Region:Global

Author(s):Dev

Product Code:KRAA2588

Pages:80

Published On:August 2025

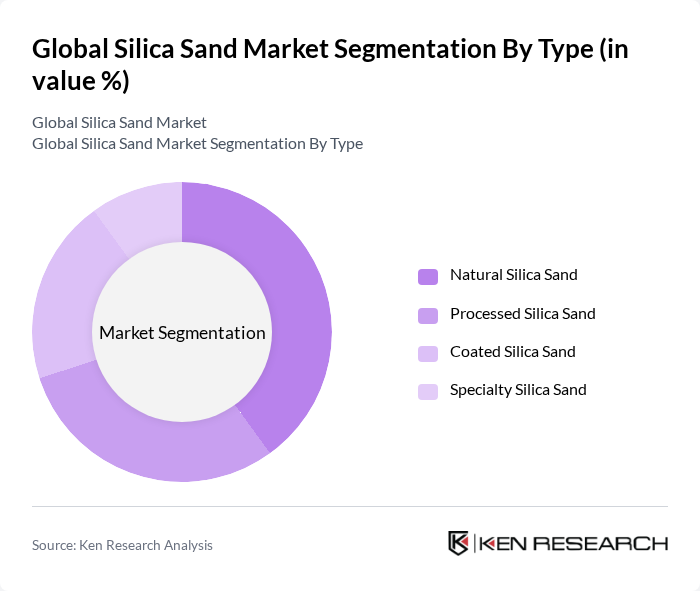

By Type:The silica sand market is segmented into four main types:Natural Silica Sand,Processed Silica Sand,Coated Silica Sand, andSpecialty Silica Sand. Natural Silica Sand is primarily used in construction and glass manufacturing due to its abundance and cost-effectiveness. Processed Silica Sand, which undergoes washing, grading, and purification, is gaining traction in foundry, chemical, and specialty glass applications. Coated Silica Sand is increasingly utilized in oil and gas industries for hydraulic fracturing, providing improved performance and durability. Specialty Silica Sand caters to niche markets such as electronics, pharmaceuticals, and high-purity glass, where stringent quality standards are required.

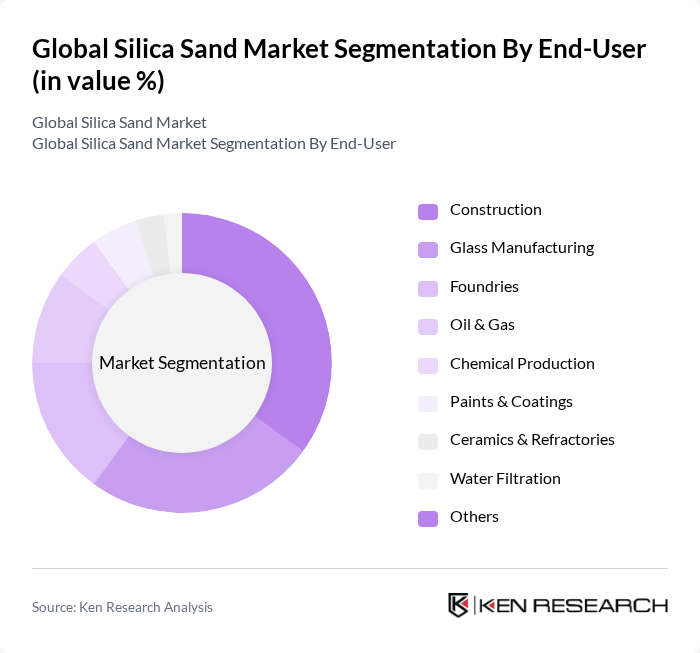

By End-User:The end-user segmentation of the silica sand market includesConstruction,Glass Manufacturing,Foundries,Oil & Gas,Chemical Production,Paints & Coatings,Ceramics & Refractories,Water Filtration, andOthers. The construction sector remains the largest consumer, propelled by ongoing infrastructure development in Asia Pacific, Latin America, and the Middle East. Glass manufacturing is the second largest segment, driven by demand for architectural, automotive, and specialty glass. Oil and gas demand for silica sand is significant due to its use in hydraulic fracturing, while ceramics, coatings, and water filtration are emerging as important users, reflecting diversified industrial applications.

The Global Silica Sand Market is characterized by a dynamic mix of regional and international players. Leading participants such as U.S. Silica Holdings, Inc., Covia Holdings Corporation, Sibelco NV, Badger Mining Corporation, Hi-Crush Inc., Mitsubishi Corporation, VRX Silica Limited, Quarzwerke GmbH, Saint-Gobain S.A., Australian Silica Quartz Group Ltd, Euroquarz GmbH, Chongqing Changjiang River Moulding Material (Group) Co., Ltd., Toyota Tsusho Corporation, Sibelco Australia Limited, Tarmac Trading Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the silica sand market appears promising, driven by increasing demand across various industries, particularly construction and energy. Technological advancements in extraction methods are expected to enhance efficiency and reduce environmental impact. Additionally, the ongoing expansion into emerging markets, where infrastructure development is a priority, will further bolster demand. As sustainability becomes a focal point, the development of eco-friendly silica sand products will likely gain traction, aligning with global trends toward greener practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Silica Sand Processed Silica Sand Coated Silica Sand Specialty Silica Sand |

| By End-User | Construction Glass Manufacturing Foundries Oil & Gas Chemical Production Paints & Coatings Ceramics & Refractories Water Filtration Others |

| By Application | Hydraulic Fracturing Glass Production Casting Water Filtration Polysilicon & Silicon Metal Production Ceramics Manufacturing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, Italy, France, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Saudi Arabia, South Africa, Rest of MEA) |

| By Quality | High Purity Silica Sand (?99.5% SiO?) Standard Silica Sand Low-Grade Silica Sand |

| By Packaging Type | Bulk Packaging Bagged Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Glass Manufacturing Sector | 100 | Production Managers, Procurement Specialists |

| Construction Industry | 80 | Project Managers, Material Suppliers |

| Foundry Applications | 70 | Operations Managers, Quality Control Inspectors |

| Oil & Gas Fracking | 60 | Field Engineers, Supply Chain Coordinators |

| Industrial Applications | 90 | Product Development Managers, R&D Specialists |

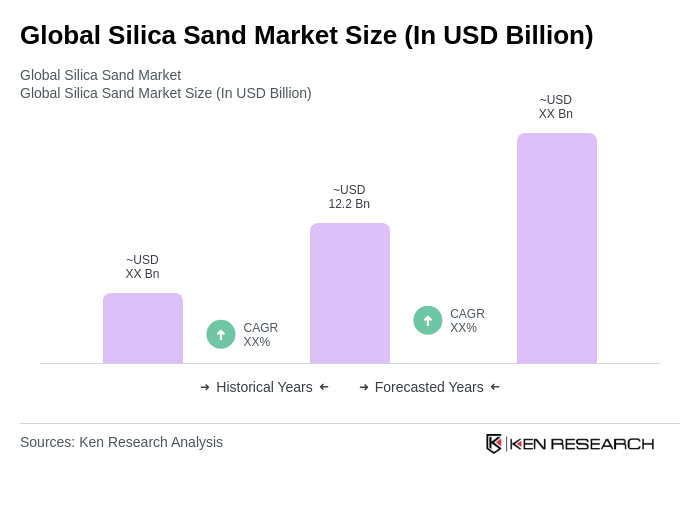

The Global Silica Sand Market is valued at approximately USD 12.2 billion, driven by increasing demand from industries such as construction, glass manufacturing, and hydraulic fracturing, particularly in regions like Asia Pacific and Latin America.