Region:Europe

Author(s):Shubham

Product Code:KRAA0972

Pages:92

Published On:August 2025

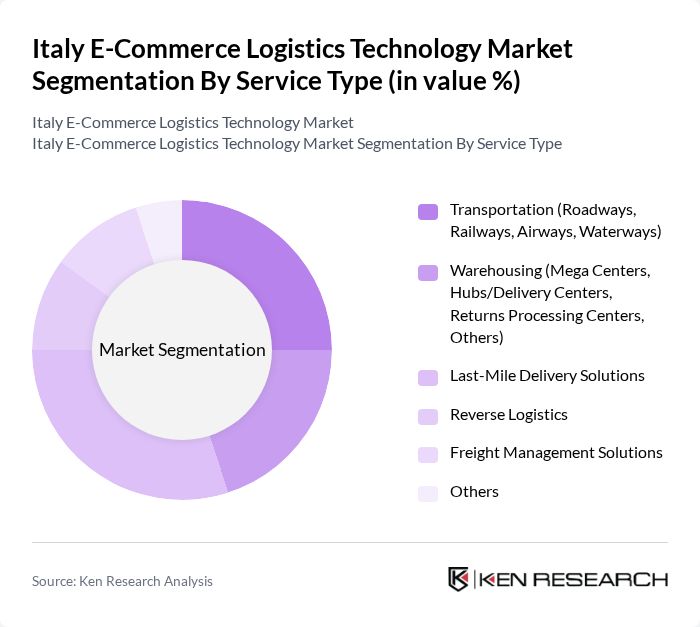

By Service Type:The service type segmentation includes various subsegments such as Transportation, Warehousing, Last-Mile Delivery Solutions, Reverse Logistics, Freight Management Solutions, and Others. Among these, Last-Mile Delivery Solutions is currently dominating the market due to the increasing demand for quick and efficient delivery services. Consumers are increasingly favoring e-commerce platforms that offer same-day or next-day delivery, prompting logistics providers to invest heavily in last-mile solutions. This trend is further fueled by the rise of mobile commerce and the need for enhanced customer experiences .

By Logistics Model:The logistics model segmentation includes 3PL (Third-Party Logistics), 4PL (Fourth-Party Logistics), and Others. The 3PL segment is leading the market as businesses increasingly outsource their logistics operations to specialized providers. This trend is driven by the need for cost efficiency, scalability, and access to advanced logistics technologies. Companies are leveraging 3PL services to enhance their supply chain capabilities and focus on core business activities, which is further propelling the growth of this segment .

The Italy E-Commerce Logistics Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, FedEx Logistics, UPS Supply Chain Solutions, DB Schenker, Kuehne + Nagel, XPO Logistics, Geodis, DPDgroup, Poste Italiane, BRT (Bartolini), GLS Italy, CEVA Logistics, SDA Express Courier, Amazon Logistics Italy, Aramex contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian e-commerce logistics technology market appears promising, driven by ongoing advancements in technology and evolving consumer expectations. As companies increasingly adopt automation and AI-driven solutions, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainable logistics practices will likely shape the industry, with businesses seeking eco-friendly delivery options to meet consumer demand for sustainability. This evolving landscape presents opportunities for innovation and growth in the logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation (Roadways, Railways, Airways, Waterways) Warehousing (Mega Centers, Hubs/Delivery Centers, Returns Processing Centers, Others) Last-Mile Delivery Solutions Reverse Logistics Freight Management Solutions Others |

| By Logistics Model | PL (Third-Party Logistics) PL (Fourth-Party Logistics) Others |

| By Operation | Domestic International |

| By Vertical | Fashion and Apparel Consumer Electronics Automotive Healthcare Food and Beverage Others |

| By Technology Integration | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions Automation & Robotics IoT & Real-Time Tracking Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Solutions | 100 | Logistics Coordinators, Delivery Operations Managers |

| Warehouse Automation Technologies | 60 | Warehouse Managers, Technology Implementation Leads |

| Returns Management Systems | 50 | Customer Experience Managers, Returns Analysts |

| Cold Chain Logistics for E-commerce | 40 | Supply Chain Directors, Quality Assurance Managers |

| Cross-Border E-commerce Logistics | 50 | International Trade Managers, Compliance Officers |

The Italy E-Commerce Logistics Technology Market is valued at approximately USD 9.2 billion, reflecting significant growth driven by the expansion of online retail, consumer demand for faster delivery, and advancements in logistics technology.