Region:Asia

Author(s):Geetanshi

Product Code:KRAA4526

Pages:89

Published On:September 2025

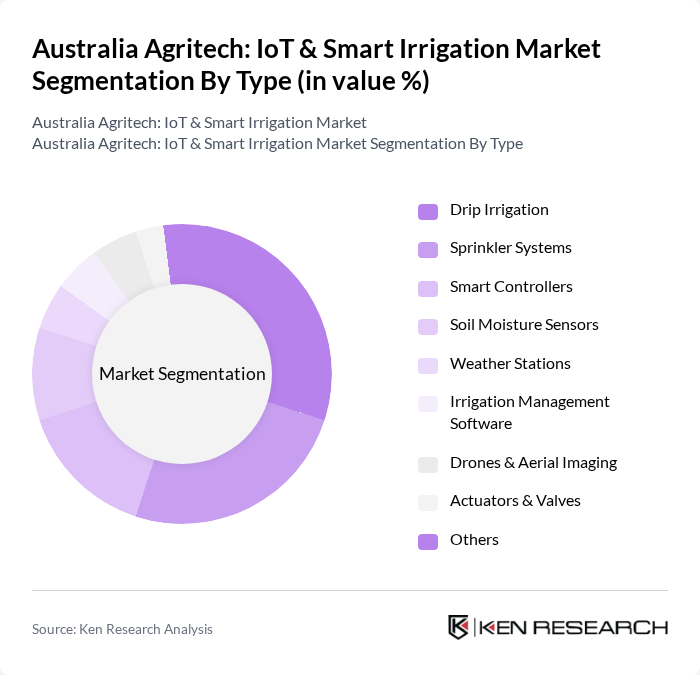

By Type:The market is segmented into various types of smart irrigation technologies, including Drip Irrigation, Sprinkler Systems, Smart Controllers, Soil Moisture Sensors, Weather Stations, Irrigation Management Software, Drones & Aerial Imaging, Actuators & Valves, and Others. Each of these technologies plays a crucial role in optimizing water usage, improving crop productivity, and enabling real-time data-driven decision-making for farmers. The integration of IoT sensors and AI-driven analytics is accelerating the adoption of these solutions, providing actionable insights for precise irrigation scheduling and resource management .

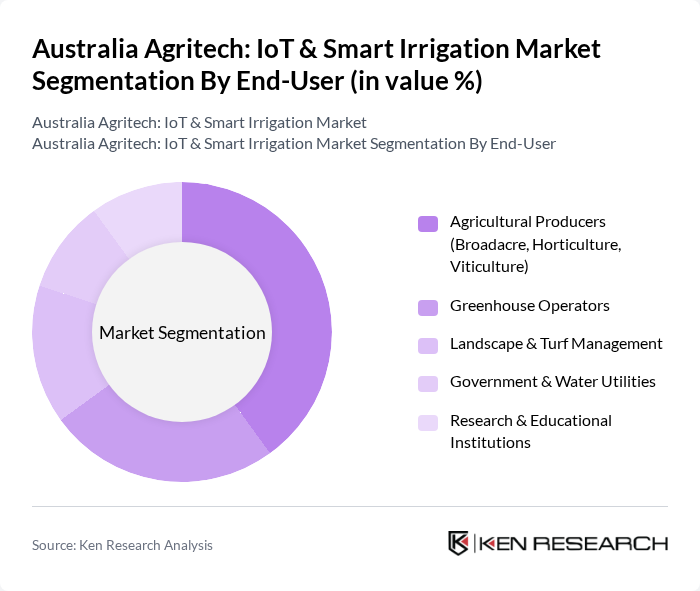

By End-User:The end-user segmentation includes Agricultural Producers (Broadacre, Horticulture, Viticulture), Greenhouse Operators, Landscape & Turf Management, Government & Water Utilities, and Research & Educational Institutions. Each of these segments utilizes smart irrigation technologies to enhance productivity, optimize water usage, and improve sustainability outcomes. Adoption is particularly strong among agricultural producers and greenhouse operators, who benefit most from automation and precision control .

The Australia Agritech: IoT & Smart Irrigation Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Yield Technology Solutions, CropX, AgriWebb, Rubicon Water, SWAN Systems, Netafim, Valmont Industries, Hunter Industries, Toro Company, Lindsay Corporation, Jain Irrigation Systems, Trimble Agriculture, Sentek Technologies, Observant (a Jain Irrigation subsidiary), Goanna Ag contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia Agritech market, particularly in IoT and smart irrigation, appears promising as technological advancements continue to evolve. With increasing government support and a growing emphasis on sustainable agricultural practices, the market is likely to witness significant growth. The integration of AI and machine learning into irrigation systems will enhance efficiency, while the rising demand for data-driven farming solutions will further propel innovation. As awareness among farmers increases, adoption rates are expected to rise, fostering a more resilient agricultural sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Drip Irrigation Sprinkler Systems Smart Controllers Soil Moisture Sensors Weather Stations Irrigation Management Software Drones & Aerial Imaging Actuators & Valves Others |

| By End-User | Agricultural Producers (Broadacre, Horticulture, Viticulture) Greenhouse Operators Landscape & Turf Management Government & Water Utilities Research & Educational Institutions |

| By Application | Crop Irrigation Greenhouse Irrigation Turf and Landscape Irrigation Orchard & Vineyard Irrigation Others |

| By Distribution Channel | Direct Sales Online Retail Distributors & Dealers System Integrators Others |

| By Component | Sensors (Soil, Weather, Flow, Pressure) Controllers & Gateways Software Platforms & Analytics Connectivity Modules (Cellular, LoRaWAN, Satellite) Others |

| By Investment Source | Private Investments Government Grants Public-Private Partnerships Venture Capital & Startups Others |

| By Policy Support | Subsidies Tax Incentives Research Grants Water Allocation Schemes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Irrigation Technology Users | 120 | Farmers, Agricultural Technicians |

| IoT Device Manufacturers | 60 | Product Managers, R&D Engineers |

| Agricultural Consultants | 50 | Consultants, Agronomists |

| Government Policy Makers | 40 | Policy Analysts, Environmental Officers |

| Research Institutions | 45 | Researchers, Academics |

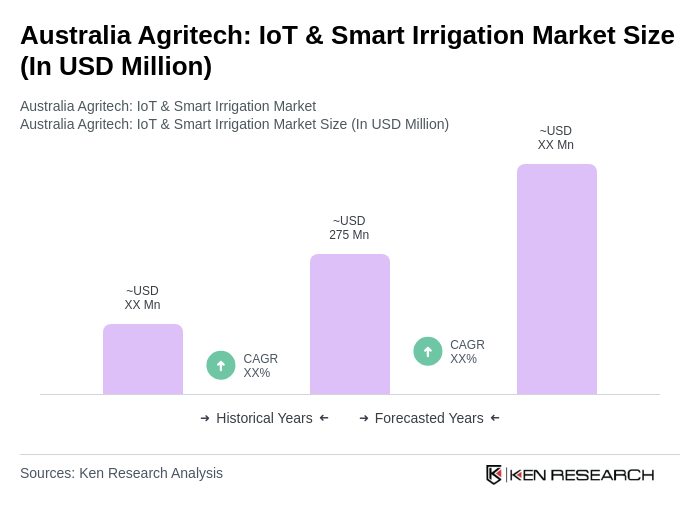

The Australia Agritech: IoT & Smart Irrigation Market is valued at approximately USD 275 million, driven by the increasing adoption of precision agriculture and automation technologies that enhance water efficiency and improve crop yield.