Asia Pacific Spirits Market Overview

- The Asia Pacific Spirits Market is valued at USD 145 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, a burgeoning middle class in rapidly developing economies, and evolving consumer preferences toward premium and craft spirits. The market is further propelled by the increasing popularity of online retail channels and a strong trend of social drinking among millennials and Gen Z. There is a marked shift toward innovative flavors, ethnic varieties, and artisanal products, catering to a more discerning consumer base.

- Key players in this market include China, India, and Japan, which dominate due to their large populations, cultural significance of spirits in social gatherings, and established production facilities. China maintains a leading position, especially with high demand for baijiu and premium craft spirits, while India is experiencing a surge in demand for whiskey and rum, driven by urbanization, a growing middle class, and increased consumer spending. Southeast Asian countries such as Thailand, Malaysia, and Singapore are also emerging as significant growth markets, supported by tourism and changing lifestyles.

- In 2023, the Indian government introduced regulations aimed at promoting responsible drinking and reducing alcohol-related harm. These regulations require all alcoholic beverage advertisements to include disclaimers about responsible consumption and prohibit marketing to minors. The initiative is designed to foster a healthier drinking culture while supporting the continued growth of the spirits industry.

Asia Pacific Spirits Market Segmentation

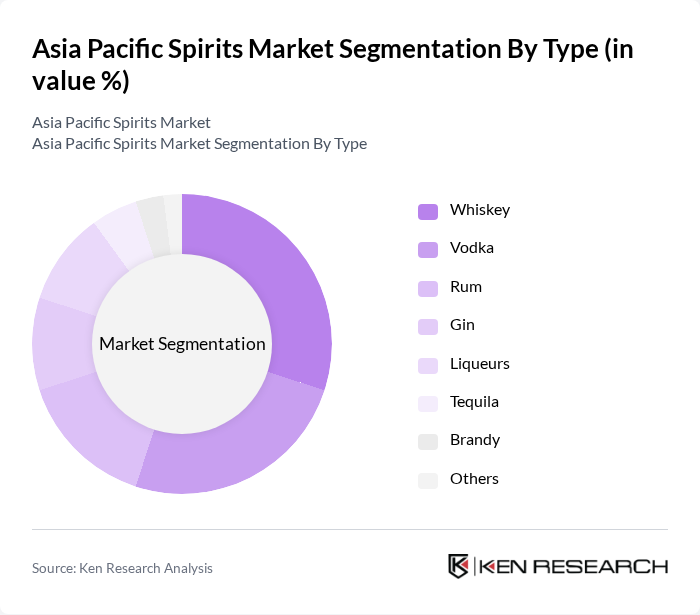

By Type:The spirits market is segmented into whiskey, vodka, rum, gin, liqueurs, tequila, brandy, and others. Whiskey and vodka remain the most popular categories, driven by their versatility in cocktails and strong brand presence. The rise of craft distilleries and premiumization trends has accelerated growth in gin and liqueurs, with consumers seeking unique flavors and experiences. Baijiu, especially in China, and premium craft spirits are increasingly influential in shaping market dynamics.

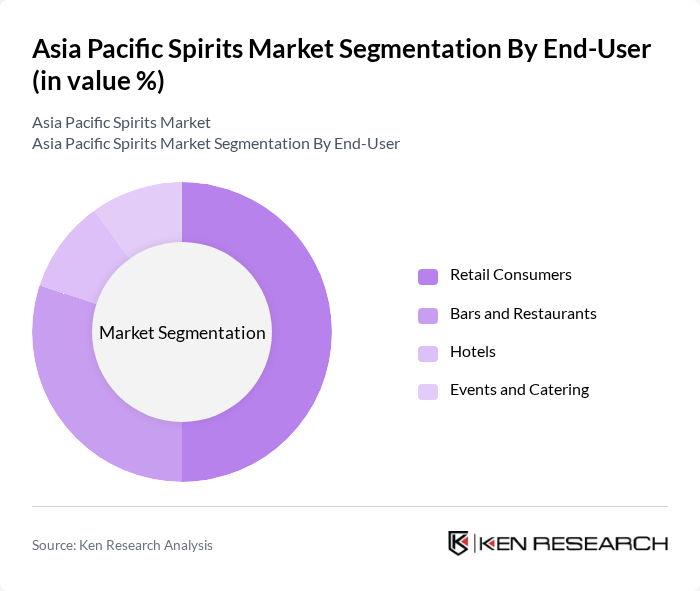

By End-User:The spirits market is segmented by end-user into retail consumers, bars and restaurants, hotels, and events and catering. Retail consumers account for the largest share, driven by the increasing trend of home consumption, growth of online retail platforms, and changing purchasing habits. Bars and restaurants remain key venues for social gatherings and events, supporting overall demand for spirits. Hotels and event catering also contribute, particularly in tourism-driven markets.

