Region:Asia

Author(s):Geetanshi

Product Code:KRAA0192

Pages:91

Published On:August 2025

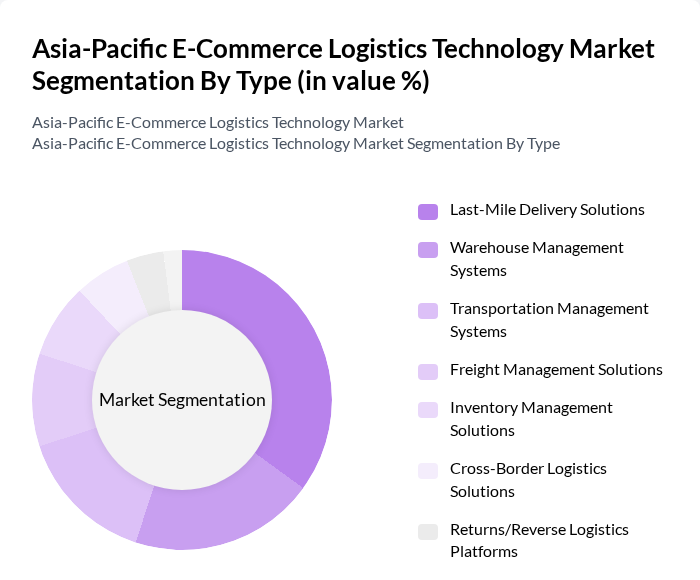

By Type:The Asia-Pacific E-Commerce Logistics Technology Market can be segmented into various types, including Last-Mile Delivery Solutions, Warehouse Management Systems, Transportation Management Systems, Freight Management Solutions, Inventory Management Solutions, Cross-Border Logistics Solutions, Returns/Reverse Logistics Platforms, and Others. Among these, Last-Mile Delivery Solutions are currently leading the market due to the increasing demand for rapid and reliable delivery services. The rise of e-commerce has heightened consumer expectations for fast, trackable, and flexible delivery, making last-mile solutions critical for logistics providers .

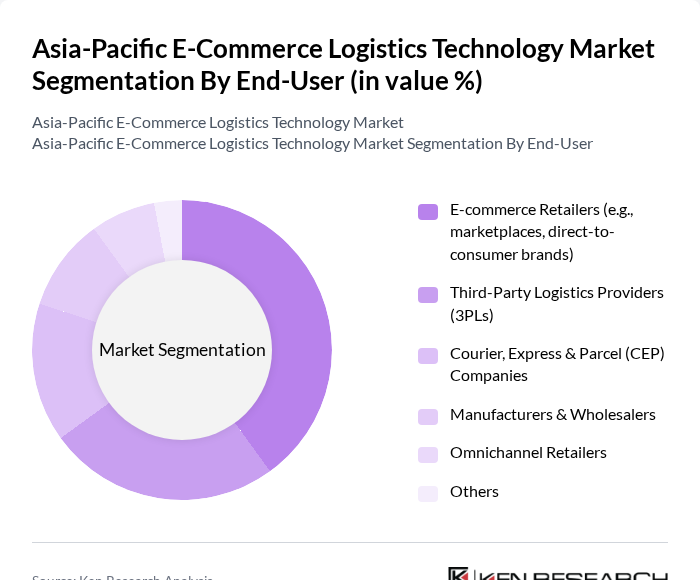

By End-User:The market can also be segmented by end-users, which include E-commerce Retailers (e.g., marketplaces, direct-to-consumer brands), Third-Party Logistics Providers (3PLs), Courier, Express & Parcel (CEP) Companies, Manufacturers & Wholesalers, Omnichannel Retailers, and Others. E-commerce Retailers are the dominant end-user segment, driven by the explosive growth of online shopping and the need for efficient, technology-enabled logistics solutions to meet evolving consumer demands .

The Asia-Pacific E-Commerce Logistics Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as JD Logistics, Cainiao Network (Alibaba Group), SF Express, ZTO Express, YTO Express, Ninja Van, Lalamove, Kerry Logistics Network, DHL Supply Chain, FedEx Logistics, UPS Supply Chain Solutions, DB Schenker, Kuehne + Nagel, Maersk Logistics, CEVA Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Asia-Pacific e-commerce logistics technology market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and automation is expected to enhance operational efficiency, while the growth of third-party logistics providers will facilitate scalability for e-commerce businesses. Additionally, sustainability initiatives are likely to gain traction, as companies increasingly prioritize eco-friendly practices in their logistics operations, aligning with consumer demand for responsible business practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Last-Mile Delivery Solutions Warehouse Management Systems Transportation Management Systems Freight Management Solutions Inventory Management Solutions Cross-Border Logistics Solutions Returns/Reverse Logistics Platforms Others |

| By End-User | E-commerce Retailers (e.g., marketplaces, direct-to-consumer brands) Third-Party Logistics Providers (3PLs) Courier, Express & Parcel (CEP) Companies Manufacturers & Wholesalers Omnichannel Retailers Others |

| By Region | East Asia (China, Japan, South Korea) Southeast Asia (Singapore, Indonesia, Malaysia, Thailand, Vietnam, Philippines, etc.) South Asia (India, Bangladesh, Pakistan, Sri Lanka, etc.) Oceania (Australia, New Zealand, Pacific Islands) |

| By Technology | Cloud-Based Solutions IoT-Enabled Logistics AI and Machine Learning Applications Robotics and Automation in Warehousing Blockchain for Supply Chain Data Analytics Platforms Others |

| By Application | B2B Logistics B2C Logistics C2C Logistics Reverse Logistics Cross-Border Fulfillment Others |

| By Investment Source | Private Investments Venture Capital Government Funding Public-Private Partnerships Others |

| By Policy Support | Tax Incentives Subsidies for Technology Adoption Grants for Infrastructure Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Logistics Technology Adoption | 100 | IT Managers, Logistics Coordinators |

| Last-Mile Delivery Solutions | 80 | Operations Directors, Delivery Managers |

| Warehouse Automation Technologies | 60 | Warehouse Managers, Technology Officers |

| Supply Chain Visibility Tools | 50 | Supply Chain Analysts, Business Development Managers |

| Returns Management Systems | 40 | Customer Experience Managers, Logistics Analysts |

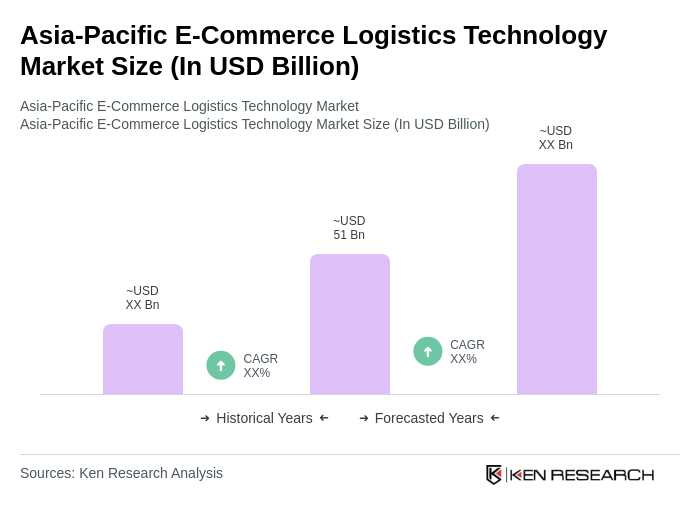

The Asia-Pacific E-Commerce Logistics Technology Market is valued at approximately USD 51 billion, driven by the rapid growth of e-commerce, consumer demand for faster delivery, and advancements in logistics technology.