Region:Middle East

Author(s):Dev

Product Code:KRAD0530

Pages:99

Published On:August 2025

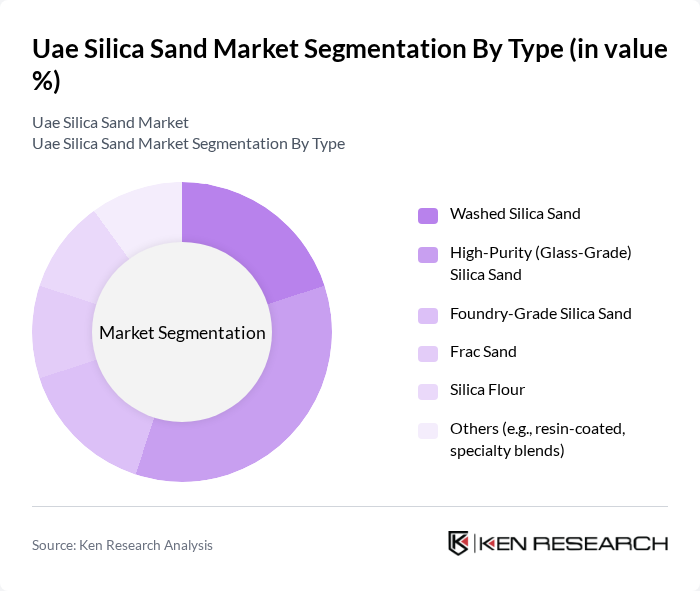

By Type:The market is segmented into various types of silica sand, including Washed Silica Sand, High-Purity (Glass-Grade) Silica Sand, Foundry-Grade Silica Sand, Frac Sand, Silica Flour, and Others (e.g., resin-coated, specialty blends). Among these, High-Purity (Glass-Grade) Silica Sand is the leading subsegment due to its critical role in glass manufacturing, which is experiencing significant growth driven by the construction and automotive industries. The demand for high-quality glass products has led to an increased focus on sourcing high-purity silica sand, making it a dominant player in the market .

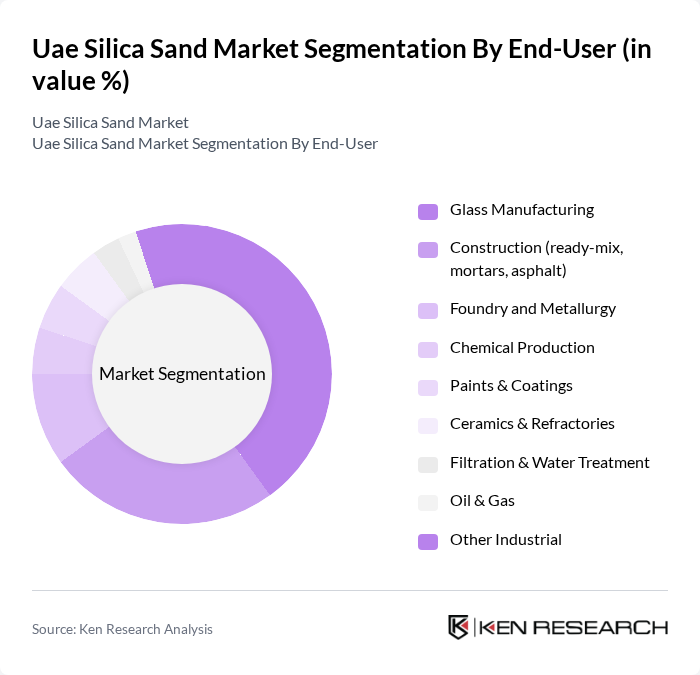

By End-User:The end-user segmentation includes Glass Manufacturing, Construction (ready-mix, mortars, asphalt), Foundry and Metallurgy, Chemical Production, Paints & Coatings, Ceramics & Refractories, Filtration & Water Treatment, Oil & Gas, and Other Industrial applications. The Glass Manufacturing segment is the most significant end-user, driven by the increasing demand for glass products in construction and automotive sectors. The growth in infrastructure projects and residential developments has further fueled the need for high-quality silica sand in glass production .

The Uae Silica Sand Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mitsubishi Corporation, Gulf Minerals & Chemicals LLC, Delmon Co. Ltd., Adwan Chemical Industries Co., National Ready Mix Concrete Co. LLC, Emirates Float Glass LLC, Saint-Gobain, Sibelco, Quarzwerke GmbH, silica industrial co. (SICO), Ittihad Paper Mill LLC (raw material sourcing), Fujairah Rock & Aggregate (Fujairah Rocks), Al Rashed Cement Company, Al-Rushaid Group (industrial minerals trading), Cairo Minerals contribute to innovation, geographic expansion, and service delivery in this space .

The UAE silica sand market is poised for growth, driven by increasing demand from construction and glass manufacturing sectors. As the government invests in infrastructure and smart city initiatives, the need for high-quality silica sand will rise. Additionally, technological advancements in processing and sustainable practices will enhance production efficiency. The market is expected to adapt to challenges such as environmental regulations and raw material price fluctuations, ensuring a resilient and competitive landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Washed Silica Sand High-Purity (Glass-Grade) Silica Sand Foundry-Grade Silica Sand Frac Sand Silica Flour Others (e.g., resin-coated, specialty blends) |

| By End-User | Glass Manufacturing Construction (ready-mix, mortars, asphalt) Foundry and Metallurgy Chemical Production Paints & Coatings Ceramics & Refractories Filtration & Water Treatment Oil & Gas Other Industrial |

| By Application | Flat & Container Glass Concrete & Masonry Foundry Molds & Cores Water Filtration Media Hydraulic Fracturing Industrial Chemicals & Silicon Derivatives Ceramics, Refractories & Abrasives Others |

| By Distribution Channel | Direct (to glass, foundry, chemicals, concrete) Industrial Distributors/Traders Project-Based Procurement (EPCs, government tenders) Online/B2B Platforms Others |

| By Region | Abu Dhabi Dubai Sharjah & Ajman Ras Al Khaimah (RAK) Fujairah & Umm Al Quwain Others |

| By Price Range | Low (construction-grade) Medium (washed/foundry-grade) High (high-purity glass/frac) |

| By Quality | Standard (industrial) Premium (low-iron, controlled PSD) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Usage | 140 | Project Managers, Procurement Officers |

| Glass Manufacturing Sector | 100 | Production Managers, Quality Control Supervisors |

| Ceramics and Tiles Production | 80 | Operations Managers, Product Development Heads |

| Environmental Impact Assessments | 60 | Environmental Consultants, Regulatory Affairs Managers |

| Silica Sand Export Market | 70 | Export Managers, Trade Compliance Officers |

The UAE Silica Sand Market is valued at approximately USD 350 million, driven by demand from the construction and glass manufacturing sectors, supported by ongoing urbanization and infrastructure projects across the region.