Asia Pacific Spirits Market Competitive Landscape

The Asia Pacific Spirits Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diageo plc, Pernod Ricard SA, Beam Suntory Inc., Bacardi Limited, Brown-Forman Corporation, Asahi Group Holdings, Ltd., Kirin Holdings Company, Limited, Suntory Holdings Limited, Moët Hennessy Louis Vuitton (LVMH), Campari Group, Edrington Group, William Grant & Sons Ltd., Rémy Cointreau, Constellation Brands, Inc., Sazerac Company, Inc., Thai Beverage Public Company Limited (ThaiBev), Wuliangye Yibin Co., Ltd., Luzhou Laojiao Co., Ltd., Allied Blenders & Distillers Pvt. Ltd., United Spirits Limited (A Diageo Company) contribute to innovation, geographic expansion, and service delivery in this space.

Asia Pacific Spirits Market Industry Analysis

Growth Drivers

- Rising Disposable Incomes:The Asia Pacific region has witnessed a significant increase in disposable incomes, with an average growth rate of 6.1% annually. In countries like China and India, disposable income per capita is projected to reach approximately $6,000 and $2,500 respectively in future. This increase allows consumers to spend more on premium and luxury spirits, driving market growth. As more individuals enter the middle class, their purchasing power enhances the demand for high-quality alcoholic beverages.

- Increasing Urbanization:Urbanization in Asia Pacific is accelerating, with urban populations expected to rise from 55% in 2020 to 68% in future. This shift leads to lifestyle changes, including increased socializing and consumption of spirits. Major cities like Tokyo and Mumbai are seeing a surge in bars and restaurants, contributing to a vibrant nightlife culture. The urban demographic is more inclined to experiment with diverse alcoholic beverages, further propelling the spirits market in the region.

- Expansion of Distribution Channels:The spirits market in Asia Pacific is benefiting from the rapid expansion of distribution channels, particularly e-commerce. Online alcohol sales are projected to grow by 22% annually, reaching $18 billion in future. Retailers are increasingly adopting omnichannel strategies, enhancing accessibility for consumers. This growth in distribution not only facilitates easier access to a variety of spirits but also encourages impulse purchases, significantly boosting overall market sales.

Market Challenges

- Stringent Regulations:The spirits industry in Asia Pacific faces stringent regulations that can hinder growth. For instance, countries like India impose high taxation rates, with excise duties reaching up to 200% on certain spirits. Additionally, regulations regarding advertising and marketing can limit brand visibility. These challenges create barriers for new entrants and can restrict the growth potential of established brands, impacting overall market dynamics.

- Health Consciousness Among Consumers:A growing trend towards health consciousness is affecting alcohol consumption patterns in Asia Pacific. Reports indicate that 28% of consumers are actively reducing their alcohol intake due to health concerns. This shift is particularly evident among younger demographics, who are increasingly opting for low-alcohol or non-alcoholic alternatives. As health awareness rises, traditional spirits may face declining demand, posing a challenge for market players.

Asia Pacific Spirits Market Future Outlook

The Asia Pacific spirits market is poised for dynamic growth, driven by evolving consumer preferences and innovative product offerings. The rise of e-commerce and digital marketing strategies will enhance brand engagement and accessibility. Additionally, the increasing popularity of craft spirits and sustainable production practices will shape the market landscape. As consumers seek unique experiences, brands that focus on quality and storytelling will likely thrive, positioning themselves favorably in this competitive environment.

Market Opportunities

- Growth in E-commerce Sales:The shift towards online shopping presents a significant opportunity for the spirits market. E-commerce sales are expected to reach $18 billion in future, driven by convenience and a wider selection of products. Brands that invest in robust online platforms can tap into this growing consumer base, enhancing their market presence and driving sales growth.

- Increasing Demand for Craft Spirits:The craft spirits segment is gaining traction, with sales projected to grow by 27% annually. Consumers are increasingly seeking artisanal and locally produced options, valuing quality over quantity. This trend offers brands the chance to differentiate themselves through unique offerings, catering to the evolving tastes of discerning consumers in the Asia Pacific region.