Region:Middle East

Author(s):Geetanshi

Product Code:KRAB1651

Pages:100

Published On:January 2026

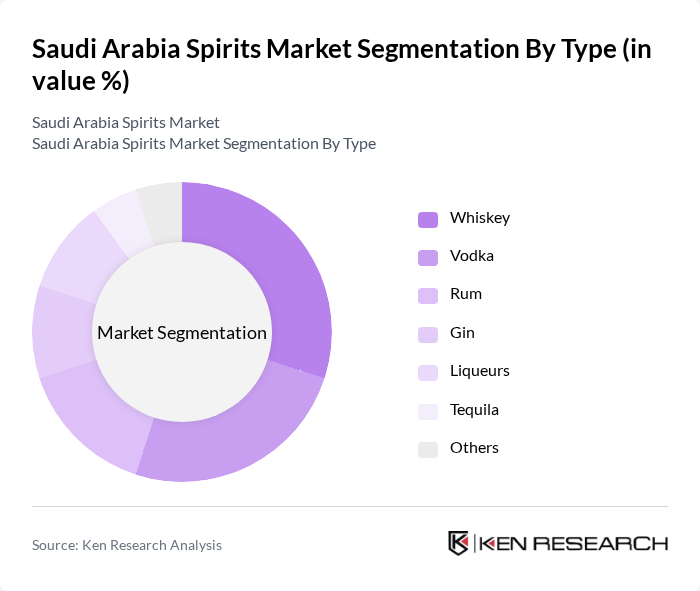

By Type:The spirits market can be segmented into various types, including whiskey, vodka, rum, gin, liqueurs, tequila, and others. Among these, whiskey and vodka are the most popular choices among consumers, driven by their versatility in cocktails and premium branding. The increasing trend of mixology and craft cocktails has further boosted the demand for these spirits.

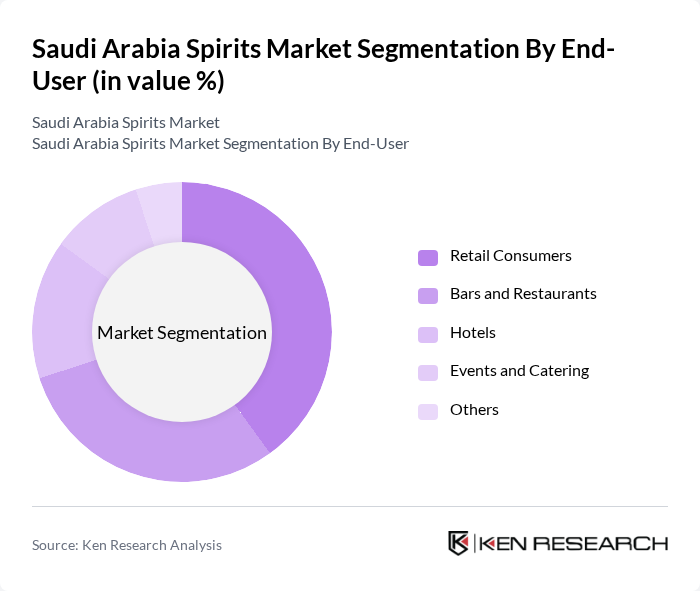

By End-User:The end-user segmentation includes retail consumers, the hospitality sector, events and catering, and others. The hospitality sector is the leading end-user, driven by the increasing number of bars, restaurants, and hotels that serve alcoholic beverages. Retail consumers are also significant, as more individuals are purchasing spirits for home consumption, especially during celebrations and gatherings.

The Saudi Arabia Spirits Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diageo, Pernod Ricard, Bacardi, Brown-Forman, Moët Hennessy, William Grant & Sons, Campari Group, Edrington, Rémy Cointreau, Sazerac Company, Constellation Brands, Allied Beverage Group, Heaven Hill Brands, Brown-Forman, Distell Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia spirits market is poised for transformation as it navigates the complexities of cultural norms and regulatory frameworks. With increasing disposable income and a burgeoning tourism sector, the market is likely to see a rise in demand for premium and craft spirits. Additionally, the growth of e-commerce platforms will facilitate wider access to diverse products, enabling brands to reach a broader audience. As consumer preferences evolve, innovative marketing strategies will play a crucial role in shaping the future landscape of the spirits industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Whiskey Vodka Rum Gin Liqueurs Tequila Others |

| By End-User | Retail Consumers Hospitality Sector Events and Catering Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Bars and Restaurants Others |

| By Packaging Type | Glass Bottles Plastic Bottles Cans Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Occasion | Celebrations Casual Gatherings Corporate Events Others |

| By Consumer Demographics | Age Group Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Spirits Outlets | 110 | Store Managers, Sales Representatives |

| Consumer Preferences Survey | 140 | Expatriates, Local Consumers aged 21-50 |

| Distribution Channels Analysis | 80 | Distributors, Wholesalers |

| Market Trends Focus Groups | 75 | Industry Experts, Market Analysts |

| Regulatory Impact Assessment | 65 | Legal Advisors, Policy Makers |

The Saudi Arabia Spirits Market is valued at approximately USD 4.5 billion, reflecting a significant growth trend driven by increasing consumer demand for premium alcoholic beverages and a shift in social attitudes towards alcohol consumption.