Region:Global

Author(s):Shubham

Product Code:KRAD5570

Pages:91

Published On:December 2025

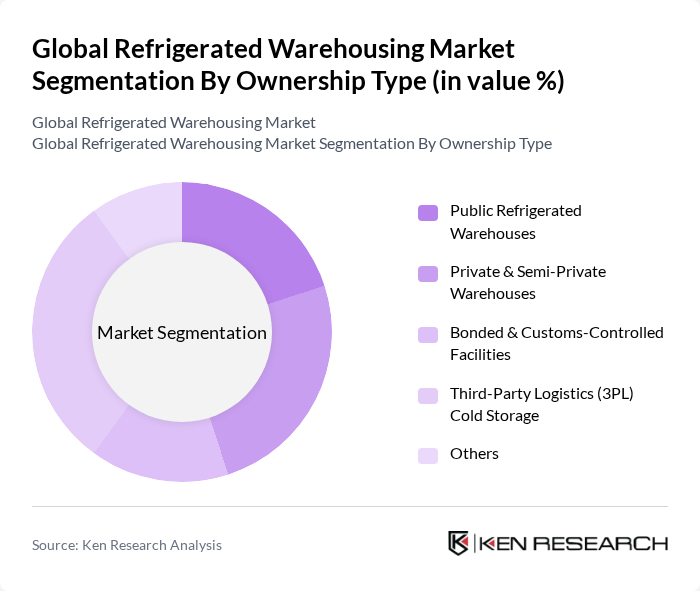

By Ownership Type:The ownership type segmentation includes various categories such as Public Refrigerated Warehouses, Private & Semi-Private Warehouses, Bonded & Customs-Controlled Facilities, Third-Party Logistics (3PL) Cold Storage, and Others. This reflects the diversity of operating models, from dedicated facilities owned by food producers or retailers to multi-client public warehouses and specialized customs-bonded sites serving import–export flows. Among these, Third-Party Logistics (3PL) Cold Storage is the leading subsegment due to the increasing trend of outsourcing logistics services by food manufacturers, retailers, and pharmaceutical companies seeking to reduce capital expenditure, optimize inventory, and access advanced automation and monitoring technologies. The flexibility, scalability, and multi-location networks offered by 3PL providers make them a preferred choice for businesses looking to handle seasonal demand peaks, expand into new regions, and support omnichannel and e-commerce distribution models.

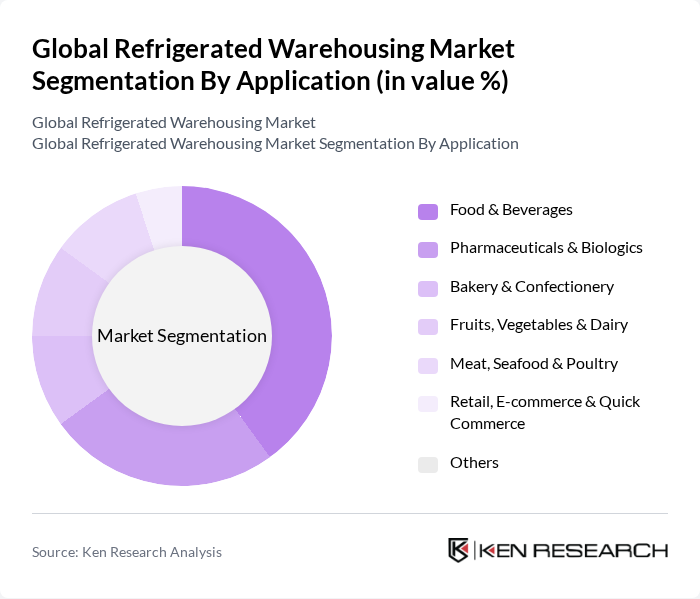

By Application:The application segmentation encompasses Food & Beverages, Pharmaceuticals & Biologics, Bakery & Confectionery, Fruits, Vegetables & Dairy, Meat, Seafood & Poultry, Retail, E-commerce & Quick Commerce, and Others. The Food & Beverages segment dominates the market, reflecting the extensive use of refrigerated warehousing for frozen and chilled foods, ready-to-eat meals, beverages, and processed products, underpinned by the expansion of supermarkets, hypermarkets, and online grocery platforms. This segment's growth is further supported by the increasing focus on food safety, shelf-life extension, and quality assurance across the global cold chain, as well as rising demand for premium, organic, and convenience foods that require controlled temperature storage.

The Global Refrigerated Warehousing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lineage Logistics Holdings, LLC, Americold Realty Trust, Inc., United States Cold Storage, Inc., NewCold Advanced Cold Logistics, VersaCold Logistics Services, Conestoga Cold Storage Ltd., Kloosterboer Group B.V., Nichirei Logistics Group Inc., Tippmann Group / Interstate Warehousing, Inc., Frialsa Frigoríficos, S.A. de C.V., DHL Supply Chain (Deutsche Post DHL Group), DB Schenker, XPO Logistics, Inc., J.B. Hunt Transport Services, Inc., C.H. Robinson Worldwide, Inc. contribute to innovation, geographic expansion, automation, and service delivery in this space through investment in high-bay automated warehouses, energy-efficient refrigeration systems, and integrated temperature-controlled logistics solutions.

The future of the refrigerated warehousing market appears promising, driven by the increasing demand for fresh and organic products alongside the growth of e-commerce. As consumers prioritize sustainability, the adoption of energy-efficient technologies will likely become a standard practice. Additionally, the integration of AI and IoT in operations will enhance efficiency and reduce costs. These trends indicate a robust evolution in the market, positioning it for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Ownership Type | Public Refrigerated Warehouses Private & Semi?Private Warehouses Bonded & Customs?Controlled Facilities Third?Party Logistics (3PL) Cold Storage Others |

| By Application | Food & Beverages Pharmaceuticals & Biologics Bakery & Confectionery Fruits, Vegetables & Dairy Meat, Seafood & Poultry Retail, E?commerce & Quick Commerce Others |

| By Storage Capacity | Up to 10,000 Pallet Positions ,001 – 50,000 Pallet Positions Above 50,000 Pallet Positions Others |

| By Temperature Range | Chilled (0°C to 15°C) Frozen (-18°C to -25°C) Deep?Frozen (below -25°C) Multi?Temperature Facilities |

| By Service Type | Storage & Handling Services Transportation & Distribution Services Cross?Docking & Consolidation Services Value?Added Services (Packaging, Labelling, Kitting) Others |

| By Geographic Coverage | Local & Urban Coverage National Network Coverage Regional (Multi?Country) Coverage Global Coverage Others |

| By Technology Adoption | Automated Storage & Retrieval Systems (AS/RS) IoT?Enabled Monitoring & Telematics Warehouse Management Systems (WMS) & TMS Integration Energy Management & Refrigeration Control Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Warehousing | 120 | Warehouse Managers, Supply Chain Analysts |

| Pharmaceutical Cold Chain Logistics | 100 | Quality Assurance Managers, Logistics Coordinators |

| Retail Refrigerated Storage Solutions | 80 | Operations Managers, Inventory Control Specialists |

| Technology Providers in Cold Storage | 70 | Product Development Managers, Sales Directors |

| Third-Party Logistics Providers | 90 | Business Development Managers, Operations Directors |

The Global Refrigerated Warehousing Market is valued at approximately USD 95 billion, driven by the increasing demand for temperature-sensitive products in sectors such as food, pharmaceuticals, and biologics, along with the growth of e-commerce and organized retail.