Region:Europe

Author(s):Dev

Product Code:KRAA0479

Pages:88

Published On:August 2025

By Service Type:The service type segmentation includes a comprehensive range of logistics services tailored to the needs of e-commerce businesses. The subsegments include Transportation (Roadways, Railways, Airways, Waterways), Warehousing (Mega Centers, Hubs/Delivery Centers, Returns Processing Centers, Others), Last-Mile Delivery Solutions, Reverse Logistics, Freight Management Solutions, Order Management Systems, Inventory Management Solutions, and Others. Among these, Last-Mile Delivery Solutions are particularly dominant due to the increasing demand for rapid and reliable delivery services directly to consumers, driven by the proliferation of online marketplaces and heightened customer expectations .

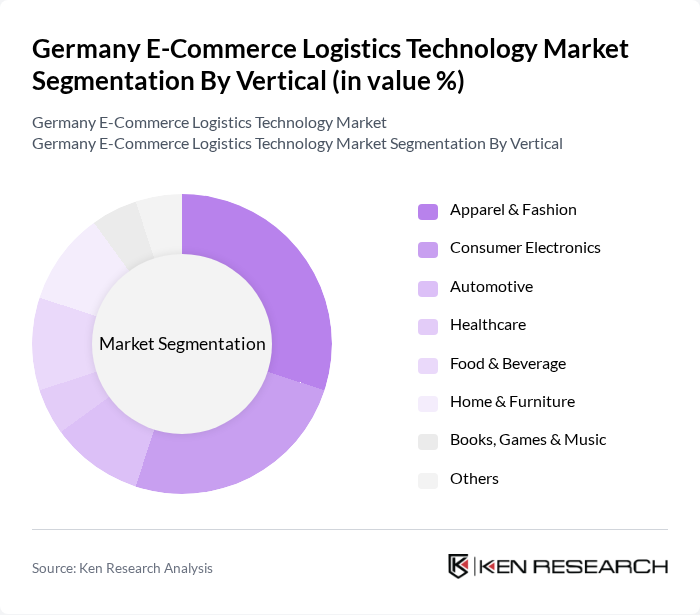

By Vertical:The vertical segmentation covers a broad spectrum of industries utilizing e-commerce logistics technology. The subsegments include Apparel & Fashion, Consumer Electronics, Automotive, Healthcare, Food & Beverage, Home & Furniture, Books, Games & Music, and Others. The Apparel & Fashion sector leads this market, attributed to the high volume of online sales, frequent returns and exchanges, and the need for agile logistics solutions capable of handling fast-moving inventory and consumer preferences .

The Germany E-Commerce Logistics Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, DB Schenker, Hermes Germany, DPD Germany, GLS Germany, Kuehne + Nagel, FedEx Germany, UPS Germany, Amazon Logistics, Zalando Logistics, Aramex, XPO Logistics, Geodis, Rhenus Logistics, SEKO Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German e-commerce logistics technology market appears promising, driven by ongoing technological advancements and evolving consumer expectations. As companies increasingly adopt AI and machine learning, operational efficiencies are expected to improve significantly. Furthermore, the rise of omnichannel retailing will necessitate enhanced logistics solutions, ensuring seamless integration across various sales channels. This dynamic environment will foster innovation and collaboration, positioning the market for sustained growth and adaptation to changing consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation (Roadways, Railways, Airways, Waterways) Warehousing (Mega Centers, Hubs/Delivery Centers, Returns Processing Centers, Others) Last-Mile Delivery Solutions Reverse Logistics Freight Management Solutions Order Management Systems Inventory Management Solutions Others |

| By Vertical | Apparel & Fashion Consumer Electronics Automotive Healthcare Food & Beverage Home & Furniture Books, Games & Music Others |

| By Logistics Model | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) In-House Logistics Integrated Logistics Others |

| By Operation | Domestic International |

| By Technology | Cloud-Based Solutions On-Premise Solutions Mobile Applications IoT-Enabled Devices Blockchain Technology Automation & Robotics Others |

| By Customer Segment | B2C B2B C2C Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Fulfillment Technologies | 100 | Logistics Directors, IT Managers |

| Last-Mile Delivery Solutions | 80 | Operations Managers, Delivery Coordinators |

| Warehouse Automation Systems | 60 | Warehouse Managers, Automation Engineers |

| Returns Management Technologies | 50 | Customer Experience Managers, Supply Chain Analysts |

| Data Analytics in Logistics | 40 | Data Scientists, Business Analysts |

The Germany E-Commerce Logistics Technology Market is valued at approximately USD 7.5 billion, reflecting significant growth driven by the expansion of online retail and advancements in logistics technology.