Region:North America

Author(s):Shubham

Product Code:KRAD0668

Pages:88

Published On:August 2025

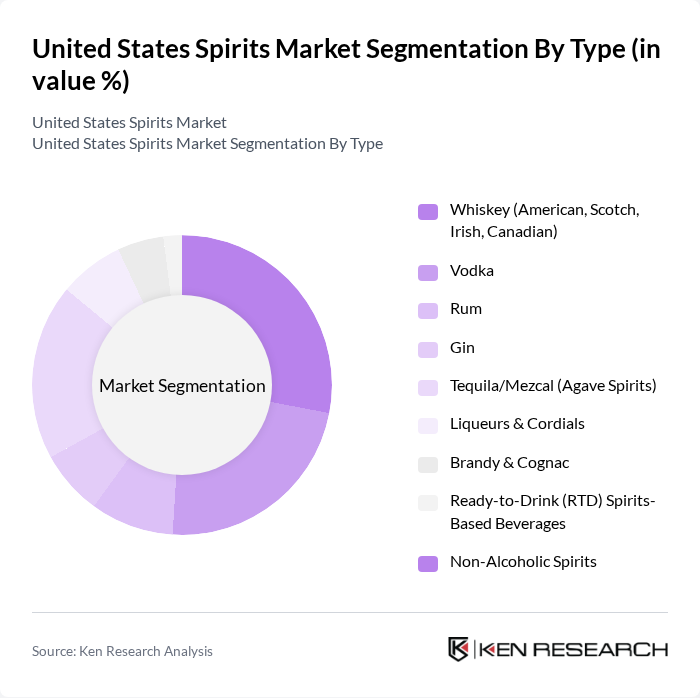

By Type:The spirits market is segmented into various types, including whiskey, vodka, rum, gin, tequila/mezcal, liqueurs & cordials, brandy & cognac, ready-to-drink (RTD) spirits-based beverages, and non-alcoholic spirits. Among these, whiskey has emerged as a dominant segment, driven by its rich heritage and increasing popularity among consumers seeking premium and craft options. The trend towards whiskey cocktails and the rise of craft distilleries have further bolstered its market presence; at a regional level, whiskey has led revenue share, while agave-based spirits have been the key growth driver in recent periods.

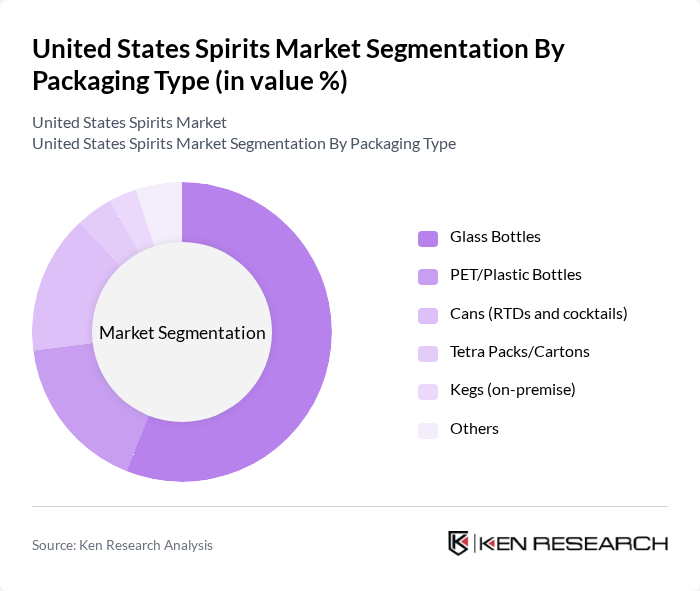

By Packaging Type:The packaging segment includes glass bottles, PET/plastic bottles, cans (RTDs and cocktails), tetra packs/cartons, kegs (on-premise), and others. Glass bottles dominate the market due to their premium appeal and preservation of product integrity, while sustainability initiatives are driving lighter-weight glass, recycled content, and refill concepts; cans are growing within spirits-based RTDs through convenience and portion control.

The United States Spirits Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diageo plc, Pernod Ricard SA, Brown-Forman Corporation, Bacardi Limited, Constellation Brands, Inc., Beam Suntory Inc. (Suntory Global Spirits), E. & J. Gallo Winery (Spirits Division), Moët Hennessy (LVMH), Davide Campari-Milano N.V. (Campari Group), William Grant & Sons Ltd., Sazerac Company, Inc., Rémy Cointreau SA, Stoli Group, The Boston Beer Company, Inc. (Dogfish Head Distilling; spirits-based RTDs), Distilled Spirits Council of the United States (DISCUS) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. spirits market appears promising, driven by evolving consumer preferences and innovative product offerings. As the demand for organic and natural spirits continues to rise, brands are likely to invest in sustainable practices and eco-friendly packaging. Additionally, the increasing popularity of ready-to-drink cocktails is expected to reshape product lines, catering to convenience-seeking consumers. Overall, the market is poised for growth, with a focus on quality, sustainability, and consumer engagement through digital platforms.

| Segment | Sub-Segments |

|---|---|

| By Type | Whiskey (American, Scotch, Irish, Canadian) Vodka Rum Gin Tequila/Mezcal (Agave Spirits) Liqueurs & Cordials Brandy & Cognac Ready-to-Drink (RTD) Spirits-Based Beverages Non-Alcoholic Spirits |

| By Packaging Type | Glass Bottles PET/Plastic Bottles Cans (RTDs and cocktails) Tetra Packs/Cartons Kegs (on-premise) Others |

| By Distribution Channel | On-trade (Bars, Restaurants, Hotels) Off-trade (Liquor Stores, Supermarkets, Club Stores) E-commerce/Direct-to-Consumer (where permitted) Control States vs. License States (state-run vs private retail) Duty-Free Shops Others |

| By Price Range | Value/Standard Premium Super-Premium Ultra-Premium/Luxury |

| By Consumer Demographics | Age Group (21-29, 30-39, 40-54, 55+) Gender Income Level Ethnicity/Cultural Affinity (e.g., Hispanic, African American, Asian American) Lifestyle/Consumption Occasion Segments (e.g., cocktail-forward, at-home entertainers) |

| By Occasion | Celebrations & Holidays Casual Gatherings & At-Home Consumption On-premise Social/Cocktail Occasions Gifting & Collecting Others |

| By Brand Loyalty | Brand Loyal Consumers Brand Switchers/Explorers New-to-Category Private Label vs. Branded Preference |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Spirits Sales | 150 | Store Managers, Beverage Buyers |

| On-Premise Consumption Trends | 100 | Bar Owners, Restaurant Managers |

| Consumer Preferences in Spirits | 140 | Spirits Consumers, Cocktail Enthusiasts |

| Distribution Channel Insights | 80 | Wholesalers, Distributors |

| Market Entry Strategies | 60 | Market Analysts, Business Development Managers |

The United States Spirits Market is valued at approximately USD 38 billion, based on a five-year historical analysis. This valuation reflects strong supplier revenues and a trend towards premiumization in consumer preferences.