Region:Asia

Author(s):Shubham

Product Code:KRAB0710

Pages:80

Published On:August 2025

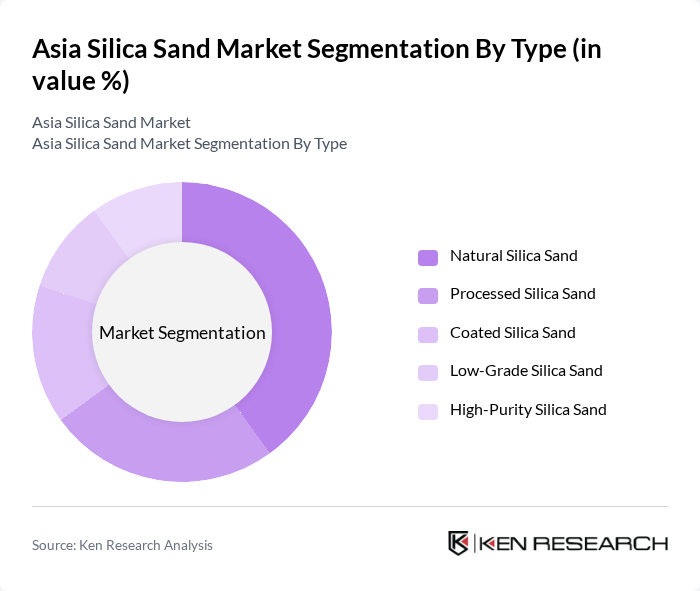

By Type:The market is segmented into various types of silica sand, including Natural Silica Sand, Processed Silica Sand, Coated Silica Sand, Low-Grade Silica Sand, and High-Purity Silica Sand. Each type serves distinct industrial applications: Natural Silica Sand is widely used in construction and glass manufacturing due to its availability and cost-effectiveness, while High-Purity Silica Sand is essential for electronics, solar panels, and semiconductor manufacturing. Processed and coated silica sands are increasingly adopted in foundry, filtration, and specialty chemical applications, reflecting advancements in beneficiation and coating technologies .

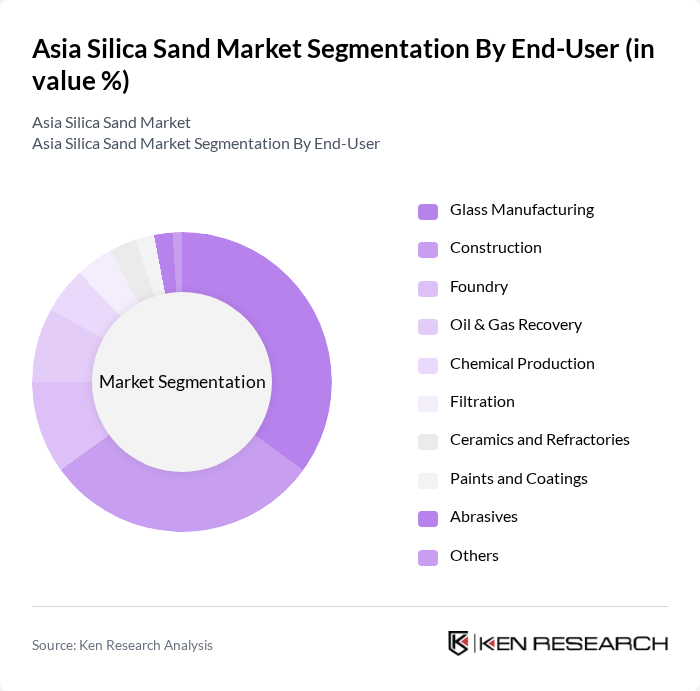

By End-User:The end-user segmentation includes industries such as Glass Manufacturing, Construction, Foundry, Oil & Gas Recovery, Chemical Production, Filtration, Ceramics and Refractories, Paints and Coatings, Abrasives, and Others. Glass Manufacturing is the largest consumer of silica sand, driven by the rising demand for flat glass, container glass, and specialty glass in construction, automotive, and electronics. Construction is the second-largest segment, with silica sand used in concrete, mortar, and asphalt. The electronics and solar energy sectors are rapidly increasing their share of high-purity silica sand consumption .

The Asia Silica Sand Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sibelco, Mitsubishi Corporation, Tochu Corporation, Toyota Tsusho Corporation, Chongqing Changjiang River Moulding Material (Group) Co., Ltd., JFE Mineral Company, Ltd., Anhui Shengxin Silicon Industry Co., Ltd., Quarzwerke GmbH, Australian Silica Quartz Group Ltd, Tochu Thailand Co., Ltd., Euroquarz GmbH, Henan Hengxin Industrial & Mineral Products Co., Ltd., Terengganu Silica Consortium Sdn. Bhd., Mangal Minerals, Sunstate Sands Pty Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The Asia silica sand market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt eco-friendly methods, the demand for high-purity silica sand is expected to rise, particularly in glass manufacturing and hydraulic fracturing. Furthermore, the expansion into emerging markets will provide new growth avenues, as infrastructure development accelerates. Companies that invest in innovative extraction technologies and sustainable practices will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Silica Sand Processed Silica Sand Coated Silica Sand Low-Grade Silica Sand High-Purity Silica Sand |

| By End-User | Glass Manufacturing Construction Foundry Oil & Gas Recovery Chemical Production Filtration Ceramics and Refractories Paints and Coatings Abrasives Others |

| By Region | China India Japan South Korea Australia Southeast Asia (Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore) Rest of Asia-Pacific |

| By Application | Glass Products Construction Materials (Concrete, Mortar, Asphalt) Industrial Applications Solar Panel Manufacturing Water Filtration Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Credits (RECs) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Usage | 120 | Project Managers, Procurement Officers |

| Glass Manufacturing Sector | 90 | Production Managers, Quality Control Supervisors |

| Foundry Applications | 60 | Operations Managers, Materials Engineers |

| Silica Sand Export Market | 50 | Export Managers, Trade Compliance Officers |

| Environmental Impact Assessments | 40 | Environmental Consultants, Regulatory Affairs Specialists |

The Asia Silica Sand Market is valued at approximately USD 6.6 billion, driven by increasing demand in industries such as glass manufacturing, construction, and oil & gas recovery, alongside rapid urbanization and infrastructure development across the region.