Region:Global

Author(s):Shubham

Product Code:KRAA0858

Pages:88

Published On:August 2025

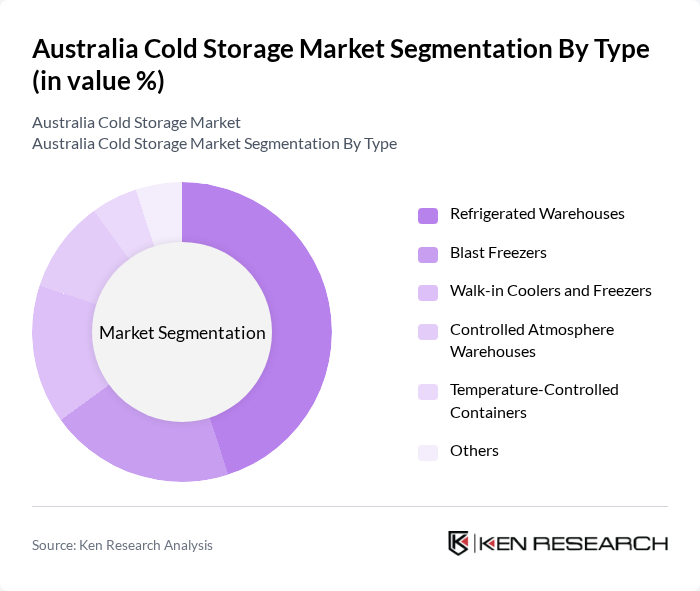

By Type:The cold storage market can be segmented into various types, including Refrigerated Warehouses, Blast Freezers, Walk-in Coolers and Freezers, Controlled Atmosphere Warehouses, Temperature-Controlled Containers, and Others. Among these, Refrigerated Warehouses are the most dominant segment due to their extensive use in storing perishable goods, which require consistent temperature control. The increasing demand for fresh produce and frozen foods has led to a significant rise in the establishment of refrigerated warehouses across Australia. This segment is favored for its ability to accommodate large volumes of goods and its efficiency in maintaining optimal storage conditions .

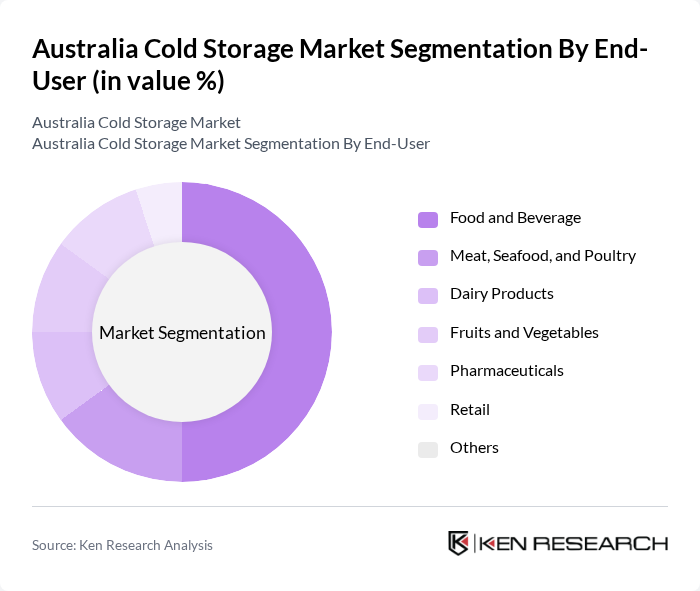

By End-User:The end-user segmentation includes Food and Beverage, Meat, Seafood, and Poultry, Dairy Products, Fruits and Vegetables, Pharmaceuticals, Retail, and Others. The Food and Beverage sector is the leading end-user, driven by the growing consumer preference for fresh and frozen products. This segment's dominance is attributed to the increasing demand for convenience foods and the expansion of the food service industry, which relies heavily on cold storage solutions to maintain product quality and safety during distribution .

The Australia Cold Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Americold Logistics, Emergent Cold, NewCold, Swire Cold Storage, Karras Cold Logistics, Linfox Pty Ltd., Melbourne Cold Storage, MFRH Cool Logistics Pty Ltd, AWT Cold Storage, Cold Storage Solutions Australia, Cold Storage Australia, Cold Chain Solutions, AFS Cold Storage, Cold Logistics, and Australian Refrigerated Transport contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian cold storage market appears promising, driven by technological advancements and a growing emphasis on sustainability. As the demand for organic and locally sourced products increases, cold storage facilities will need to adapt to meet these consumer preferences. Additionally, the integration of renewable energy solutions is expected to enhance operational efficiency while reducing environmental impact, positioning the industry for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Warehouses Blast Freezers Walk-in Coolers and Freezers Controlled Atmosphere Warehouses Temperature-Controlled Containers Others |

| By End-User | Food and Beverage Meat, Seafood, and Poultry Dairy Products Fruits and Vegetables Pharmaceuticals Retail Others |

| By Application | Meat and Seafood Dairy Products Fruits and Vegetables Pharmaceuticals and Vaccines Bakery & Confectionery Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Storage Capacity | Small Scale (Up to 5,000 pallets) Medium Scale (5,000–20,000 pallets) Large Scale (Above 20,000 pallets) |

| By Temperature Range | Chilled (0°C to 15°C) Frozen (-18°C to -25°C) Deep Frozen (Below -25°C) |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Storage | 120 | Warehouse Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Chain Management | 90 | Quality Assurance Managers, Logistics Directors |

| Retail Cold Storage Solutions | 60 | Operations Managers, Inventory Control Specialists |

| Technological Innovations in Cold Storage | 50 | IT Managers, R&D Directors |

| Environmental Sustainability Practices | 40 | Sustainability Officers, Compliance Managers |

The Australia Cold Storage Market is valued at approximately USD 2.1 billion, driven by the increasing demand for temperature-sensitive products, particularly in the food and pharmaceutical sectors, as well as the rise in e-commerce and consumer expectations for fresh goods.