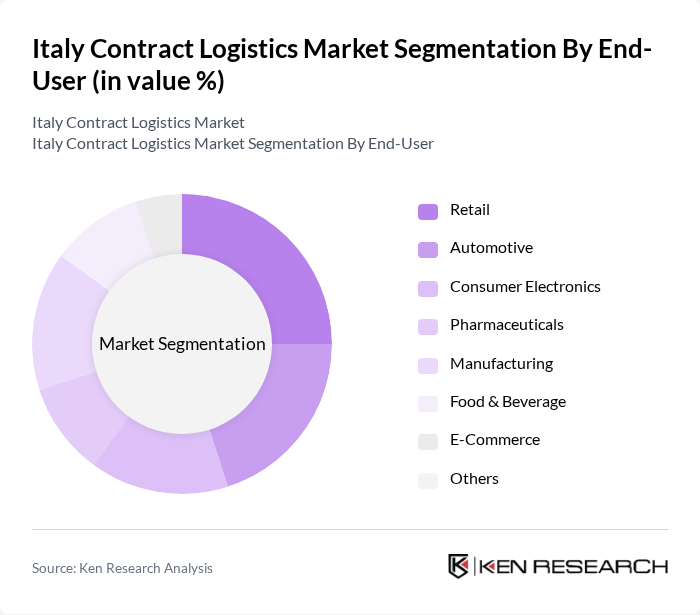

By End-User:The contract logistics market serves various end-user industries, includingRetail, Automotive, Consumer Electronics, Pharmaceuticals, Manufacturing, Food & Beverage, E-Commerce, and Others. Each sector has unique logistics requirements, driving the demand for tailored solutions.

TheRetailsector is the leading end-user in the contract logistics market, driven by the rapid growth of e-commerce, omnichannel strategies, and the need for efficient supply chain management. Retailers are increasingly outsourcing logistics functions to focus on core business activities and enhance customer satisfaction. The demand for timely deliveries, last-mile solutions, and advanced inventory management has led to significant investments in logistics capabilities, making this sector a critical driver of market growth.

The Italy Contract Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, XPO Logistics, DB Schenker, Geodis, CEVA Logistics, DSV, UPS Supply Chain Solutions, FedEx Logistics, Rhenus Logistics, Fercam S.p.A., Arcese Trasporti S.p.A., Savino Del Bene S.p.A., Bolloré Logistics, Poste Italiane S.p.A. (SDA Express Courier) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy contract logistics market appears promising, driven by the ongoing digital transformation and the increasing emphasis on sustainability. As companies adopt advanced technologies, such as AI and automation, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainable practices will likely reshape logistics strategies, encouraging providers to innovate and adapt. This evolving landscape presents opportunities for growth, particularly in sectors that prioritize efficiency and environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing Services Value-Added Services Freight Forwarding Inventory Management Distribution & Aftermarket Logistics |

| By End-User | Retail Automotive Consumer Electronics Pharmaceuticals Manufacturing Food & Beverage E-Commerce Others |

| By Service Model | Dedicated Contract Logistics Shared Logistics Services Integrated Logistics Solutions Insourcing Outsourcing Others |

| By Industry Vertical | Food and Beverage Healthcare Electronics Chemicals Fashion & Apparel Others |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Distributors Others |

| By Geographic Coverage | Northern Italy Central Italy Southern Italy Islands |

| By Customer Type | B2B B2C Government Others |

| By Mode of Transportation | Roadways Railways Seaways Airways Intermodal |

| By Contract Type | Dedicated Contracts Shared Contracts Managed Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 100 | Logistics Managers, Supply Chain Executives |

| Pharmaceutical Distribution | 60 | Operations Directors, Compliance Officers |

| Automotive Supply Chain Management | 50 | Procurement Managers, Warehouse Supervisors |

| Food and Beverage Logistics | 40 | Quality Assurance Managers, Distribution Coordinators |

| E-commerce Fulfillment Strategies | 45 | eCommerce Operations Managers, Logistics Analysts |

The Italy Contract Logistics Market is valued at approximately USD 5.2 billion, driven by the increasing demand for efficient supply chain solutions, e-commerce growth, and specialized logistics services across various sectors such as automotive, retail, and healthcare.